When to Send NPS Survey for Maximum Impact

Sending the right survey to the right customer at the right time significantly captures relevant and accurate feedback.

Now, determining the survey timing, that’s the tricky part.

Imagine you bought a washing machine from Amazon that was delivered this morning. And within an hour, you received a survey in your inbox – ‘How likely are you to recommend the washing machine to your friends?’

Your washing machine still needs to be installed, and they expect you to recommend it to others!

You’ll simply ignore it, right?

So what should have been the right question to ask at this touchpoint?

A CSAT Survey on delivery experience – ‘On a scale of 1 to 5, how satisfied are you with your overall experience with our delivery service?’

Since Net Promoter Score is a loyalty metric, it is not the right question here. But more often than not, businesses make this common mistake while sending an NPS survey.

The success of the NPS survey mainly depends on timing. Also, sending the right type of NPS survey at the right time matters, and the NPS survey frequency matters a lot.

What does that mean?

Well, there are two types of NPS surveys – relationship NPS surveys and transactional NPS surveys. And each of them has a different approach when it comes to understanding and measuring overall customer satisfaction and loyalty.

Sounds a bit much? Fret not!

After working with many businesses across different industries, we have listed down when to send NPS surveys, the best time to send the NPS survey, how long you should run an NPS survey, and how often you should send an NPS survey, using robust NPS software.

Let’s dive in!

The Old Way of NPS Survey Timing

Traditionally, companies scheduled NPS surveys on an annual or quarterly basis. These surveys were often sent out at the same time every year – for example, after a customer’s anniversary with the brand, or at the end of each fiscal quarter. While this method made internal planning simpler, it came with significant shortcomings.

— First, the feedback collected was often outdated by the time it was received. A customer’s experience from months ago might no longer reflect their current perception, making it difficult for businesses to address issues in a timely manner.

— Second, these broad, infrequent surveys lacked context. Customers were asked to recall experiences that might have happened long ago, leading to vague or inaccurate responses.

— Third, because these surveys were not tied to specific touchpoints or recent interactions, which is why they often failed to capture actionable insights.

As a result, businesses missed critical opportunities to improve customer experience in real-time, and customers felt their feedback wasn’t valued when it mattered most.

This is why understanding when to send an NPS survey at the right touchpoint is important, so let’s understand it.

When to Send an NPS Survey? – Relationship NPS Survey

Relationship NPS surveys are used to measure overall customer satisfaction and loyalty over a longer period. So, we recommend sending an rNPS survey every quarter to see the highest impact on improving customer retention.

As we now know, relationship surveys can be sent either quarterly or after significant milestones in a customer journey. Let’s discuss this based on each industry and the survey frequency.

— Sending Relationship NPS Surveys At Regular Intervals

Before sending out rNPS surveys, you need to figure out the right balance that aligns with your objective.

Decide how often to send an NPS survey. The frequency can vary depending on your industry like banking, travel, etc, customer base, and the nature of your relationships. Common intervals include quarterly, semi-annually, or annually. Choose a schedule that aligns with your goals and resources.

Choosing the best time to send an NPS survey can be tricky and you might not get it right every time. So, consider using the best NPS tools in the market, like SurveySensum, where CX consultants can help you with the right time to send your NPS surveys and also allow you to automate the survey-sending process.

Now, let’s understand when to send regular rNPS surveys for different industries.

| Industry | Survey Frequency | Best Time to Send | Why to Send |

| B2B SaaS | Semi-annually or annually | Before subscription expiration or contract renewals | To gauge customer satisfaction with the software, identify usability issues, understand feature adoption, and gather suggestions |

| B2B Manufacturing | Semi-annually or annually | Before subscription expiration or contract renewals | To assess product quality, customer service satisfaction, and delivery efficiency, and identify opportunities for product innovation |

| B2B Marketing & Advertising | After significant campaigns or projects | After major marketing campaigns, to understand the impact of your efforts on client satisfaction | To evaluate the effectiveness of marketing campaigns and understand brand perception |

| B2B Fintech | Annually or after significant updates | Annually, to gauge long-term satisfaction | To measure user satisfaction with the platform’s security, usability, transaction speed, and customer support |

| B2B Service | Quarterly or semi-annually | Shortly after service delivery | To assess customer satisfaction with service quality, responsiveness, and professionalism, and identify areas for service improvement |

| B2B Logistic | After significant shipments or orders | After important shipments or orders | To evaluate service reliability, timeliness, accuracy of deliveries, and communication effectiveness |

| Insurance | Annually | Near policy renewal dates or after significant interactions | To assess customer satisfaction with policy coverage, claims handling, premium rates, and customer service quality |

| Telecom | Annually | After service disruptions, or during new service or feature rollouts | To evaluate service reliability, network coverage, call quality, internet speed, and customer support effectiveness |

| Automotive | After every service appointment | After vehicle servicing appointments or dealership visits | To help you understand customer satisfaction levels with the service quality, customer support, and overall dealership experience. |

Note: You can automate this whole process of sending NPS surveys with efficient NPS software tools like SurveySensum. Just set the time and date for your surveys in advance and the tool will automatically send your surveys to your uploaded customer list in time.

Ready to take action? Launch targeted NPS surveys today, gather real-time insights, and turn feedback into powerful strategies that boost customer satisfaction, loyalty, and growth. Start listening, start improving!

— Sending Relationship NPS Surveys After Significant Milestones

Okay, so now we have established what type of industries need to send rNPS surveys at regular intervals over a year. But what about the ones that don’t need regular follow-ups?

Let’s say a customer bought sunscreen from your beauty brand. The product might last for 2-3 months after regular usage. Do you think sending an rNPS survey annually or quarterly to this customer is going to help you measure their satisfaction and their likelihood of suggesting your product to others?

No.

Here, it is important to send an rNPS survey after the customer has used the product for a significant amount of time. This approach will help you capture customer feedback when it matters most and understand their sentiments after key interactions and experiences.

Now, we have discussed this in length regarding the right intervals for rNPS surveys, but what but the tNPS surveys? Let’s find out.

When to Send an NPS Survey? – Transactional NPS Survey

As you know, Net Promoter Score is a loyalty metric. It focuses on building and gauging relationships over time, making it less suitable for gathering feedback after just a single transaction or interaction. That is why we recommend sending CSAT surveys instead of tNPS surveys.

And here’s how you can use a CSAT survey, instead of tNPS.

Use clear and concise questions in your CSAT survey. For instance – ‘How satisfied were you with your recent support interaction?’

Offer a rating scale with the question, typically from ‘Very Unsatisfied’ to ‘Very Satisfied’, allowing customers to provide their sentiment.

You can also include NPS follow-up questions to gather insights into specific aspects of the interaction that contributed to the customer’s satisfaction or dissatisfaction.

