Did you know that your surveys are causing fatigue among your customers? Yup, that’s right, more than 24% of respondents have stated that they abandon surveys if it’s too long.

This low response rate is more than just a numerical woe – it represents the difficulty in cutting through the digital noise to engage your customers who are burdened with requests for customer feedback at every point.

To overcome this, the strategic deployment of surveys using a robust customer feedback tool becomes more than critical. The decision of when to reach out to customers with survey requests is all about creating a balance between gathering actionable insights and respecting the boundaries of customer patience.

After working with different companies across industries, I have understood that choosing the right survey frequency is not a mere technicality – it’s a strategic approach that influences how businesses perceive and respond to evolving customer needs and preferences. Most importantly, it helps promote a healthy image of your brand among your customers.

But, how to create this delicate balance?

Well, after working across different industries for the last 10 years, I gathered my learning in creating the ideal survey frequency for these industries.

So, let’s scroll down to discover that, along with some key factors to consider for survey frequency distribution, but first, let’s understand the survey frequency definition.

Key Factors to Consider for Survey Frequency Distribution

So, How Often Should You Send Surveys?

Is It Poor Form to Receive Surveys from Multiple Departments Within the Same Company?

What is Survey Frequency?

Survey frequency refers to how often a survey is administered or conducted within a given period.

It is a crucial aspect of survey design and implementation that impacts the quality of the data collected and the overall experience for respondents. The decision on survey frequency involves different factors such as the target audience, business goals, etc.

Let’s understand these factors in detail.

Key Factors to Consider for Survey Frequency Distribution

Several key factors should be considered to strike the right balance and ensure that the survey frequency aligns with the goals of your business and the preferences of your customers.

Here are some key factors to consider:

- Target Audience: Understand your target audience and their characteristics. Different demographics have different levels of tolerance for survey frequency. For example, the younger demographic is more accustomed to frequent digital interactions, while the older audience prefers less frequent surveys.

- Survey Goals and Objectives: Clearly define the goals and objectives of your survey. If the purpose is to track long-term trends, a regular schedule with consistent intervals is appropriate. However, if the survey is tied to a specific transaction, adjusting the frequency accordingly is essential.

- Industry Standards: Research industry benchmarks or standards regarding survey frequency to understand the ideal survey frequency prevalent in your industry.

- Survey Length and Complexity: Make sure your surveys are not too long and complex for your customers. The ideal survey length should fall within 5 minutes, with respondents willing to answer around 4-5 survey questions. This is because people have limited time and attention spans.

- Previous Response Patterns: Analyze the response patterns from previous surveys. If you observe a decline in response rates or engagement with increased frequency, it may be an indication to adjust the survey schedule.

Now, let’s discover the ideal survey timings for different industries in order to avoid survey fatigue.

So, How Often Should You Send Surveys?

Here’s a breakdown of the survey frequency distribution for different industries.

1. SaaS

| SaaS Touchpoints | When to Conduct the Survey? |

| Product Fit Market Survey | A few months after the launch |

| Product NPS | After 90 days |

| Onboarding |

|

| Feature Satisfaction |

|

| Feature Request and Prioritization |

|

| Product Churn | Immediately after a customer discontinues using your product |

| Product Experience | After 90 days when the customer gives a ten score on the NPS survey |

| Free Trial | After the 14 days or when the free trial period ends |

| Customer Support | Immediately after customers have interacted with your support team |

| Relationship NPS | Every 6 months to assess the overall health of your customer relationships |

Sign Up and Start Launching Product Feedback Surveys With SurveySensum for Free!

