Text Analytics for Mutual Funds: Why It Matters

There is a lot of discussion going on in the CX industry on the relevancy and importance of NPS. Questions about its relevance and significance echo in boardrooms and strategy sessions. The truth is, that NPS holds significant weight in measuring customer loyalty and fortifying retention strategies.

But here’s the catch – it’s not a one-size-fits-all solution.

Let me tell you something straight, NPS is a very important CX metric when it comes to gauging customer loyalty and boosting retention. However, the issues arise when its feedback is not properly analyzed.

The insights gathered from the survey should be properly analyzed in order to extract an action plan from it, especially the feedback gathered from the open-ended questions.

You see the quantitative feedback will only give you a score, but only with proper analysis of qualitative feedback can you identify areas of improvement.

But how to do that? With the help of Text Analytics Feature, you can properly analyze your NPS program.

So, let’s understand how the text analytics feature can help you uncover a treasure trove of information from your NPS surveys with the help of a case study of Text Analytics for a mutual funds company.

Use Case: Mutual Fund Company

The Challenge

A prominent mutual fund company was on a mission to boost its customer retention rate by identifying issues in customer interactions.

Now, for this mutual fund company, customers were onboarding to their services in three ways:

- Through their own Bank’s Websites/Apps

- Through Partner Banks

- Through Stock/ Mutual Fund Trading Apps

The highest transaction rate was through the bank’s agents. Agents get in touch with customers, explain the benefits and the process, and hand them over to relationship managers who help customers through the entire process of buying mutual funds. In this way, there were no issues as the customers directly interacted with the bank’s agents.

And the best part – since they were selling the funds from their own bank’s Websites/Apps, they didn’t have to pay any commission to their partners.

But, the challenge arises with the other two ways – through the partner bank’s app/website and Stock Trading Apps. Here the transaction rate was low and the company was not able to figure out the issue as the customers were not having any direct interaction with the bank.

→ So, they wanted to understand the reasons for the low transaction rate in order to resolve it.

Launch Your First NPS Survey!

The Solution

In order to boost the transaction rate, the company decided to create NPS surveys and launch them to ask customers about their preference for the mutual fund and any recommendations for the company for improvement. And remember NPS is different in industries like banking, SaaS, B2B, etc.

The survey uncovered A LOT of insights. However, analyzing the data was another headache.

So, they used the Text Analytics feature of SurveySensum’s NPS tool to tag and analyze thousands of feedback. This helped them eliminate the manual work and generate detailed reports on customers’ challenges.

Here’s how they did it:

Step 1: They first trained the system. Read a few comments and figure out some categories. For example, ‘Information/Knowledge’ was one of the trending comments.

Step 2: Then, they added some keywords related to it.

Step 3: In tag analysis, the tool tagged every comment automatically and gave a detailed report of top trends and customer sentiments in just a few minutes.