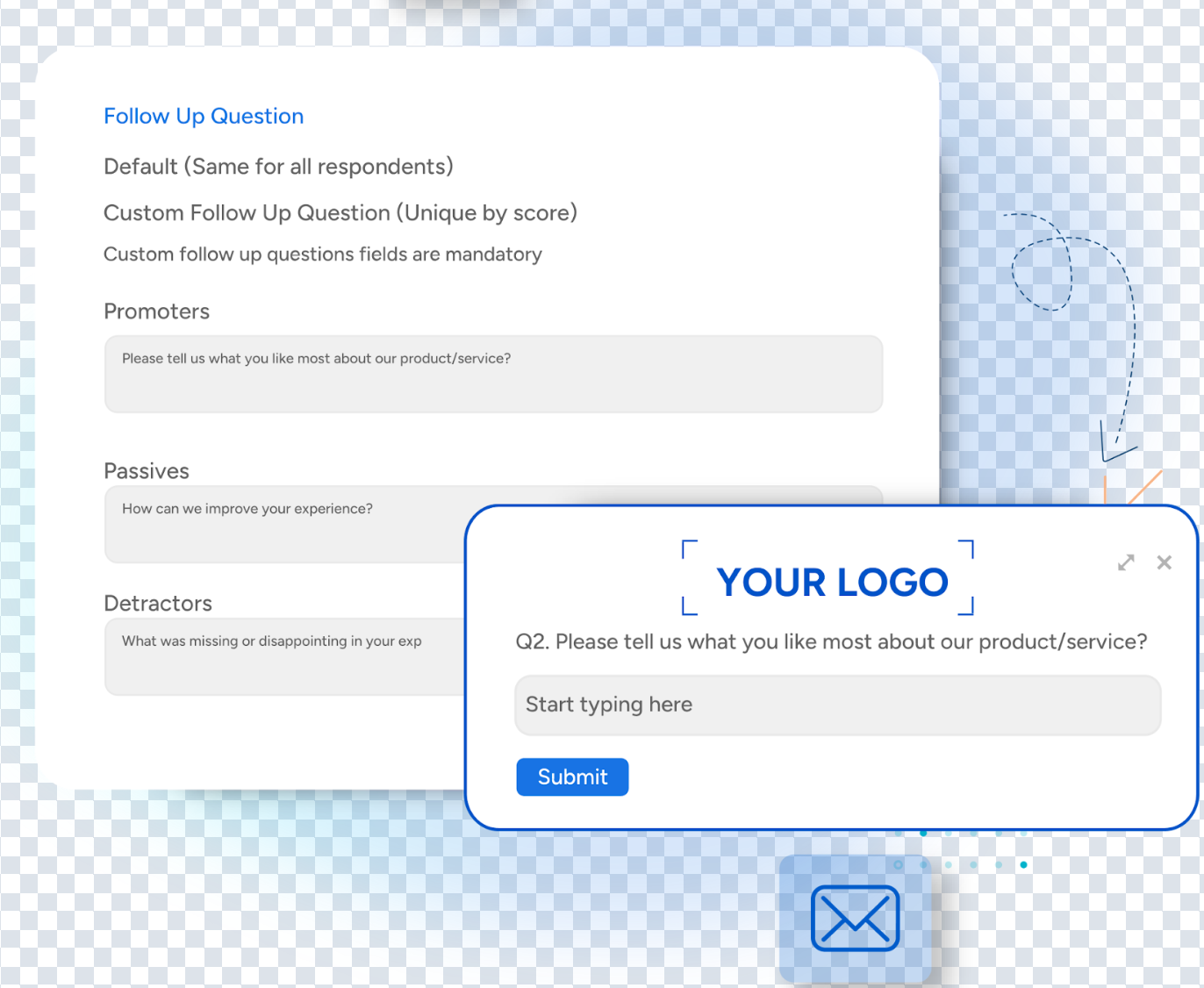

With SurveySensum’s custom follow-up question feature, you can personalize your surveys based on customer sentiment.

- Promoters? Ask them what they love most.

- Passives? Discover how you can improve.

- Detractors? Uncover what disappointed them.

This helps you design tailored questions and smart segmentation that lead to deeper insights and better decisions.

Best Days to Send NPS Surveys

When it comes to sending NPS surveys, the day of the week doesn’t matter as much as it might seem. Why?

Because, as we have discussed above, the customer-brand interaction is a better indicator of when to send NPS surveys rather than a day of the week.

Nonetheless, there are days in a week that yield more success than others. Here are some of those days:

- For shorter B2B surveys, without any follow-up questions, Monday is the best day.

- For longer surveys, for instance B2B SaaS Survey, Thursday yields more open and NPS response rates.

- And when it comes to the time of the day, low peak hours during working days seem to work the best.

Now that we’ve discussed the optimal day and time to send your NPS surveys, let’s delve into some important aspects of your NPS surveys.

Close the Feedback Loop

There is no point in going through the trouble of launching an NPS survey if you don’t take any action on it, right?

So, address issues promptly, capitalize on positive feedback, and close the feedback loop in time – maintaining customer satisfaction.

But how to do that?

Closing the Loop with Promoters

When reaching out to promoters who provide positive feedback, express gratitude for their support, acknowledge their satisfaction, and show that you value their input and appreciate their loyalty.

But don’t just stop there. They have the potential to become brand advocates, so leverage them.

But how to create brand advocates?

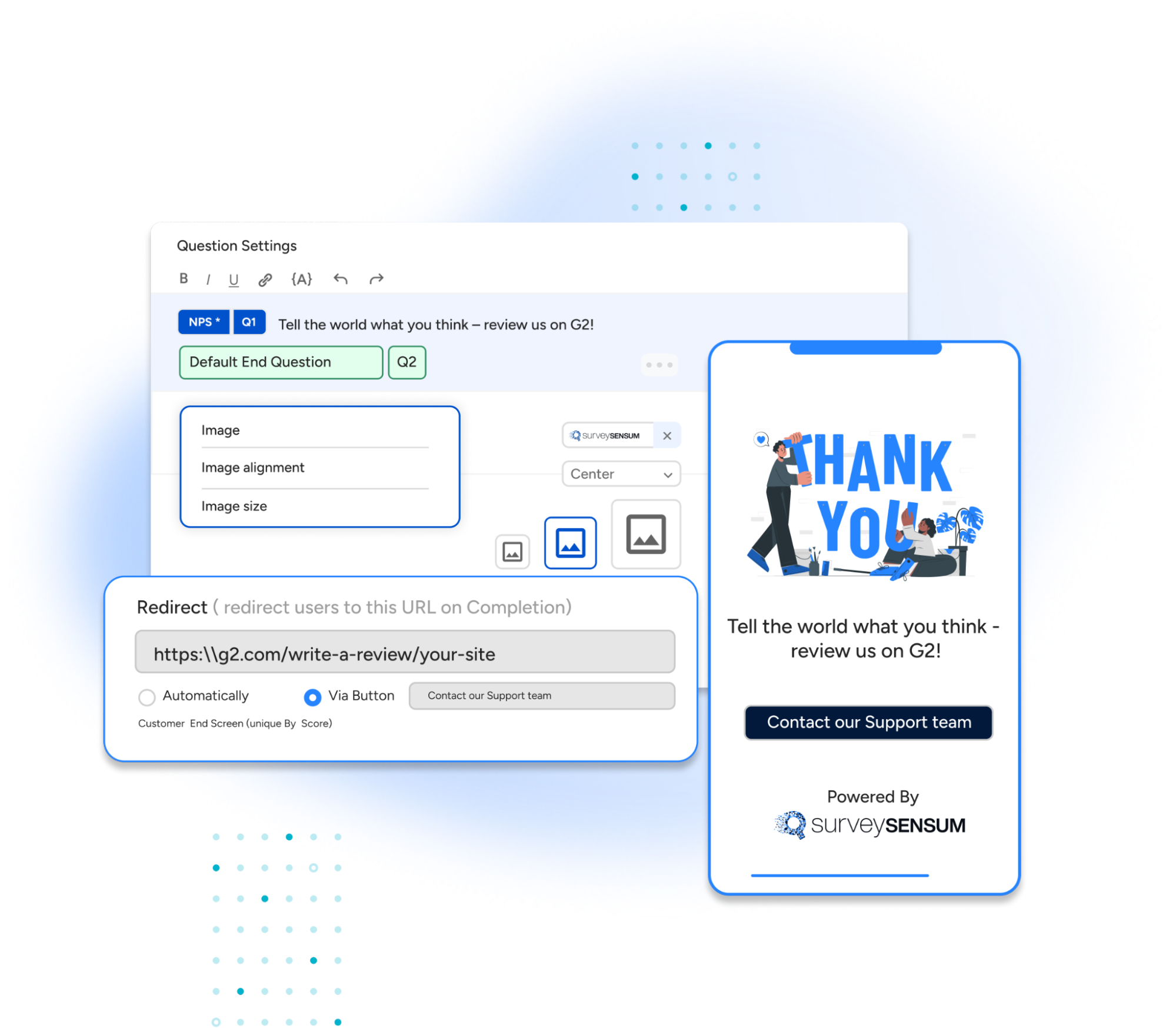

Your promoters are already satisfied with your brand so put in extra effort and convert them into your brand advocates and they will promote your brand willingly. Offer exceptional personalized service to them, create meaningful loyalty programs for them with relevant benefits, and engage with them on social media.