2. B2B

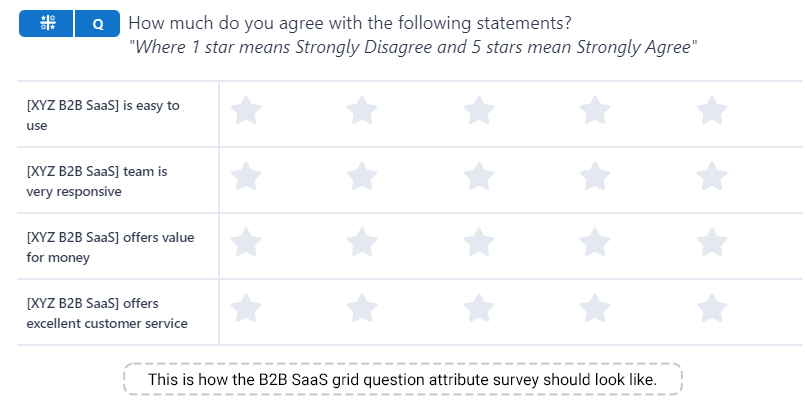

1. B2B SaaS

| B2B SaaS Touchpoints | When to Conduct the Survey? |

| Onboarding | 2 weeks after sign-up |

| Customer Support | After resolving an issue |

| New feature launch | One Week after release |

| Product Usage and Overall Relationship | Quarterly or semesterly (every 6 months) |

