The automotive industry faces various challenges – from revenue growth to increasing footfall at the service station. Among multiple obstacles, three pain points are the most crucial.

- How to increase the number of sales conversions?

- How to drive more customer visits for after-sales service?

- How to encourage repeat purchases from your customers?

In this comprehensive guide, we’ll delve into the heart of three critical pain points that are hindering the success of most automotive businesses.

And we’ll talk about how an automotive feedback tool can be a game-changer in optimizing the customer experience.

Here’s what we will cover in this automotive customer experience guide:

So, buckle up, and let’s get started with the first pain point and how to resolve it.

Pain Point 1: Increase the Number of Inquiries and then Convert those Inquiries into Sales

The first pain point is how to increase the number of inquiries and turn those inquiries into sales.

To resolve this issue, you should first segregate your customers into two categories:

- Intender – who’ve taken a test drive and are interested in buying

- Rejecter – who showed interest but chose another company

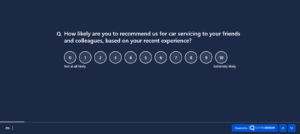

After segregation, launch QVOC surveys.

Now you must be thinking of – What are QVOC surveys?

QVOC surveys are quick voice-of-customer surveys that are used to gauge instant customers’ experience during the pre-sales period.

If your customer is interested in buying the car from your dealership, then you should launch a QVOC intender pre-sales survey.

1. QVOC Intender (Pre-Sales) Survey

Main Goal

QVOC Intender survey enables you to significantly improve sales conversions by delivering an exceptional test drive experience and providing clarity on essential aspects, including delivery, finances, features, and more.

With this survey, you can understand potential buyers and tailor your approach to meet their specific needs.

But what will you get?

By launching this survey, you will:

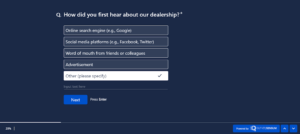

- Gain insights into the types of customers you attract and their pre-dealership research.

- Pinpoint models, dealerships, and regions with the highest and lowest conversion rates, uncover the reasons behind these variations.

- Assess how effectively dealers communicate features, delivery schedules, and financial details.

- Identify the marketing channels that are hitting the mark and those that require improvement.

- Gain an understanding of overall customer satisfaction with your cars and dealerships by asking automotive customer satisfaction survey questions.

- Discover which influencers, groups, videos, and content potential buyers follow before their dealership visits.

That’s how you can leverage the information gathered from these QVOC intender surveys for sales and marketing to attract potential buyers, enhance their experience, and increase conversions.

But when to send this survey?

The Right Time to Send this Survey

Ideally, you should send the survey one or two days after the test drive.

Survey Distribution

The preferred method for survey distribution is through phone calls due to the low response rate via SMS/Email.

Launch QVOC Intender Pre-sales Survey!

Now what about those who rejected your dealership even before buying the car?

For them also you should launch a rejecter pre-sales survey.

2. Rejecter (Pre-Sales) Survey

You cannot convert all the leads into sales but you can definitely turn those missed opportunities into valuable insights for your future success by conducting – Rejecter surveys.

Main Goal

The purpose of launching these surveys is to discover WHY deals slipped through your fingers and how you can explore opportunities for improvement.

But what will you understand?

Here are the following:

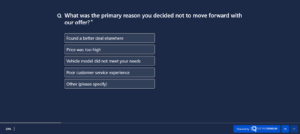

- Identify the top reasons potential buyers said “no” to your offers.

- Learn which competing car models are winning over your customers.

- Discover improvement areas where you can enhance your sales efforts to increase your market share.

- Listen to the feedback from prospects that can help your sales and marketing teams reduce rejections.

This is how the rejecter pre-sales survey helps you uncover the secrets behind lost sales and guides you toward improvement.

After knowing that, let’s learn when to send this survey.

The Right Time to Send this Survey

You should launch this survey a day after the dealer marks the opportunity as lost.

Survey Distribution

The preferred method for survey distribution is through phone calls due to the low response rate via SMS/Email.