SurveySensum makes collecting public reviews seamless and efficient with its customizable end screens and redirect feature. After completing a survey, respondents can be automatically guided to leave a review on platforms like G2, Google, etc. You can personalize the end screen with images, messages, and CTA buttons, ensuring a branded, engaging experience.

Closing the Loop with Detractors

On the other hand, with detractors, contact them promptly after receiving negative feedback. Apologize for their dissatisfaction and assure them that their concerns will be addressed. Now, investigate the issue and find a resolution that aligns with the customer’s needs and expectations.

Keep the customer informed about the steps being taken to rectify the situation.

Closing the Loop with Passives

Lastly, when dealing with passives, engage with them to understand their concerns and identify areas for improvement. Proactively address their feedback and show how you’re making changes based on their input. Tailor your responses based on the specific feedback given. Demonstrate that you’re genuinely interested in their experience and opinions.

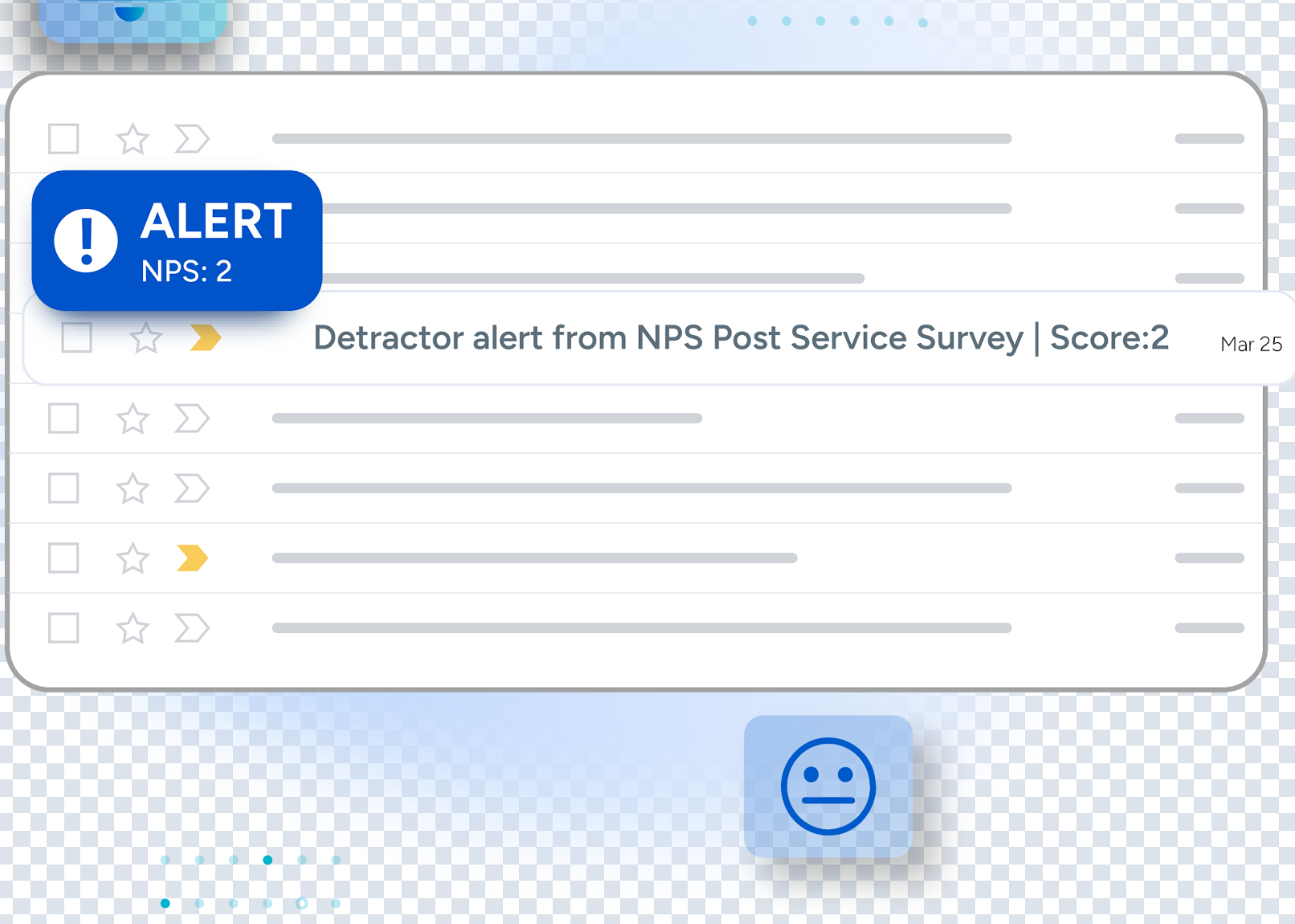

SurveySensum’s real-time detractor alert feature empowers support teams to act fast and retain unhappy customers. When a negative response comes in, the platform instantly notifies your team, highlights key pain points, and tracks resolution progress within a ticketing system. You can also segment customers by similar issues to identify patterns and fix root causes, improving customer experience proactively and at scale.

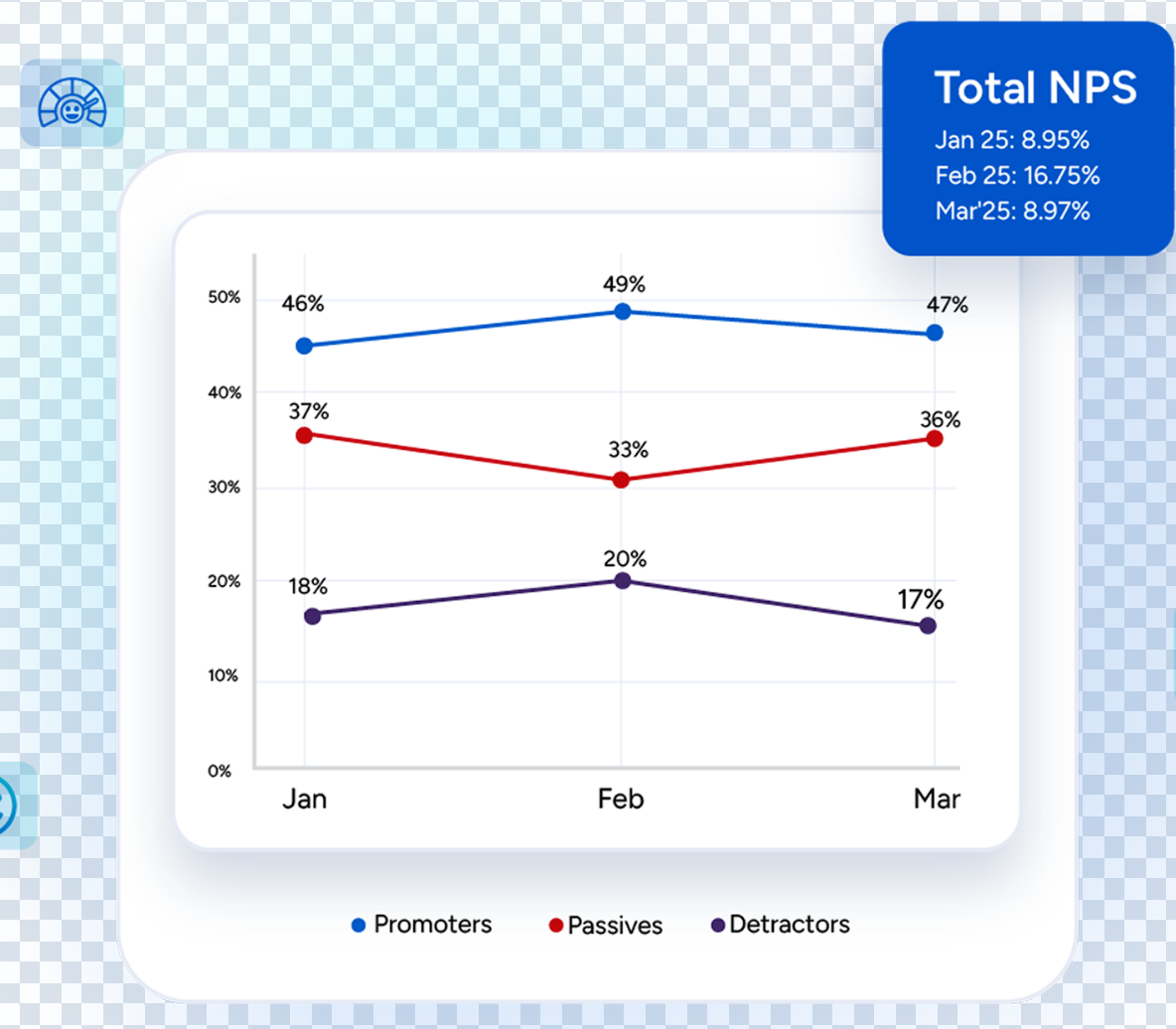

Analyze Impact With Historical NPS and Industry Benchmarks

Just calculating NPS is not enough! You need to compare and benchmark.

