Chris went to the Zara store to buy a pair of jeans. After exploring for a while, he found a pair that fit him perfectly but he didn’t like the color of it. He asked the staff if they have something in black in their stock. The staff said they don’t and advised him to scan the QR code to check its online availability.

But the scan didn’t work properly so Chris entered the product code and it showed that the product was available in black and in his size. Now, Chris knows the product is available online so he exited the store.

But what about the faulty QR scan? The staff is not aware of it.

What if the next customer doesn’t put the code to check and exits the store dissatisfied?

This is where intervention is required. But how?

With customer feedback retail surveys.

Customers go through various interactions during their shopping journey. By gathering customer feedback at these touchpoints, you can identify areas for improvement and tailor your strategies to better meet their expectations and enhance their retail customer experience.

But more often than not, retailers make mistakes while designing their retail surveys which prevents them from gathering optimal results from their customers.

After working with many retail businesses around the globe, we collated these top 7 mistakes that brands generally make. And how you can avoid them with the help of a robust retail customer feedback platform.

1. Not Being Clear Enough

Let’s say you received a survey questionnaire in your mail from a brand that you shopped for last week. You liked the product so decided to fill out the survey. As you begin filling out the survey, you realize that the survey is asking for personal information and the questions are very detailed. However, the purpose of the survey is not specified anywhere in the survey.

Do you think you will feel safe answering the survey?

No, right?

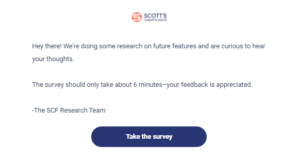

Let’s take a look at this introduction by Scott’s Cheap Flights for their survey:

Now, what did Scott’s Cheap Flight’s marketing team do right?

- They clearly defined their survey’s objective to their customers; which was to collect information about any future features their customers want.

- They also mentioned the average time it will take to complete their survey.

This way Scott’s Cheap Flight made sure that their customers were well aware of the purpose and objective of the survey.

An introduction sets the tone for your retail surveys and provides important context for participants. It allows you to explain the purpose of the survey, assure your customers of data confidentiality, and express gratitude for their participation.

By skipping the introduction, you risk confusing customers and reducing their willingness to provide accurate responses. So, take your time to properly introduce yourself and clearly define your goals for the survey.

Some of the important points that you can include in your introduction are:

- Who are you?

- What is the goal of your survey?

- What will you be using the information for?

- How long will you keep the information?

- How long will it take to complete the survey?

2. Too Many Or Too Little Questions? Neither!

You received a survey request right after your call with a customer support agent. The survey’s objective was to understand your experience with the agent. You clicked on the survey, and on the first page, you answered 10 questions and when you reached the bottom of the page, you found out that the questionnaire had another page!

Think about it – If someone sends you this long survey, would you complete it?

No, right? – Neither does your customer.

According to a recent survey by Hubspot on “The Ideal Survey Length”, 47% of customers said that they are most likely to abandon a survey if it’s taking them too long to complete it. And 42% of the customers said they’re willing to answer 7-10 questions as part of a survey.

Long and complex surveys can easily lead to survey fatigue, resulting in lower response rates and reduced data quality.

So how to avoid that?

- Keeping your survey questions straightforward and concise

- Remove unnecessary or redundant questions, to keep your data clean. This will also give an impression to your customers that you value their time.

- Ask necessary questions that are relevant to your objective for the survey.

- Include multiple-choice and open-ended questions to gather quantitative and qualitative data, respectively for deeper insights.

Example- Here’s an example of an ideal customer support feedback survey:

- Was the representative able to solve your problem? If not, please specify.

- How was the quality of the call with our customer support agent?

- On a scale of 1-5, how would you rate your overall experience with our customer support agent?

That’s all the questions you need to ask to gather relevant information and get better insights into your customer service experience.

3. Don’t Ask Leading Questions

“How was your experience with our customer support call?”

Does the above survey question, sound a little off to you as a respondent? Yes, but why?

In the above question, the respondent is provided with choices between satisfied to extremely satisfied. But what if the call was not a satisfying one? How will the customer respond?

This is an example of a leading question.

In retail surveys, leading questions can be described as survey questions that steer or influence respondents toward a particular answer or opinion. This creates the so-called survey response bias.

In the above example, you are already asking your customers how delightful it was talking to your representative. Here you are already setting the precedent that the call was a positive one.