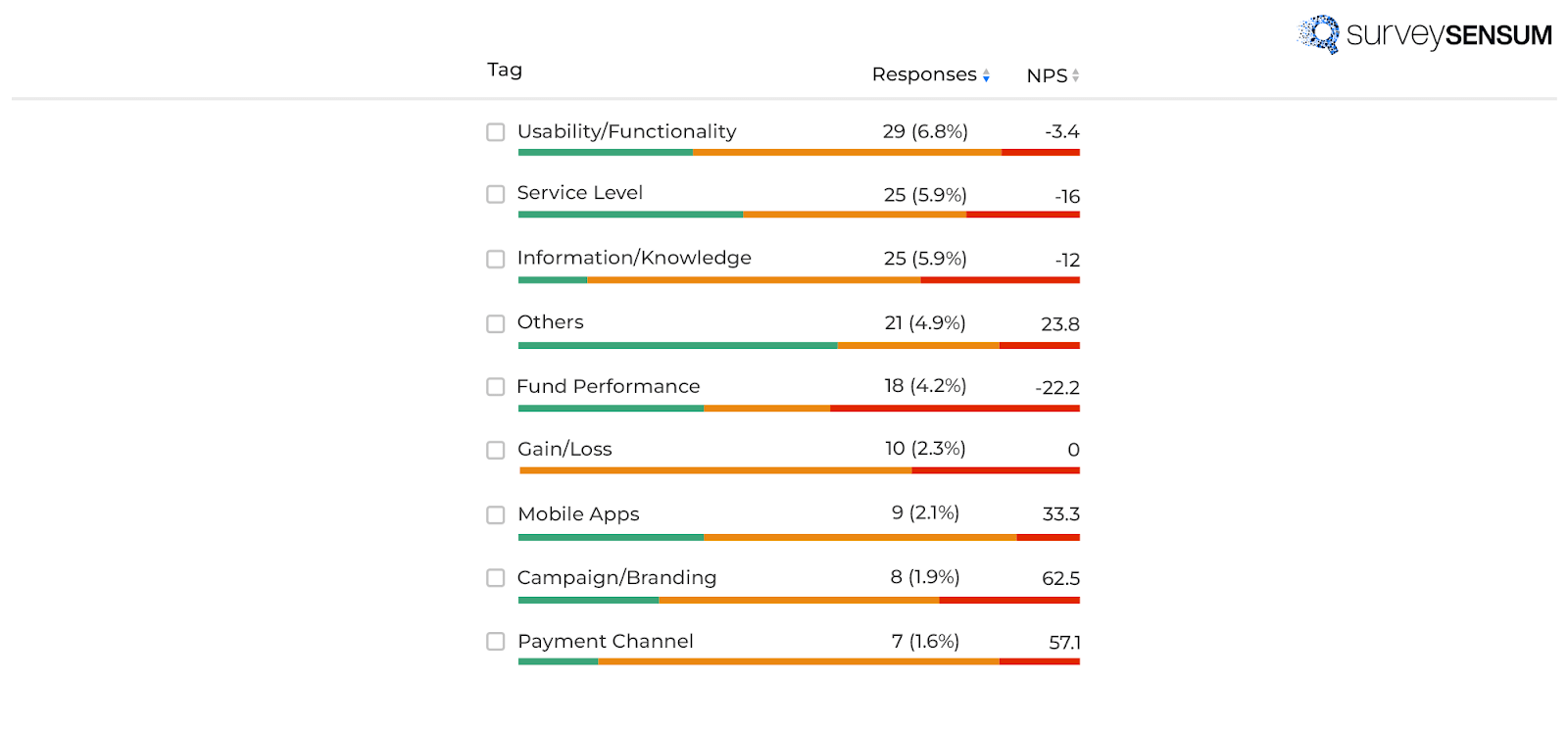

Now, when they run the text analytics feature, they discovered these key findings

- For the category ‘Usability/Functionality’ the NPS score was -3.4.

- For the category ‘Information/Knowledge’ the NPS score was -12.

- For the category ‘Fund Performance’ the NPS score was -22.2.

- For the category ‘Others’ the NPS score was -23.8.

With the help of this NPS analysis, the company gained valuable insights into customer preferences, revealing a strong desire for in-depth information and knowledge regarding mutual fund offerings, something they would not have gathered from a simple NPS scale question. It became evident that customers were not only interested in understanding the intricacies of the investment process but also sought insights into the potential benefits and expected outcomes.

This shift in customer behavior highlighted a growing inclination towards self-empowerment and informed decision-making.