Why? It allows you to continuously monitor the impact of your actions over time.

This process shouldn’t be a one-time activity; rather, it should be a recurring practice. By tracking your NPS over various time periods, you gain insights into the trends and fluctuations in customer satisfaction. You can pinpoint when changes were implemented and how they influenced NPS.

This historical perspective is invaluable because it helps you understand the long-term effects of your efforts.

In essence, analyzing historical NPS enables you to connect the dots between your actions and their impact on customer satisfaction, providing a roadmap for continuous improvement and informed decision-making

Imagine: As the manager of a telecom customer support team, you implemented a training program to boost response times and issue resolution. After a few months, you decide to analyze your NPS to see if these changes have positively influenced customer satisfaction.

Initially, you measured an NPS of 20. However, after implementing the program, you monitor NPS for several months and observe a steady increase to a score of 40. This reflects the positive impact of your improvements. Your regular analysis allowed you to see this positive trend.

Upon analysis, you discovered that the improvement is because customers are mentioning shorter wait times and quicker issue resolution. This confirms the effectiveness of your actions, like the training program.

Though your rising NPS is promising, you understand the importance of NPS benchmarks by industry. Your research reveals the telecom industry’s average NPS is 45, indicating you’re slightly below the norm despite improvements.

This benchmarking against industry standards gives you a broader perspective and suggests that there may be additional opportunities for improvement to compete more effectively with your competitors.

Note: Industry NPS benchmarking can differ based on geographical regions due to cultural differences and local expectations. Analyzing how you fare in your targeted geography provides a localized perspective.

So, through regular analysis of your NPS and benchmarking against industry standards, you not only identified the positive impact of your actions on customer satisfaction but also gained insights into where you stand relative to your competitors.

Avoiding These Common Survey Timing Mistakes

Here are four common survey mistakes that you can avoid.

1. Not Sending Surveys Consistently: Inconsistent survey timing can lead to skewed data analysis and hinder your ability to accurately track trends over time. Sending surveys regularly allows you to capture shifts in customer sentiment, identify patterns, and make informed decisions based on reliable data.

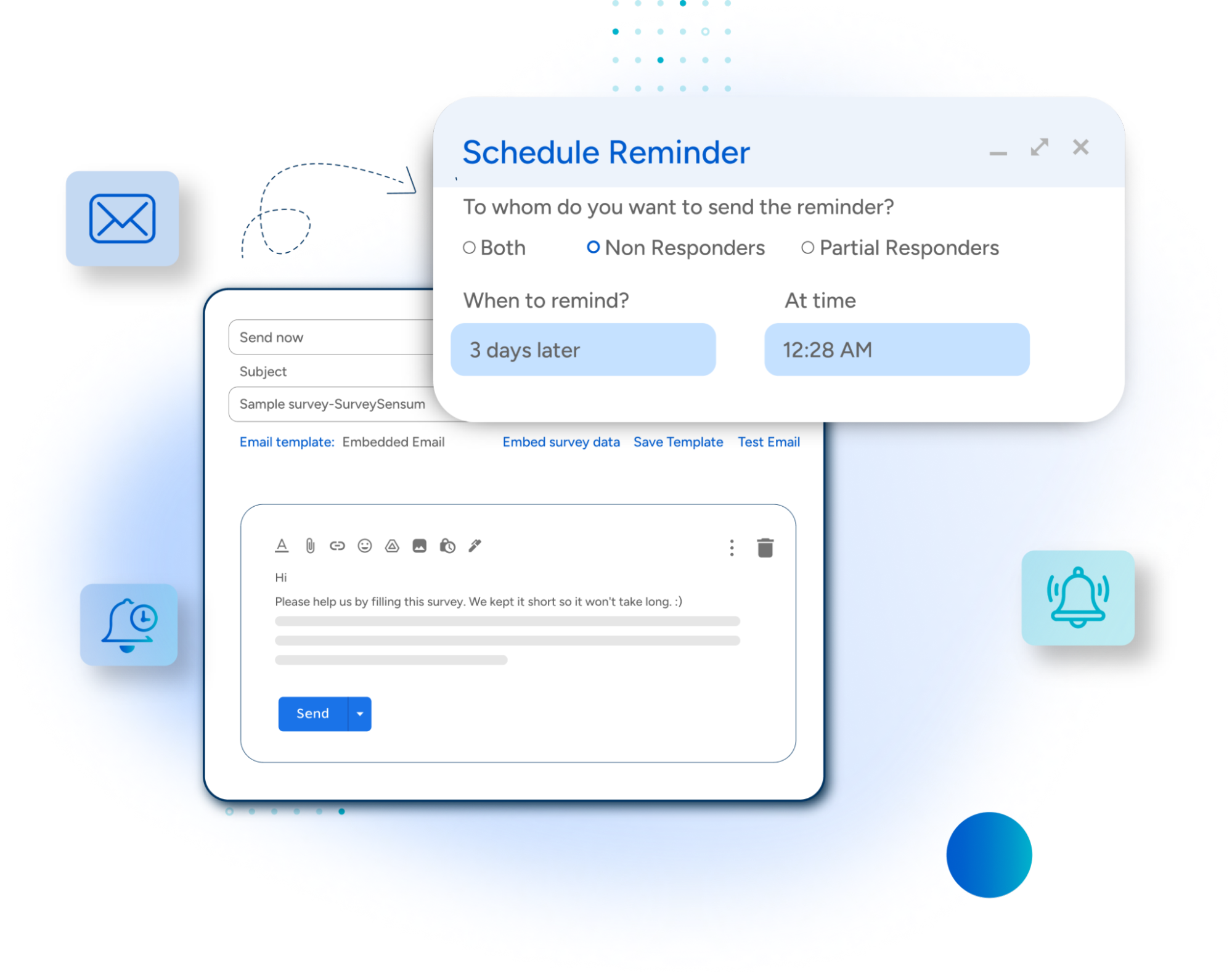

2. Ignoring Survey Fatigue and Its Effect on Response Rates: To mitigate this, carefully manage the frequency of survey requests. Avoid bombarding customers with surveys, especially if they’ve recently responded to one.

3. Not Taking Action on the Feedback: Collecting feedback is only valuable if you act on it. Neglecting to address customer concerns, suggestions, and issues communicated through surveys can result in dissatisfaction and erosion of trust.

4. Not Measuring the Impact of the Actions: After implementing changes based on customer feedback, it’s essential to measure the impact of these actions. Failure to do so leaves you in the dark about the effectiveness of your efforts.

How to Build and Launch NPS Surveys the Right Way With SurveySensum?