3. Social Media Groups, Competition Car Groups

Listen to your respondents’ opinions and experiences on social media platforms including those who’ve taken test drives and your existing customers to gain valuable insights like

- Identify the top 5 aspects of your cars that customers love the most. This can vary by car model, so segment the feedback accordingly.

- Pinpoint improvement areas about your cars. Again, categorize this feedback by car model for a more precise understanding.

- Pay attention to the overall sentiment of what customers are saying about your brand and vehicles.

Now, when should you engage with them?

You should get involved in the groups and communities when customers discuss your brand or specific car models. This proactive approach shows that you value their feedback and are committed to continuous improvement.

That’s how you can address customers’ concerns, highlight the features customers love, and ultimately, build a stronger rapport with your target audience.

The next thing that helps you in improving sales conversion is the product quality survey.

4. Product Quality Survey (Inbound & Outbound)

When it comes to selling cars, understanding your customers is key. One way to do this is through launching – Product Quality Surveys. These surveys help you gather valuable insights from recent car buyers including

- Buyer Persona: You’ll discover who’s buying which car model, why they chose it, and if there are any gaps between what they expected and their actual experience.

- Reasons for Purchase: Understand the motivations behind their decision to buy.

- Expectations vs. Reality: Find out if customers’ expectations were met or if there were any surprises after they received their cars.

- Likes and Dislikes: Learn about the features they love and the ones they don’t.

- Defects: Identify any known defects or issues that need attention.

With this you can understand what drives the purchase, and whether they feel they made the right decision, what features they love or don’t.

But who will be your targeted audience?

People who have recently purchased a car from you. Their feedback can be fruitful for your marketing and sales teams.

What will you do with the gathered feedback?

With this data, you can

- Help your marketing and sales teams to increase sales conversions and answer tough questions.

- Inform your product team of improvements if there are common issues.

The Right Time to Launch this Survey

Launch these surveys after 1 month of the car delivery and after 6 months of the car delivery to understand their automotive customer journey.

Survey Distribution

When gathering customer feedback, consider launching surveys on channels like WhatsApp, phone calls, or any other method the customers in that particular country prefer. It’s best to schedule these surveys approximately 1 to 2 months after the car purchase. Additionally, make sure to maintain detailed records of each conversation for future reference.

And now comes a very important point – what will you do with all this gathered automotive customer feedback?

5. Take Action on the Gathered Automotive Customer Feedback

After collecting customer feedback through surveys, it’s time to put it to good use by:

- Creating a consolidated report and analyzing the data by the dealership, by car model, and by competition to see what’s working and what needs improvement.

- Sharing with sales and marketing teams to take action on the gathered feedback accordingly.

- Identifying challenges to prioritize your efforts and make an action plan to address them. Also, train your teams to focus on positives and fix negatives.

- Monitor progress quarterly or half-yearly to know how your actions impact customer satisfaction.

By following these steps, you can turn customer insights into actions that drive your automotive business forward.

Analyze Customer Feedback With SurveySensum!

Real-Life Use Case

And here’s a real-life use case that actually used these tips and boosted its CSAT scores by 10 points and bookings in the city increased by 1%.

Problem

Two years ago, a new SUV was launched, gaining popularity among young customers. However, actual bookings fell short of expectations.

Solution

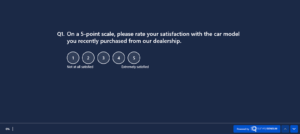

To understand this issue, SurveySensum conducted a post-test drive survey, asking participants to rate the car’s POWER, TECHNOLOGY, INFOTAINMENT, INTERIOR, and EXTERIOR DESIGN.

Surprisingly, respondents from the city gave low ratings for the car’s power, unlike those from town areas. Further investigation revealed that city traffic prevented customers from experiencing the car’s power.

We then trained city salespeople to guide potential buyers to less crowded roads where they could test the car’s power.

Result

Over 3-6 months, the CSAT score increased by 10 points, and city bookings saw a 1% rise.