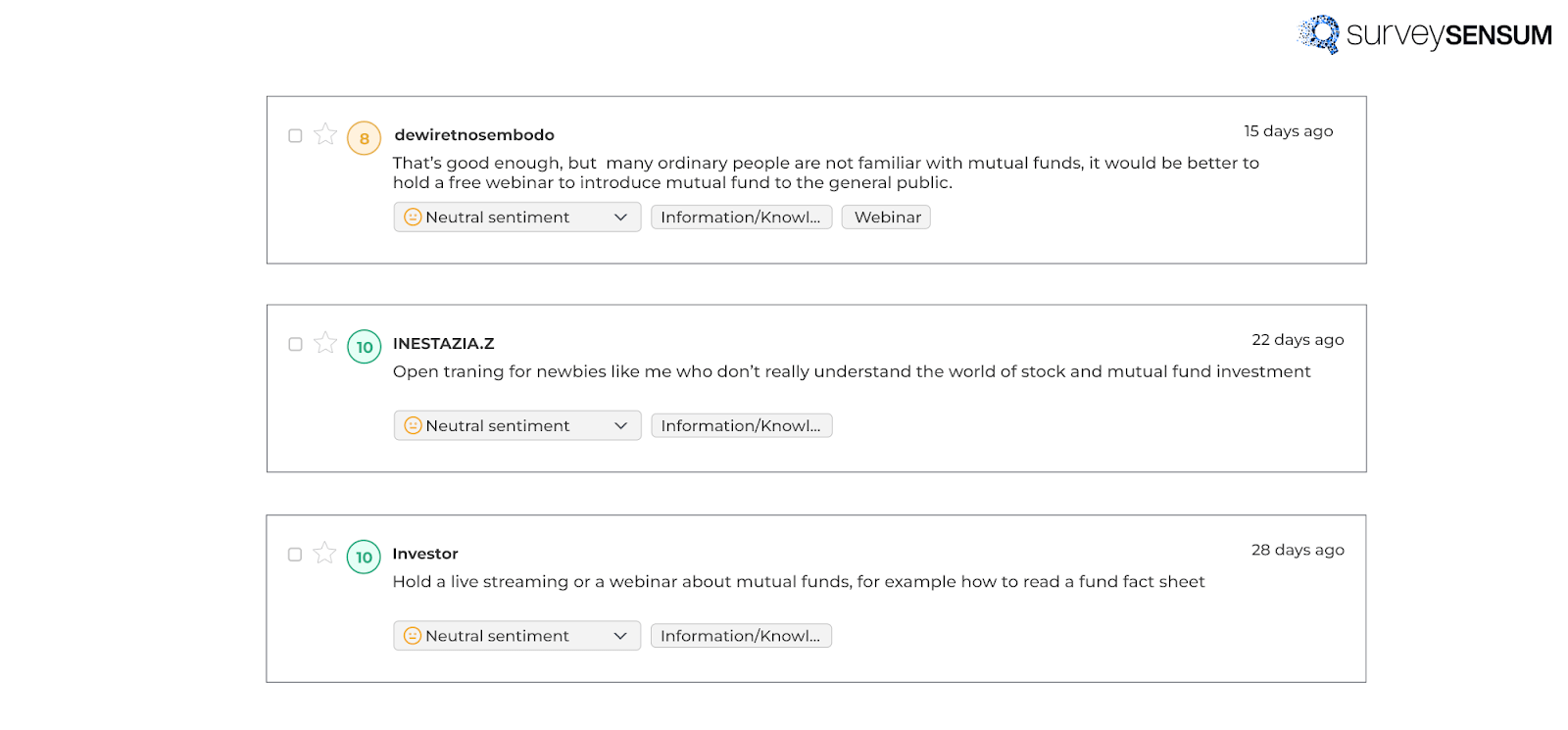

Here are some of the feedback shared by the customers.

Action Taken

Understanding that customers were eager for accessible and engaging resources, they alerted their marketing team to create webinars and videos for easy knowledge sharing with their customers.

The implementation of webinars and knowledge-sharing resources allowed the company to conduct interactive sessions, providing customers with a platform to engage directly with experts and ask questions in real-time.

The Result

Implementing these webinars, knowledge-sharing sessions, and videos with their customers increased their transaction rate by 18%.

Conclusion

This use case of text analytics for mutual funds not only highlights the importance of listening to the voice of your customers and going beyond a mere NPS calculation but also underscores the importance of properly analyzing customer feedback to extract actionable insights.

The success achieved in increasing the transaction rate and enhancing customer satisfaction validates the potential for similar strategies across the sector.

Analyze Your Survey Data With Text Analytics