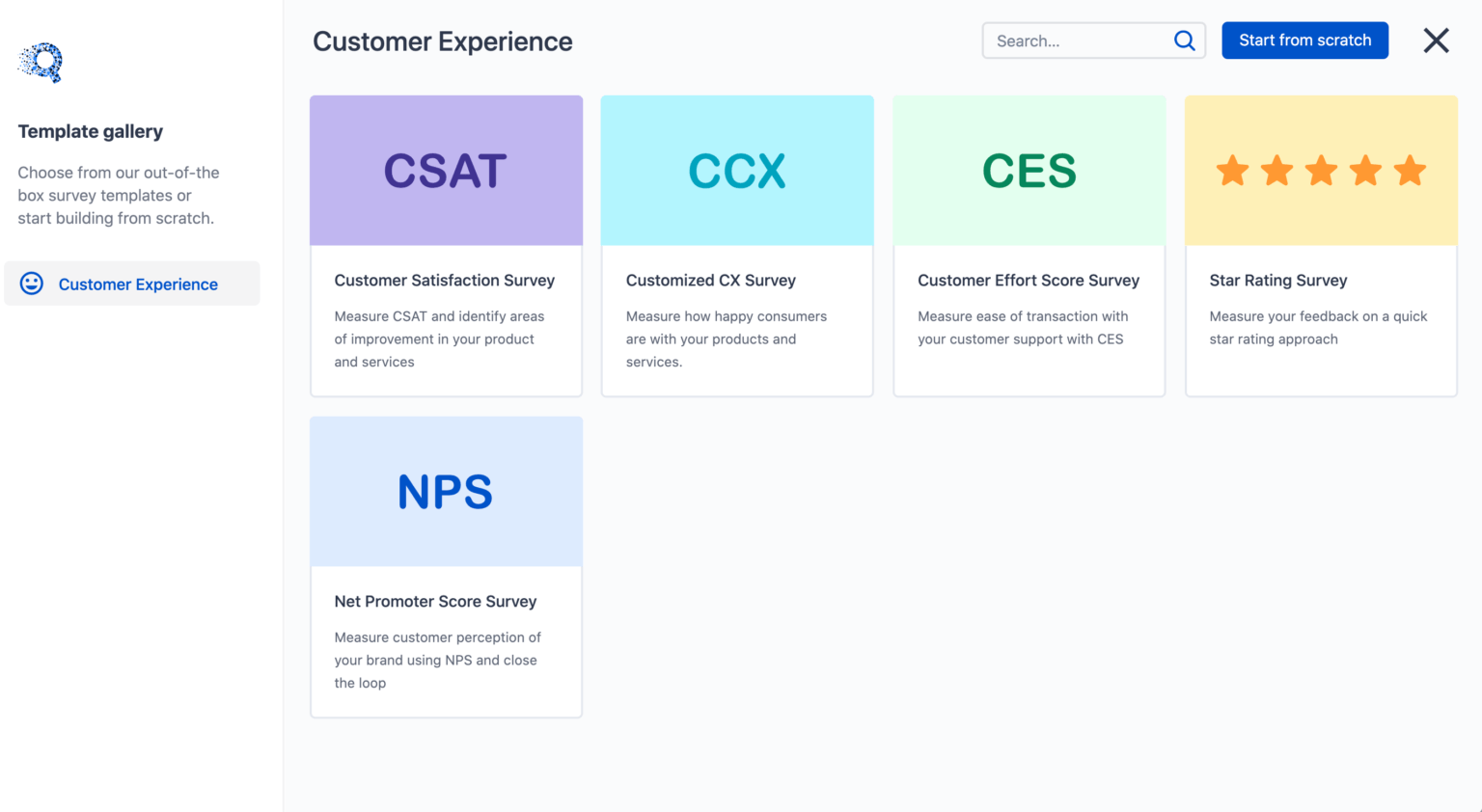

Creating an NPS survey and launching it at the right time and at the right interaction is a huge undertaking. Well, lucky for you, NPS software like SurveySensum, can help you automate this process so that you can launch the right survey at the right time. Here’s a step-by-step breakdown of how to do it.

STEP 1: Sign up for the SurveySensum survey-builder tool.

STEP 2: Click on “Start survey” and select “NPS” as the survey template.

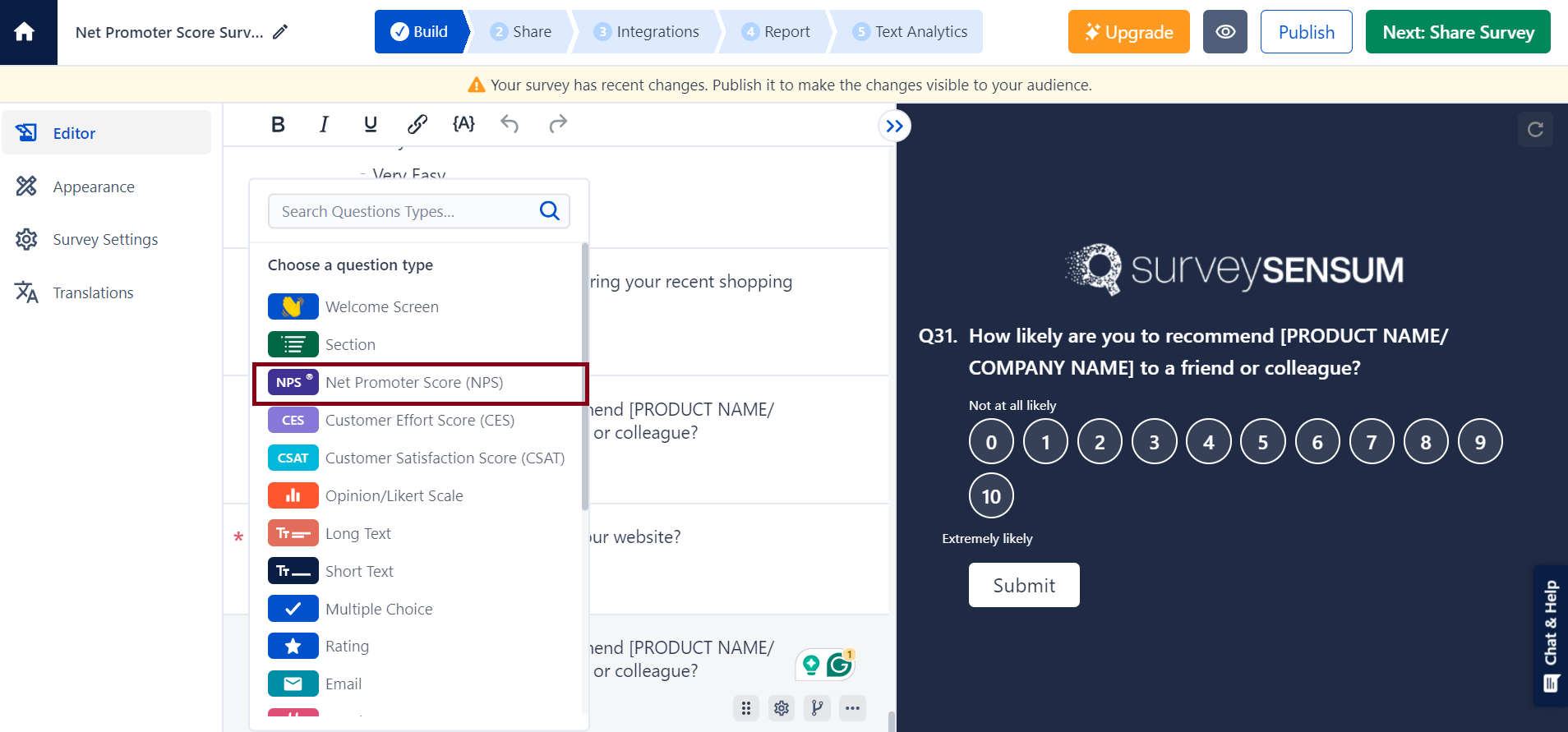

STEP 3: On the survey editor, select the “Net Promoter Score (NPS)” option in the types of questions.

STEP 4: Now, you can personalize your survey by adding the questions, setting the scale, and changing the label name accordingly.