So, what is the point of gathering customer feedback if you are adding your own bias to it and don’t have the intention to understand the REAL customer experience?

Here is an example of a leading and non-leading question to provide a better understanding:

Leading Question: “On a scale of 1-5, how good is our product?”

Non-Leading Question: “How would you rate the quality of our new product?”

The first question assumes that the new product is the best, implying that customers should agree. This leads customers toward a positive response, potentially leading to a biased answer regarding the product’s quality. The second question, on the other hand, seeks a neutral and unbiased assessment of the product’s quality.

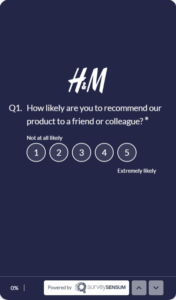

Here is the perfect example of a non-leading question in a survey:

In this example, the participant is simply asked to rate their experience with the representative on a scale of 1-5; there is no assumption here that the call was a positive or negative one.

Create Perfect Non-Leading Retail Survey Questions With SurveySensum – Request a Demo

4. Don’t Ask Double-Barreled Questions

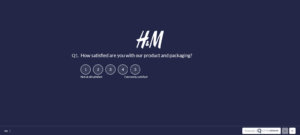

“How satisfied are you with our product and packaging?”

Now, in the above survey question, the respondents are being asked about two completely different things; one is about the product and another is about the packaging. This is an example of a double-barreled question in retail surveys.

Now how do you think your customer will answer the above question?

Because your customer might be satisfied with the packaging design and not the product itself or vice versa.

Do you think you can get an accurate answer to this question?

These types of questions combine multiple inquiries or ideas into one single question and it leads to confusion among respondents and leads to inaccurate or incomplete responses.

To avoid asking double-barreled questions in your surveys:

- focus on asking one clear and concise question at a time

- separate each inquiry into distinct questions to collect more precise and reliable feedback

- prioritize simplicity and clarity to ensure participants can easily comprehend and respond to the questions.

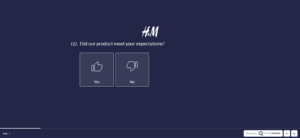

Here’s an example of how to avoid asking double-barrel questions in your retail surveys:

In this example, the question is quite simple. The respondent is being asked about just one thing and that is about the product and whether the product met their expectations or not. Here there is neither any confusion nor two separate ideas inserted into one question.

You can use an AI text generator to add variations of questions. Moreover, when this technology is integrated with an anti AI detector and word counter , it can facilitate the achievement of highly-optimized outcomes.

For example, instead of only writing, “Did our product meet your expectations”, tools like Bard and ChatGPT Stats give you options and you can choose the best one:

– Did our product live up to your expectations?

– Were you satisfied with our product’s performance?

5. Failure To Do Pilot Surveys

When you plan for a family vacation over the summer do you just go to a random place and then start planning your trip? No, right?

When you plan a family vacation with kids and senior citizens you need to keep a lot of things in mind, like the temperature of the place, the places you are going to visit and whether they are family-friendly or not, and most importantly your budget.

Just like that when you are planning to send out retail surveys to your customers you are not only asking them their opinions but also asking them to invest their time in you. So, you need to prepare and plan for it by doing pre-tests or pilot surveys.

But how to do that?

Doing pre-tests or pilot surveys involves running the survey with a small sample audience to identify potential problems.

- It allows you to validate the survey’s effectiveness before launching it to a broader audience.

- It ensures that the respondents are guided through a logical and coherent retail survey experience, enhancing the reliability of the data collected.

- It also helps you to identify any unintended patterns or biases and make adjustments accordingly.

- You can gather feedback from pilot retail survey participants on the time taken to complete the survey and determine if the survey is too long or not.

- It also provides you an opportunity to validate the survey instruments, such as scales, rating systems, or measurement tools.

Example: Let’s say you work as the head of product development at a fintech company and you are working on designing a new feature in your app where your customers can take finance lessons with top experts. After weeks of hard work and testing you and your team are ready with the final version.

Do you directly launch it?

No, you might have tested the technical and design aspect within your team but there are several aspects like user-friendliness, lesson plans, signing up, etc. that needs to be tested by the general public.

So what do you do?

You do test runs and pilot surveys to get feedback from your sample group to understand the pain points and friction experienced by people other than you.