Now that we know how to overcome the challenge of increasing conversion and inquiries, let’s talk about how to increase the number of customer visits after a car’s service.

Pain Point 2: How to Increase the Number of Customer Visits for After-Sales Service?

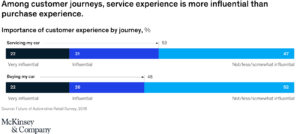

In today’s automotive industry, after-sales services are a hidden treasure, contributing up to 50% of some automakers’ profits and more than 40% of large dealership gross profits. Astonishingly, these services account for just 10% of dealership revenue.

This statistic underscores the significance of after-sales service in the automotive sector. It’s not merely about selling cars; it’s about fostering customer relationships beyond the initial purchase. However, one of the industry’s persistent challenges is how to increase the number of customer visits for after-sales services.

To increase this number you should proactively remind customers about service appointments and offer enticing discounts.

And conduct a QVOC sales survey.

1. QVOC Sales Survey

QVOC sales surveys are designed to ensure a seamless onboarding experience for customers by gauging their satisfaction with various aspects of the car buying process, from timely delivery to dealer interactions.

Why should you launch this survey?

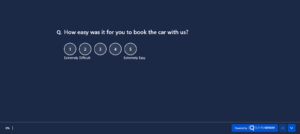

The insights from this survey help you understand the ease of booking, the condition of the car at delivery, and the help provided by the dealership.

Not just that, you will also understand:

- Customer experience through Net Promoter Score analysis, examining various levels, including the dealer, city, region, and national levels.

- Commitment to delivering cars as promised, ensuring timely delivery.

- How your dealers handle various aspects of the customer experience, such as communication, financial transparency, feature explanations, insurance, warranty, and after-sales documentation, with the goal of improvement.

- Your customers’ satisfaction with the entire buying process, gauging their feelings about the purchase experience and delivery.

- Whether your customers know who to contact if they encounter any problems and whether those issues are timely resolved.

This highlights the importance of launching this survey. But launch these surveys at the right time.

The Right Time to Send this Survey

You should send the survey immediately after delivery. And if they didn’t fill then make sure you follow up with them.

Survey Distribution

Your customers can conveniently complete the survey through QR Code, SMS, Email, or Phone.

2. QVOC Service Survey (After Sales Satisfaction)

Launching the QVOC service survey is the best way to ensure that your customers receive prompt and high-quality after-sales service, leading to customer satisfaction and increased repeat visits.

To achieve this, it’s crucial to understand and align with customer expectations and address their concerns effectively. When customers seek service, they expect clear pricing, timely service, issue resolution, and answers to their questions.

Why should you launch this survey?

To understand post-service feelings, identify delays, assess issue resolution, and spot areas for improvement.

Also, you should consider the following to customize your service approach effectively:

- Prioritize effective communication, with dealerships promptly addressing inquiries and issues.

- Emphasize the value of transparent pricing, ensuring service costs are explained upfront to prevent surprises.

- Highlight the benefits of timely reminders, aiding customers in planning ahead for service appointments.

- Acknowledge the importance of objection handling, including the anticipation and addressing of common customer objections.

- Explore how loyalty programs and marketing campaigns can incentivize customers to return.

- Realize the significance of punctuality, guaranteeing on-time vehicle delivery in good condition.

- Maintain parts availability as a preventive measure to avoid service delays.

- Recognize the value of providing customer amenities, such as creating a comfortable waiting area with snacks and coffee.

After gathering this information, launch it at the right time.

The Right Time to Launch this Survey

Send the survey right after service completion and follow up with non-respondents.

Survey Distribution

Distribute your survey via a QR code at your dealership, and send an SMS. You can also create a WhatsApp survey and share it via WhatsApp. This makes it easy for them to respond.

By implementing the QVOC service survey and acting on insights, dealerships can enhance customer satisfaction, encourage return visits, and ultimately boost revenue and market share.

Now that you’ve launched customer feedback to enhance the automotive customer experience, what will you do with all the gathered feedback?