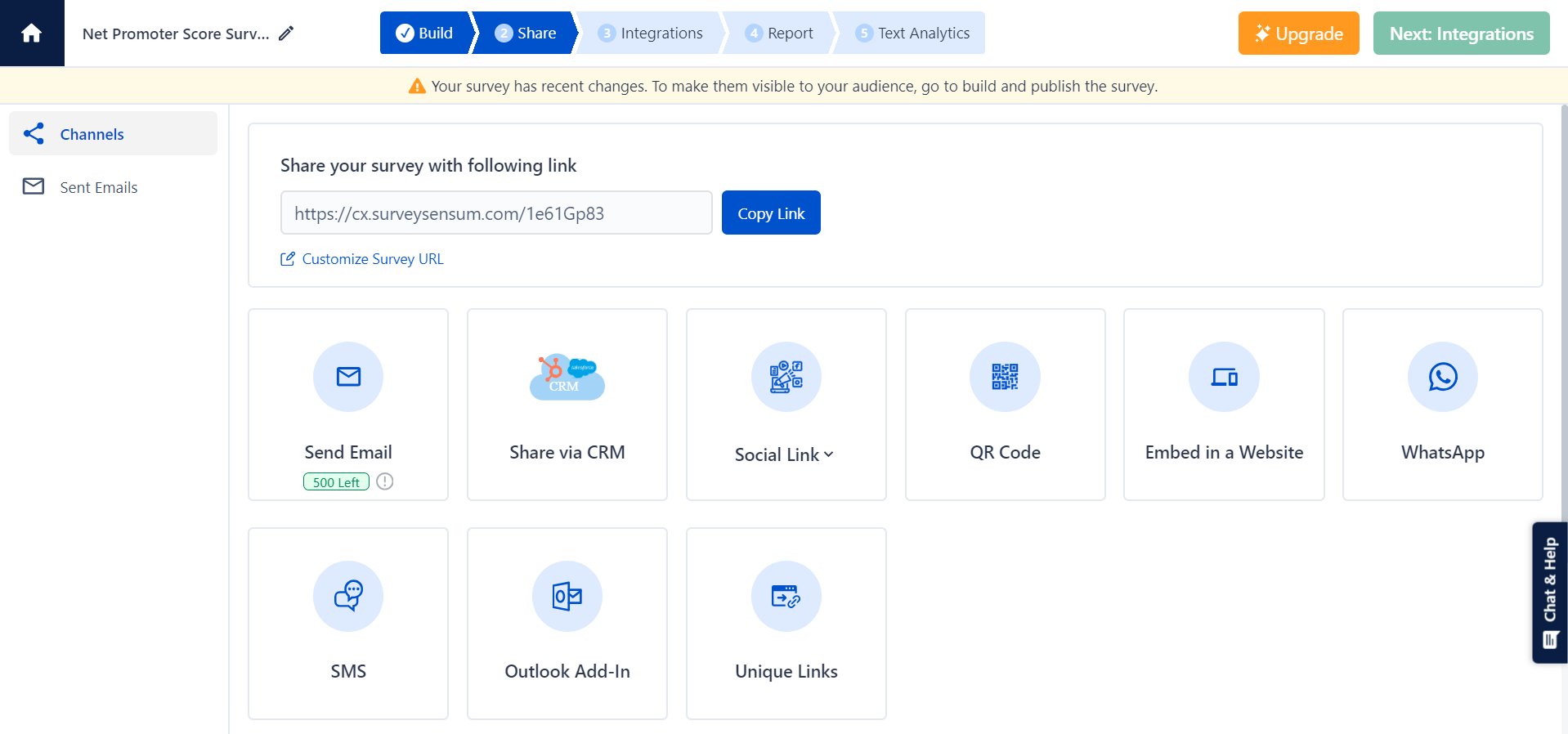

STEP 5: Once done, save and share the survey with your customers.

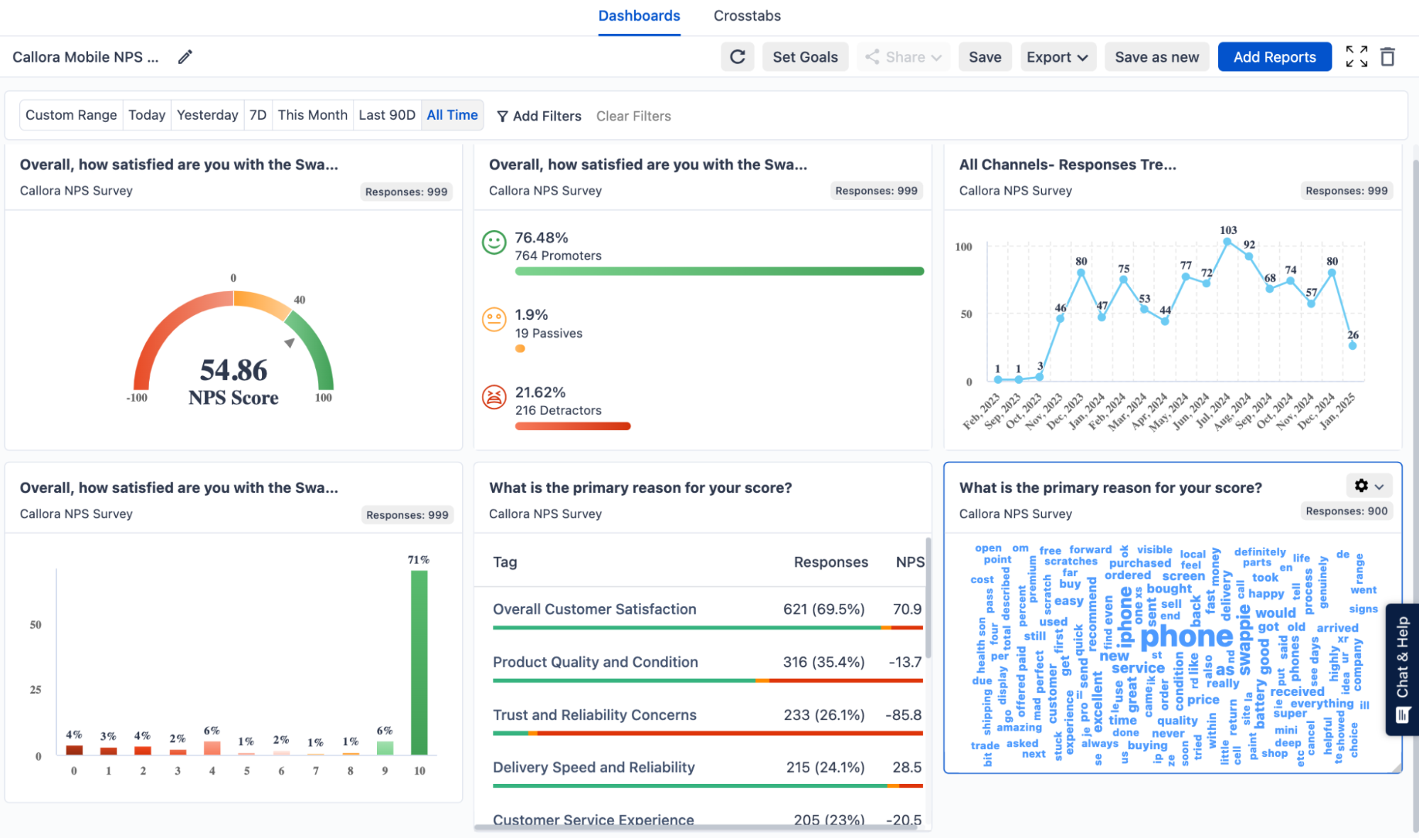

STEP 6: After sharing the survey, you can simply create your custom dashboard based on the responses you want to.