6. Neglecting Mobile-Friendliness

According to a statistics report on “Smartphone Mobile Network Subscription Worldwide” by Statista, in 2022, the number of smartphone users reached 6.6 billion worldwide and is expected to exceed 7.8 users by 2028.

The above statics is a fact that the number of mobile users is increasing every year which makes it crucial to optimize your retail surveys for mobile users. Neglecting this point can result in a poor user experience, leading to lower response rates.

Example of a non-friendly mobile survey:

In the mobile survey shown above the text is not visible properly. A customer has to scroll the screen from left to right and up and down to read the whole survey. This is what happens when brands don’t pay attention to the mobile-friendliness of surveys.

In the example given above the question is visible properly. A customer doesn’t have to scroll the screen to read the questions. This is an example of a mobile-friendly survey.

So, how can you create mobile-friendly surveys?

Here are the points to follow:

- Responsive Design: You can incorporate responsive design principles, which adapt the survey layout and formatting based on the screen size and orientation of the device.

- Easy Navigation: To prioritize ease of navigation, you can include using mobile-friendly interfaces, clear and concise instructions, and intuitive question layouts.

- Testing Survey Compatibility: It is crucial to test survey compatibility across a variety of mobile devices and operating systems to ensure consistent functionality and appearance.

- Minimizing Load Time: Optimizing surveys for mobile devices involves minimizing file sizes, compressing images, and utilizing efficient coding practices to reduce load times to enhance overall performance.

- Mobile-Specific Question Formats: You can leverage mobile-specific question formats, such as sliders, swipe scales, or touch-based input methods.

7. Don’t Let Your Survey Results Collect Dust

Collecting data is just the first step. It’s what you do with it makes all the difference.

Failing to analyze the results and take action based on the insights gathered renders the survey process ineffective – resulting in a waste of time and effort for your company and your customers. When you collect customer feedback and don’t do anything about it, your customers will eventually stop responding.

Why?– because they feel like you don’t care enough about what they have to say and are just gathering feedback for the sake of it.

So not doing anything about the feedback also results in – a poor relationship with the customers, lower response rates, and failure to identify the issues.

By digging deep into the collected data, you can find valuable patterns and trends in the data. This analysis will allow you to get a comprehensive understanding of your customer’s preferences, pain points, and satisfaction drivers. It is essential to invest time and resources into extracting meaningful insights from survey data.

Here are some strategies to consider:

- Focus on the most critical insights that align with your business goals and objectives. Identify recurring themes, high-impact issues, or opportunities for improvement.

- Collaboration among different teams, such as marketing, product development, and customer support, ensures a holistic approach to addressing survey findings.

- Clearly define SMART goals based on the survey insights. This ensures that actions are well-defined and progress can be tracked effectively.

- Develop a roadmap that outlines the steps to be taken, responsible parties, and timelines for implementation.

- Execute the action roadmap, making necessary adjustments to products, services, processes, or policies based on survey insights.

- Consistently monitor the implemented changes. Also, encourage continuous feedback from customers to assess the impact of implemented changes.

- Track relevant KPIs to measure the success of implemented changes. This allows for continuous evaluation of progress and identification of areas that require further refinement.

To streamline the process of closing the feedback loop and driving continuous improvement, you can leverage the power of SurveySensum. This retail customer feedback platform offers you help in gathering data in real-time with NPS, CSAT, and CES surveys. With SurveySensum, businesses can:

- Easily identify touchpoints with the most friction.

- Use the Text Analysis software on open-ended feedback to identify top trends and sentiments from thousands of feedback.

- Get instant automated alerts on detractors on your CRM in real-time.

- Take required action in real time, inform your customers, and close the feedback loop efficiently.

Key Takeaways

Retail surveys gather feedback and understand customer thoughts, but common survey mistakes are made while creating these surveys. Here’s a summary of the discussed errors:

- Allow your customers to understand the purpose of your survey, with a detailed introduction.

- Long and complex questionnaires will only lead to survey fatigue.

- Don’t ask questions that will sway your customer’s responses and compromise the accuracy of the survey data.

- Asking double-barreled questions will only lead to confusion and inaccurate data.

- Doing pilot retail surveys with a smaller audience will help you identify many potential problems.

- Mobile users are growing at a fast pace so ensuring the mobile-friendliness of your surveys is crucial.

- Doing retail surveys is the first step, the actions that you take after that make all the difference.