3. Now take Action on the Feedback to Enhance Automotive Customer Experience

After collecting feedback from the QVOC Survey, it’s time to analyze the quantitative and qualitative feedback:

- Analyze feedback thoroughly, focusing on each area—dealerships, workshops, and regions—to identify areas for improvement.

- Share these insights directly with dealers and the aftersales team. Encourage discussions on how to make things better.

- Develop an overall strategy by consolidating all feedback to plan improvements tailored to specific regions and car models.

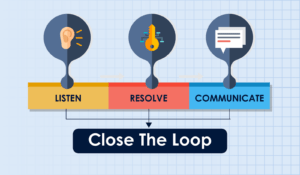

- Close the feedback loop by acting on the feedback. Make the necessary changes, and ensure customers notice the improvements, be it quicker service or better communication.

You’ve learned the importance of collecting and using feedback, but how do you ensure that no valuable insight goes unnoticed?

That’s where – Closed Loop Automation steps in.

4. Closed Loop Automation

Closed-loop automation ensures that swift action is taken based on customer feedback, especially when it’s negative. A robust feedback tool like SurveySensum excels at transforming feedback into actionable results by efficiently closing the feedback loop.

Here’s how it works:

- Immediate Ticket Generation: When the QVOC survey captures negative feedback from detractors, it promptly generates a ticket.

- Automated Assignment: The system instantly directs the ticket to dealers or the contact center team.

- Escalation Notification: In case an agent doesn’t respond promptly, an alert is sent to the higher authorities to ensure a timely resolution.

- Contact Center Follow-Up: A dedicated contact center agent proactively contacts both dealers and customers to gain deeper insights into the feedback.

- Closing the Loop: Empowered with valuable insights from these follow-ups, the contact center agent diligently resolves the issue, ensuring satisfaction for both dealers and customers.

This is how the entire process of closing the feedback loop on automotive surveys removes manual work, reduces response time, and ensures no feedback is overlooked.

Turn Detractors into Promoters with SurveySensum

5. Proactive Call Process to Book Service Appointments

According to a McKinsey report, consumers spend 15 hours buying a new car but up to 50 hours on servicing during ownership. Also, they value the service experience more than the last buying experience when choosing their next car. This highlights the need for action, especially in crowded markets.

That’s why boosting after-sales service visits demands — the Proactive Service Booking Process. This savvy strategy ensures not only timely appointments but also addresses customer concerns with finesse.

Here’s what the PCP process includes:

- PCP sends automated reminders for regular Preventive Maintenance Service schedules. For instance, a call is triggered when it’s been 10,000 kilometers or 6 months since their last service.

- During these calls, objections are identified and resolved. For example, a home pickup option is given to customers when they’re too busy.

- Encourage customers to book appointments in advance, boosting attendance rates.

- Periodic campaigns offer special deals, attracting customers.

- Four attempts are made to contact the customer without intrusion.

- Weekly updates on customer interactions ensure a comprehensive overview.

- Booking Assistance is provided for dealership or app portal service bookings.

- A systematic follow-up process ensures customers are available for appointments.

- PCP guarantees 100% issue resolution during interactions.

With that, you must be thinking about using them, right?

When to Use PCP?

PCP involves timely outbound calls and SMS messages, activating when a customer’s vehicle is due for regular PMS. It ensures convenient scheduling, demonstrating proactive customer service.

So, by doing this, you should strategically implement PCP to improve after-sales service visits, customer satisfaction, and retention.

After knowing all this, here comes one of the crucial parts- what to do with the gathered feedback?

Take Action on the Gathered Feedback

You should leverage the gathered feedback to increase the number of customer visits after-sales service by doing the following:

- Analyze feedback to pinpoint objections, customer profiles, and service preferences. This data personalizes the service experience.

- Record feedback in the CRM system for future reference, facilitating ongoing improvement efforts.

- Identify customers avoiding service and uncover the reasons. Take proactive measures to prevent future avoidance.

- Understand dealers’ top concerns post-service to enhance collaboration and address issues promptly.

This feedback-driven approach ensures service excellence and fosters customer loyalty.