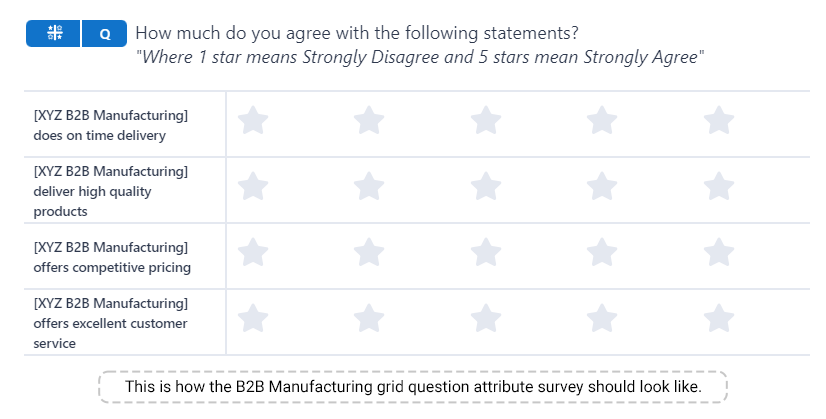

2. B2B Manufacturing

| B2B Manufacturing Touchpoints | When to Conduct the Survey? |

| Order Delivery | Upon product delivery |

| Post-Purchase | 6- Monthly after purchase |

| Customer Support | After resolving an issue |

| Overall Relationship | Every 6 months |

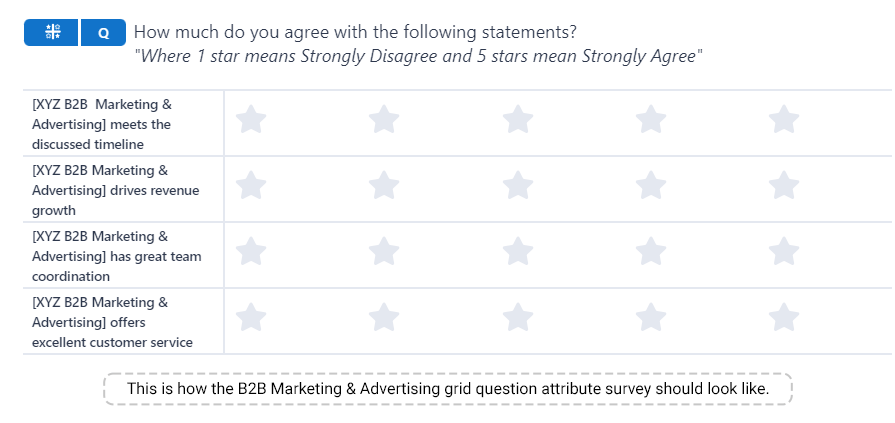

3. B2B Marketing & Advertising

| B2B Marketing & Advertising Touchpoints | When to Conduct the Survey? |

| NPS After Project Ends | After the contract ends (3 or 6 months) |

| Relationship NPS after long project ends (1-2 years) | Every 6 months |

4. B2B Service

| B2B Service Touchpoints | When to Conduct the Survey? |

| Service Delivery | After project completion |

| Customer Support | After resolving an issue |

| Overall Relationship | After 3 or 6 months |

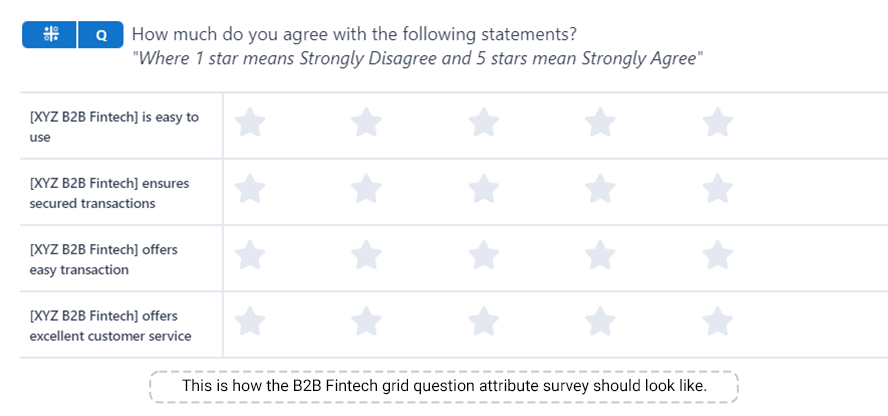

5. B2B Fintech

| B2B Fintech Touchpoints | When to conduct the Survey? |

| Onboarding | After sign-up or integration |

| Product Usage | After 3 months |

| Overall Relationship | Every 6 months |

| Customer Support | After resolving an issue |

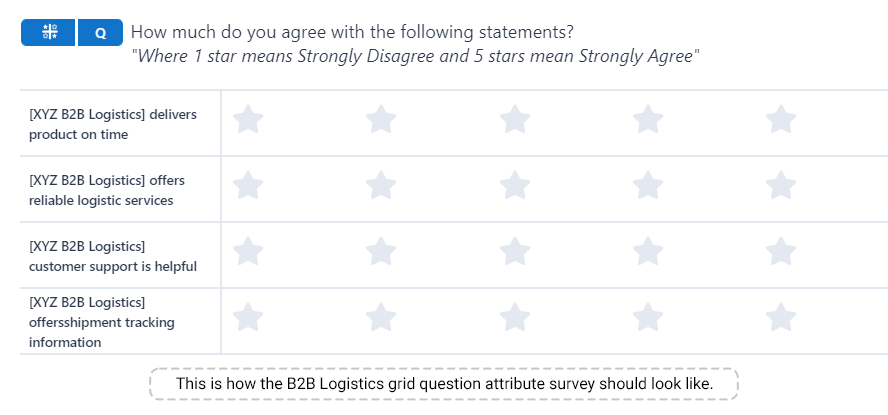

6. B2B Logistics

| B2B Logistics Touchpoints | When to conduct the Survey? |

| Delivery Experience | After order delivery |

| Customer Support | After resolving an issue |

| Overall Relationship | Periodically during the account management phase or upon request |

→ Now that you know the important touchpoints in the B2B customer journey and the ideal survey frequency, read more on how to boost the B2B Customer Experience Journey With Survey questions for each of the touchpoints.

Launch B2B Surveys With SurveySensum!