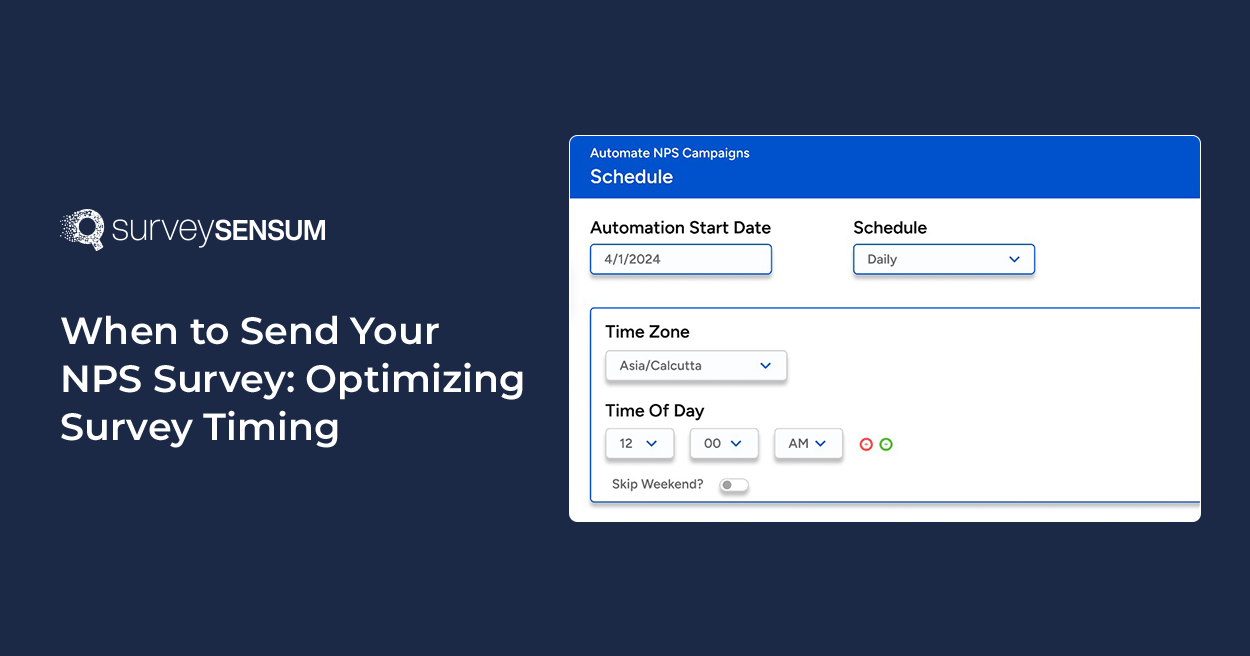

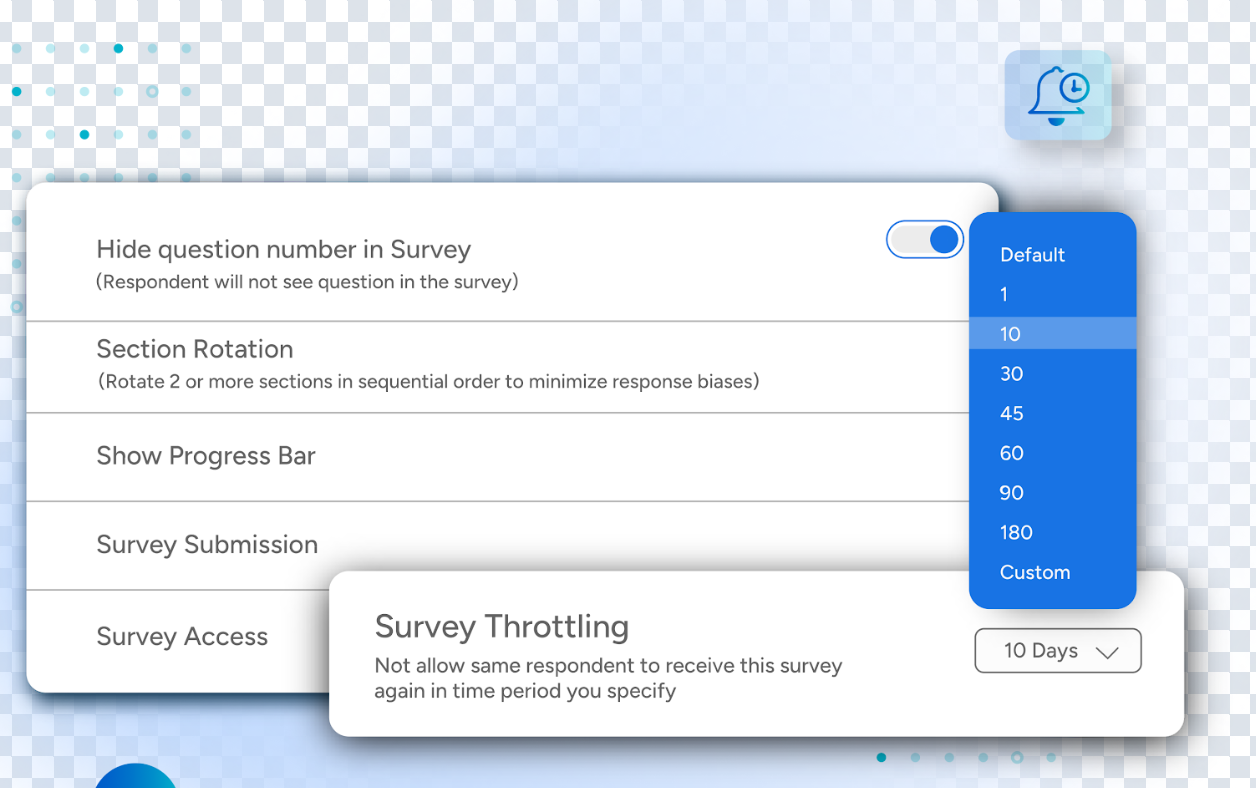

If you want to set up an NPS survey frequency and automate the process of NPS survey sharing, then follow these steps.

STEP 1: On your SurveySensum dashboard, go to “Settings”. Here, select “Survey Throttling”.