Real-Life Use Case: Daimler

Mercedes Daimler achieved a 30% increase in its CSAT score by partnering with SurveySensum. Here’s their story.

The Challenge: Daimler faced a problem – declining customer satisfaction due to service delays. They dug deep and found that parts availability was the root issue, especially in certain dealerships across cities. Further investigation uncovered that rough roads in the city outskirts led to more wear and tear, while customs clearance slowed parts delivery.

The Solution: Daimler adapted to the situation by meeting the higher demand in these specific dealerships.

The Result: The outcome was fantastic – a rapid and impressive 15+ point increase in customer satisfaction at one dealership.

How It Worked?

Daimler made it easy for customers. After each workshop visit, they could scan a QR code to share feedback. This simple approach helped identify and fix issues quickly, leaving customers happier than ever.

Just like Daimler, you can also raise your customer satisfaction score with SurveySenusm.

Increase Your CSAT Score With SurveySensum!

You’re now familiar with two pain points of the automotive industry and how to resolve them. Here comes the third pain point – how to increase customer retention and loyalty.

Pain Point 3: How to increase the number of repeat purchases?

The simplest way to boost repeat purchases is to be there when your customers need you the most.

To do that you must incorporate telematics and RSA. What’s that?

1. Telematics

The automotive telematics market was worth $8.8 billion in 2022 and is projected to reach $15.5 billion by 2027, with a 12.1% CAGR from 2022 to 2027.

This remarkable growth is propelled by several key factors such as government initiatives for smarter transportation, rapid advancements in 5G connectivity, growing consumer demand for in-car smartphone features, and the rise of automated driving technology, alongside increased focus on passenger safety.

But what is telematics?

In simple words, Telematics involves using technology to collect and transmit real-time vehicle data, offering insights into vehicle performance, driver behavior, and incidents.

They enhance safety, customer support, and operational efficiency by

- Establishing a system for receiving automatic alerts from distressed vehicles, enabling rapid emergency responses.

- Using telematics data to promptly assist customers during issues or emergencies, improving customer satisfaction in the automotive industry.

- Sharing vehicle details with dealers when problems occur to speed up repairs and improve the customer experience.

2. RSA

To understand RSA, here’s an example of one of my colleagues Tom. When his car broke down late at night on a deserted highway, he called for roadside assistance that came with his car purchase. Within 30 minutes, a skilled technician arrived to fix it. Even if the car couldn’t be fixed on-site, a tow truck and a nearby hotel room were provided.

This is the power of RSA, a service dedicated to promptly assisting customers who encounter vehicle-related emergencies on the road, ensuring 100% assistance. Also, RSA:

- Ensure quick responses to emergency calls, reducing wait times.

- Collaborate with providers for on-site help.

- Maintain a well-connected network for services like towing, crane support, ambulances, and hotel bookings.

- Equip a skilled team to handle various roadside situations.

- Make customer safety and satisfaction a priority.

You can also establish an efficient RSA for your customers to enhance their experience.

Now you must be wondering about how to utilize the gathered feedback, right?

Take Action on the Gathered Feedback

Use the gathered feedback to deliver a great automotive customer experience by

- Identifying top road-related problems by analyzing customer feedback that you collected via automotive customer feedback tools.

- Looking for recurring patterns to pinpoint the most pressing concerns.

- Improving response time based on feedback.

- Expanding partnerships with service providers to ensure faster assistance.

With feedback analysis, you can better serve customers by addressing their needs efficiently and proactively.

Wrapping Up

Now that you’ve got the inside scoop on boosting your automotive business, let’s talk about making your customers feel like automotive royalty. It’s not just about selling cars; it’s about giving them a personalized experience and staying tech-savvy.

To succeed, you should keep yourself updated with changing customer expectations, provide seamless emergency support, and offer tailor-made solutions.

To continually enhance your automotive customer experience, consider integrating tools like SurveySensum. With SurveySensum, you can collect valuable insights from customers and make data-driven improvements to keep them happy and your business booming.😉