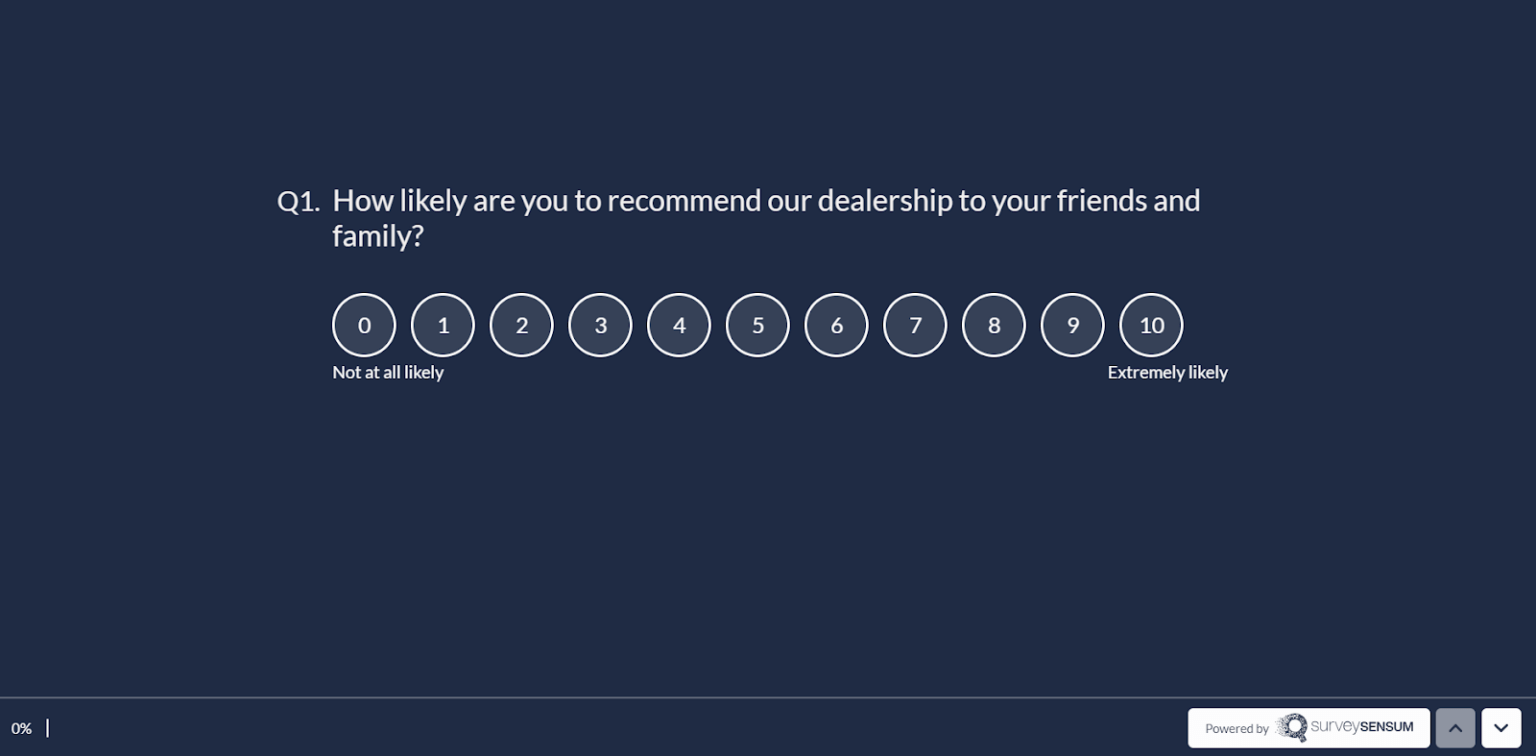

3. Automotive

| Automotive Touchpoints | When to Conduct the Survey? |

| Intender (Pre-Sales) Survey | Within 1-2 weeks of the visit to the dealership |

| Rejector (Pre-Sales) Survey | Within 1 week of the visit to the dealership or interaction with the brand |

| Product Quality Survey (Inbound & Outbound) |

|

| QVOC Sales Survey | Within 2 weeks after the sales transaction is completed to capture the customer’s immediate post-purchase experience |

| QVOC Service Survey (After Sales Satisfaction) | Within 1 week of completing routine maintenance or repairs |