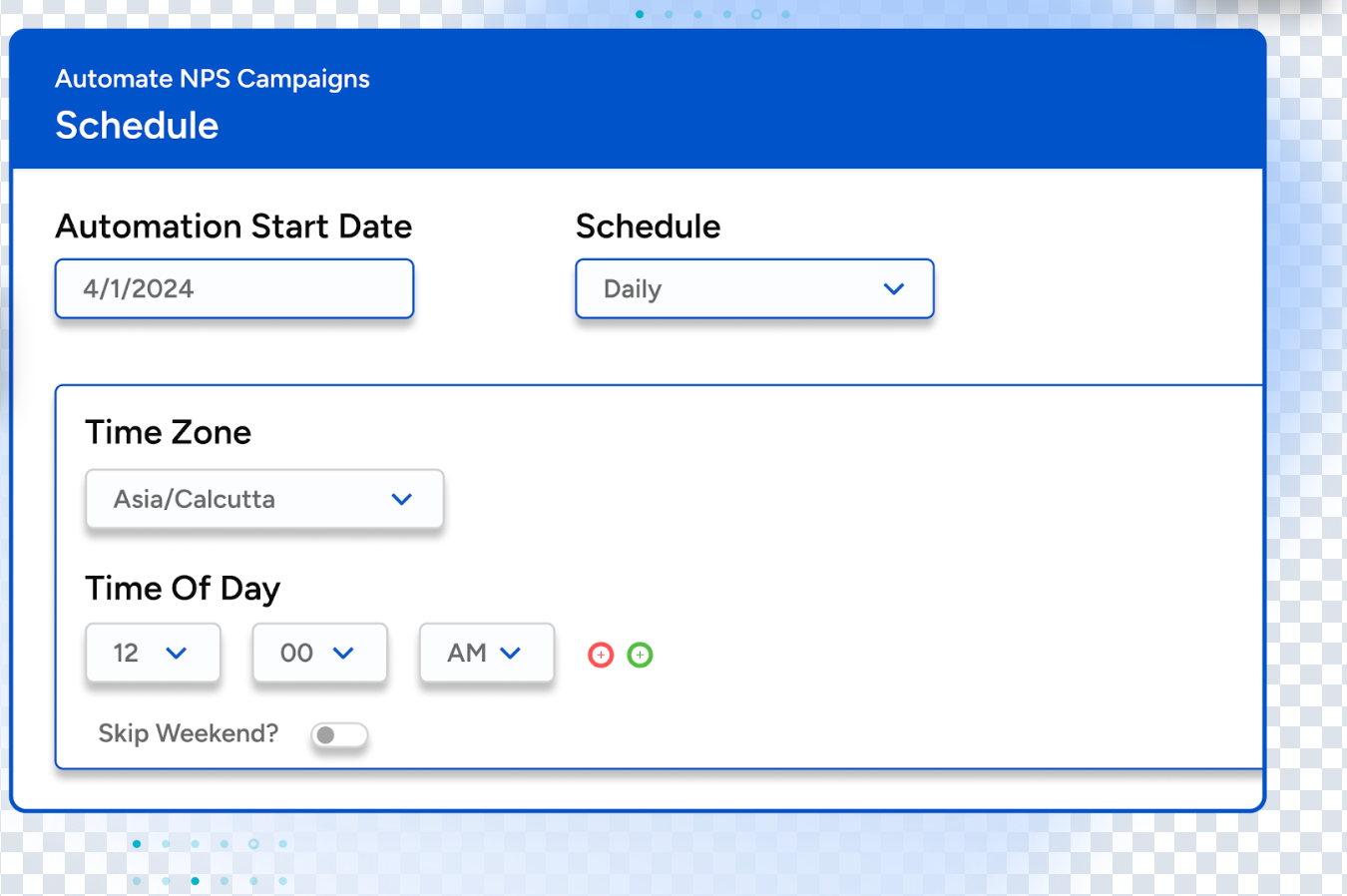

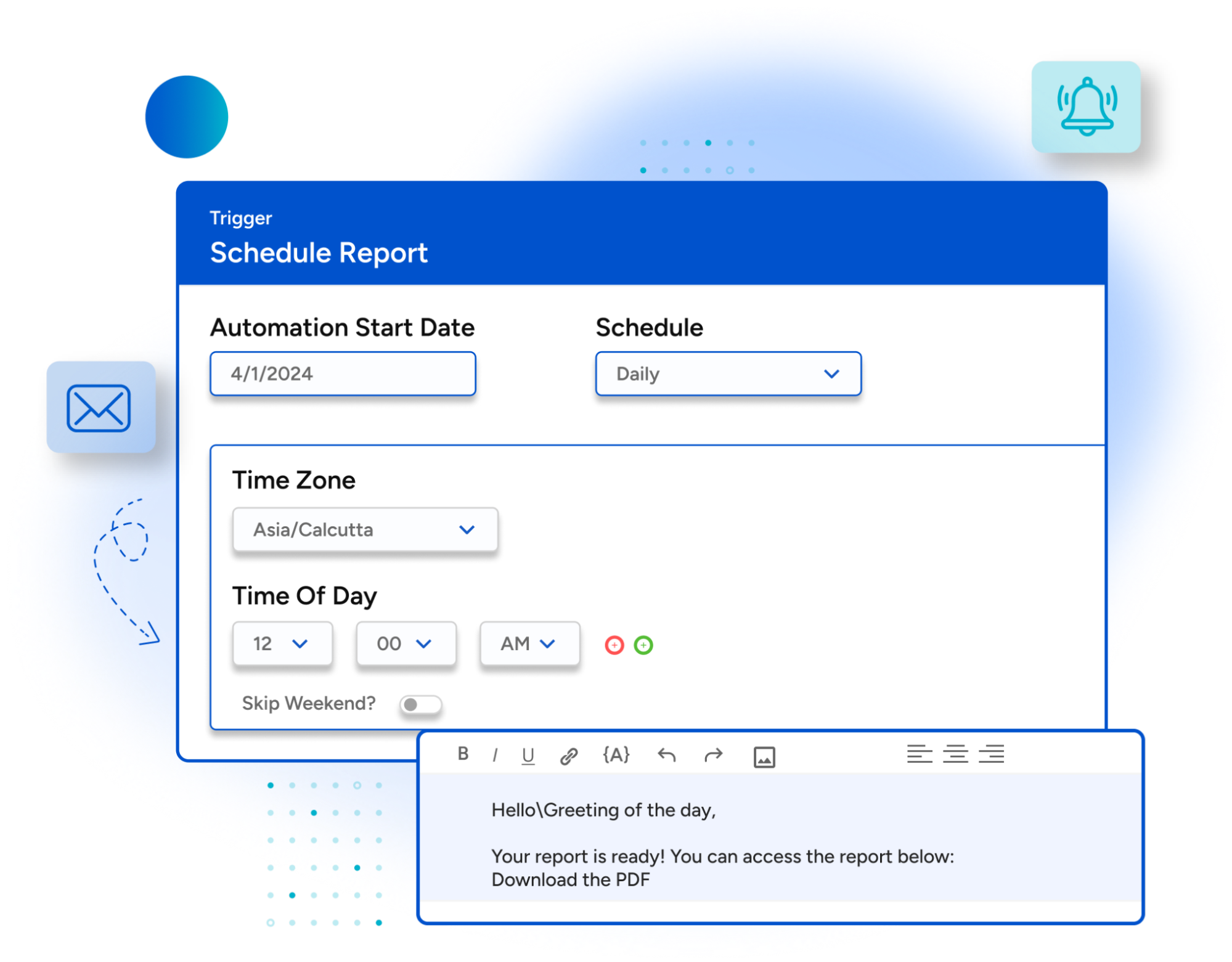

STEP 2: Here you can define the start date for survey automation, choose the frequency (daily, weekly, etc.), set the time zone and preferred time of day, and even opt to skip weekends to avoid customer fatigue.

STEP 3: Finally, schedule automated NPS report delivery to your team’s inbox so everyone stays aligned with real-time customer insights.

Conclusion

Surveys are only effective when they are sent in the right way at the right time. Not understanding the importance of sending NPS surveys at the right touchpoint of the customer journey will result in the gathering of unreliable and inaccurate customer feedback.

So, before sending out your NPS surveys, make sure that you properly understand what type of NPS survey needs to be sent at which touchpoint and that it properly aligns with your goals and objectives.

In order to do that, use customer feedback software like SurveySensum. It enables timely NPS survey creation and distribution while also facilitating NPS analysis, sentiment tracking, and real-time detractor resolution and feedback closure.

Frequently Asked Questions about When to Send NPS Surveys

The frequency of running NPS surveys depends on various factors such as the nature of your business, customer engagement cycles, and the rate of change in your products or services. Generally, it’s recommended to run NPS surveys at regular intervals, such as quarterly or semi-annually.

You should ask for NPS in your app at a point when users have had sufficient experience with your product or service to provide meaningful feedback. This could be after they have completed a transaction, achieved a milestone, or used a feature extensively.

There’s no definitive answer to this question as it depends on your specific goals and the user experience of your survey. Some prefer to ask the NPS question first to capture initial impressions, while others place it at the end to allow respondents to provide more context before rating. Experiment with both approaches to see which works best for your audience.

NPS questions can be valuable for gathering insights into customer satisfaction and loyalty. They provide a simple and standardized way to measure overall customer sentiment and identify areas for improvement. However, pairing it with other CX metrics like CSAT, CES, etc will be more beneficial.

The frequency of sending NPS surveys depends on your business objectives and customer interaction points. Sending NPS surveys quarterly or semi-annual surveys is common, but you may adjust the frequency based on your specific needs.

The best practice frequency for NPS surveys depends on your industry, customer base, and business goals. Generally, it’s recommended to strike a balance between capturing frequent feedback and avoiding survey fatigue. You should make an educated decision on when to send which survey with either a 5 or 11 pointer scale.

You should survey for NPS at points in the customer journey where users have had significant interactions with your product or service. This could include after completing a purchase, receiving customer support, or using a key feature.

Typically, organizations review and analyze survey results shortly after each survey cycle (e.g., quarterly or semi-annually) to identify trends, insights, and areas for improvement. Results may be shared with relevant stakeholders and used to inform strategic decision-making.

NPS surveys can be sent out via various channels, including email, SMS, in-app notifications, and web pop-ups. The method of distribution depends on your audience’s preferences and the touchpoints where you can reach them effectively.

The frequency of eNPS surveys depends on your organization’s culture, employee turnover rates, and the pace of change within the company. Generally, eNPS surveys are conducted annually or semi-annually to track employee sentiment over time.

As mentioned earlier, there’s no definitive answer to this question. Some companies prefer to ask NPS questions first to capture initial impressions, while others place them at the end to allow respondents to provide more context before rating. Consider experimenting with both approaches to see which yields the most meaningful insights for your organization.

NPS surveys can provide valuable insights into customer satisfaction and loyalty, making them worth considering for many businesses. However, pairing it with other CX metrics like CSAT or CES will give a more holistic view of your customer experience.