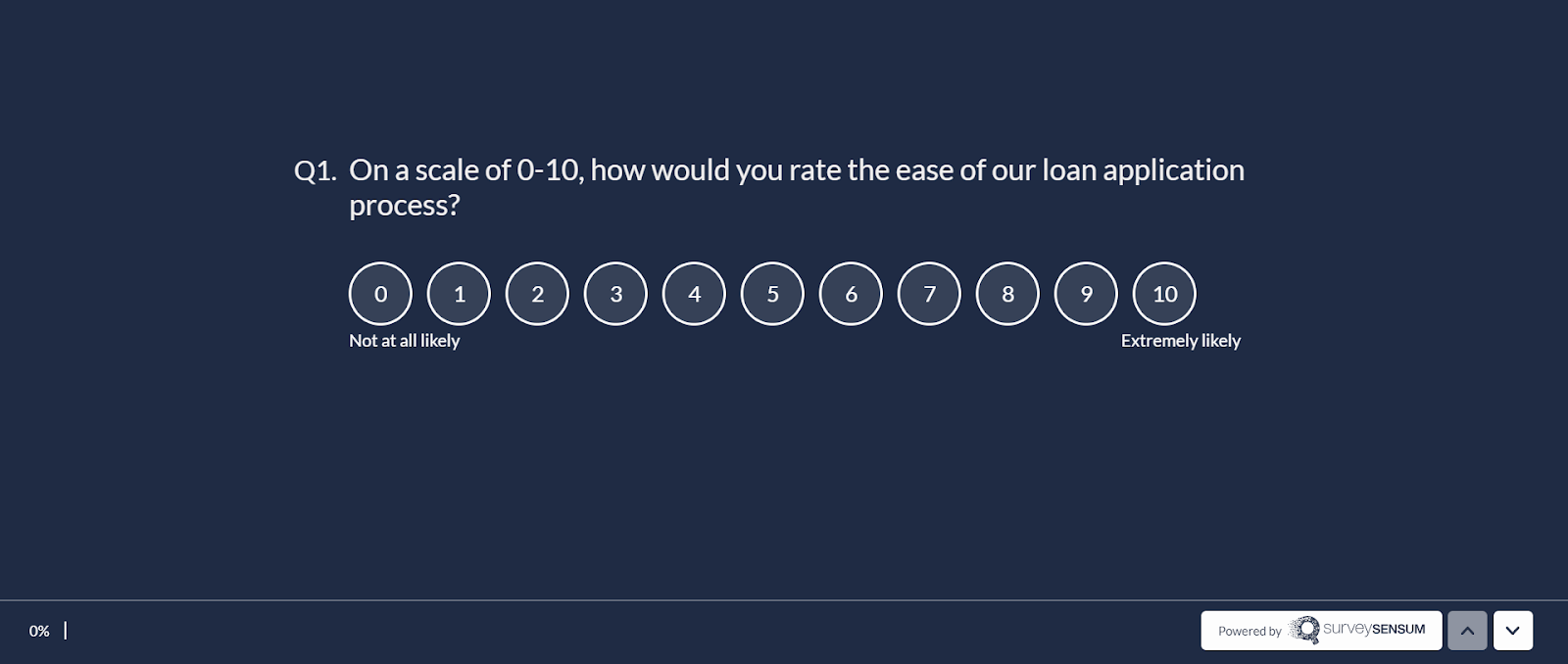

4. NBFC

| NBFC Touchpoints | When to Conduct the Survey? |

| Customer Drop-off | Within 1-2 days of the drop-off event |

| Ease of Loan Process | Immediately after the loan application process |

| After the Loan Process Completion | Within 1 week after the customer has been approved for the loan |

| Customer Support | Within 1-2 days of the customer support interaction |

So, there you go! All the important touchpoints across different industries and their survey distribution frequency. Simply follow these timelines to send the right survey at the right time to get maximum benefit.

But, another important issue that many businesses tend to overlook is the issue of multiple surveys from different departments within the same organization.

Why is that an issue and what’s the solution here? Let’s find out!

Is It Poor Form to Receive Surveys from Multiple Departments Within the Same Company?

Receiving surveys from multiple departments within the same company can be considered poor form if not handled with sensitivity and strategic intent. Here are a few reasons why this practice is perceived as problematic:

- Receiving numerous surveys from different departments within a short timeframe can lead to survey fatigue. This will result in decreased response rates, lower data quality, and a negative perception of the company.

- If surveys from different departments contain overlapping or redundant questions, customers will feel that their time is being wasted.

- Sending surveys without proper coordination between departments can create a disjointed experience for customers.

So, striking the right balance between gathering valuable insights and respecting respondents’ limited time and attention is crucial.

But how to do that? Let’s see!

Solution: Survey Throttling

What is Survey Throttling?

Survey throttling is a strategic approach to regulate the frequency at which surveys are sent to customers.

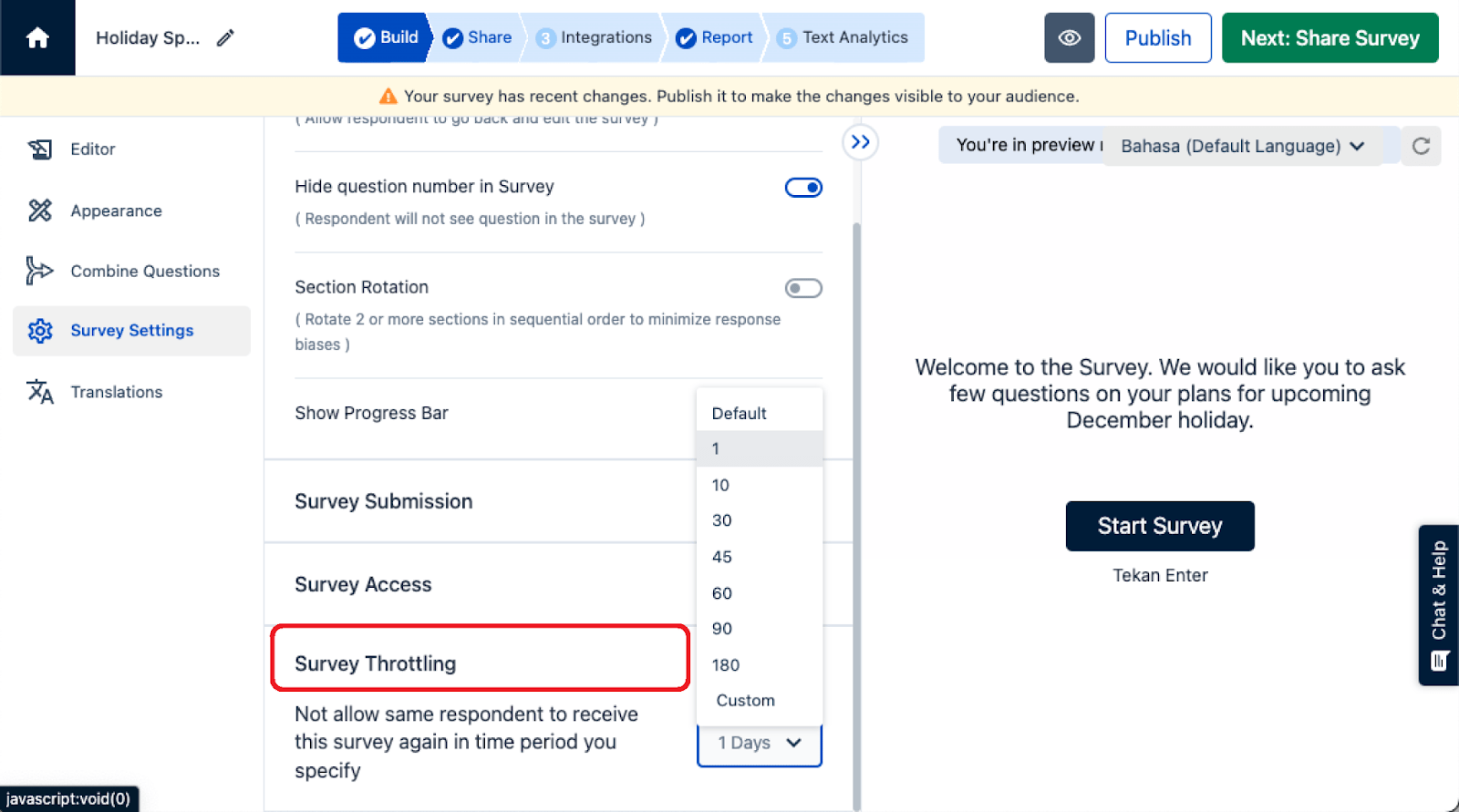

Implementing survey throttling involves carefully scheduling and spacing out survey invitations to ensure that individuals do not feel overwhelmed by the constant influx of requests for feedback.

Don’t worry, you don’t have to do it manually!

SurveySensum track your survey campaigns in a centralized manner. This feature allows you to set a timeline for your surveys.

Here’s how I set up this feature for my surveys:

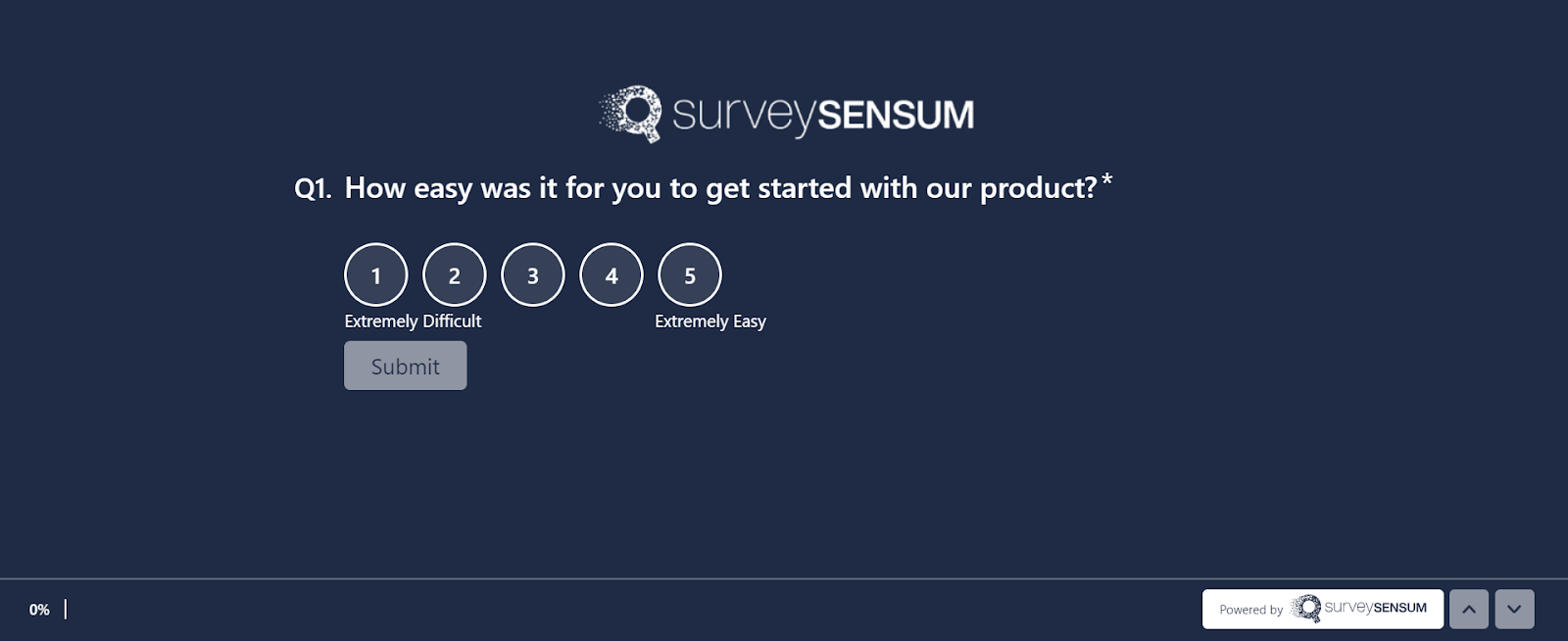

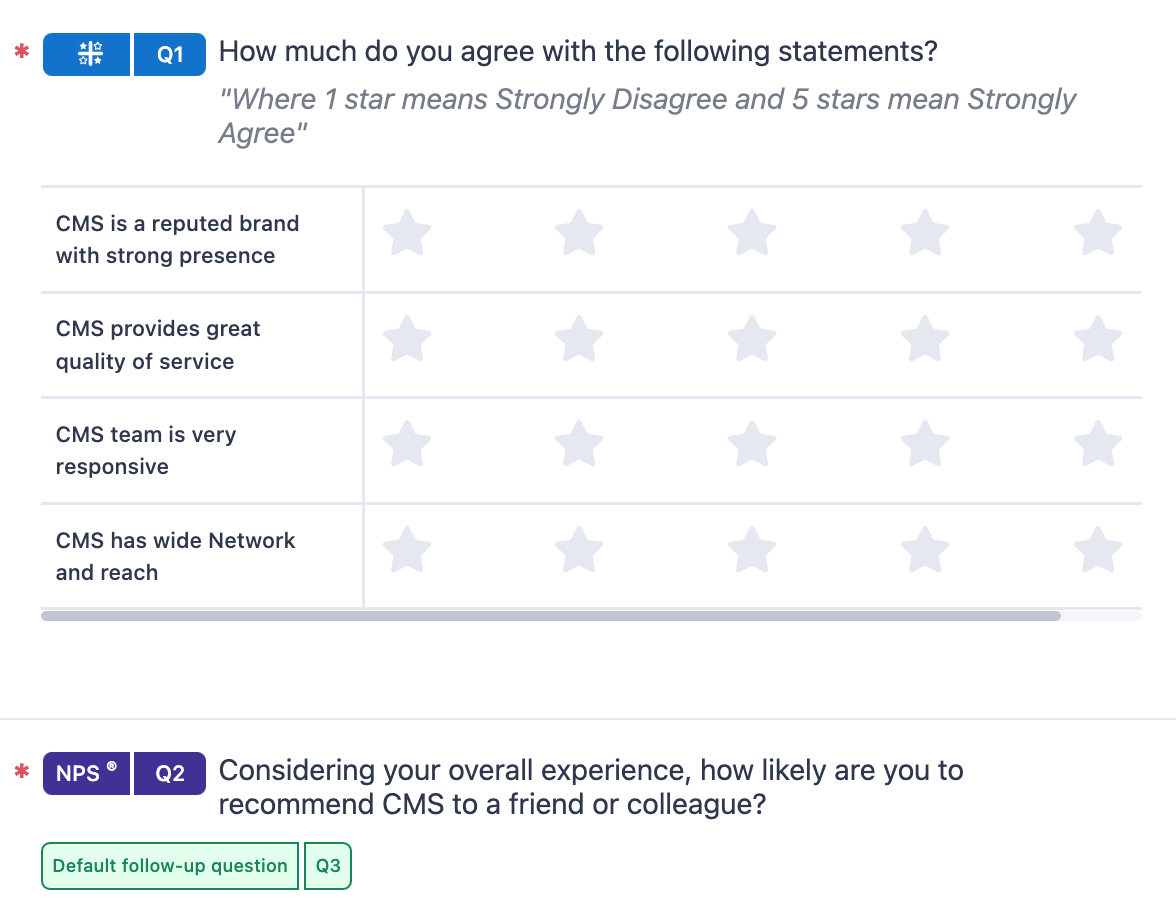

Step 1: Login to the SurveySensum portal and click on “create a survey”.

Step 2: Select the type of survey you would like to create.

Step 3: Now, click on the “survey settings” option. Here you will find the survey throttling feature.

Step 4: Click on it and you will be able to set a timeline for your surveys. This feature will keep a check on your surveys and will not allow you to send multiple surveys to the same person in the provided time frame.

Piece of cake!

Conclusion

Launching surveys is a strategic approach to gathering customer feedback. This helps businesses understand their customer’s pain points, extract actionable insights and improve their customer experience.

But, more often than not, this becomes a nightmare instead of a boon for many businesses. This is because they forget the importance of creating the right balance between asking for feedback and customer preferences, which often leads to survey fatigue and low response rates.

So, to overcome this issue, it is important to understand the survey frequency of different types of surveys, across different touch points of different industries. Understanding this survey frequency will help you gain unbiased feedback and maintain a healthy reputation among your customers.

Now, to do so you need a robust customer feedback tool, like SurveySensum, that will help you create, track, and analyze your survey campaigns and will also alert you in case you are sending too many surveys. Also, this tool comes with CX experts who will provide you with end-to-end support and will guide you through the survey process so that you can gain maximum benefit from it.