The Impact of Onboarding Surveys in Retail Fintech

I remember the excitement when I ordered a new phone. It seemed like the ultimate device, promising a seamless experience. But as I began using it, disappointment hit hard. The battery drained in a blink, and apps crashed more often than they worked. The initial thrill turned into disappointment with every glitch.

The real struggle began when I attempted to return it. The customer service center had a really complex return procedure. Each call felt like hitting my head on walls, and securing a refund took a lot of effort. Eventually, after a series of calls and endless patience, I managed to get my money back. However, the entire experience left me determined never to revisit that brand.

Then, six months later, an NPS survey landed in my inbox, asking, “How likely are you to recommend us?“

I couldn’t help but sit there like, “really?”

Looking back at that situation, those surveys asking how likely I was to recommend the brand felt out of touch with what I’d gone through. They arrived long after I’d moved past the frustration, missing the real feelings I had during that time. I wonder if they had sent different surveys like CSAT or CES right after my experience?

It’s clear that these surveys need to change to match how customers feel in that moment. They should catch those true feelings and experiences when they happen, not after they fade. That way, they’d understand what customers go through.

It’s not that NPS surveys are bad—they have their place—but they do have some pitfalls, especially when capturing customers’ raw and immediate emotions.

Pitfall of Annual NPS Surveys

You know, running an NPS Survey just once a year doesn’t really dive into the heart of problems along the customer journey. It shows how customers feel generally, but it doesn’t solve those immediate issues.

I mean, think about it. Problems need fixing right now, not six months down the line when memories might fade.

What if I received a survey just 5-7 days after buying a product? That’s when I’m fresh off the experience and can spill all the details. It could stop me from switching brands.

It’s all about timing. Surveys right after a touchpoint?

They’re like lifesavers, reducing customer churn and protecting customer experience. Catching feedback when it’s most impactful—that’s the key.

Let’s delve deeper into this with a detailed use case from a retail fintech company I’ve recently collaborated with.

Launch NPS Survey with SurveySensum

Case Study: How Onboarding Surveys Rescued a Retail Fintech from Churn

The Challenge

A major retail fintech company providing payment machines faced a crisis – despite successful marketing and sales, 20% of their machines were returned within a week of installation.

Relying solely on once-a-year NPS surveys posed a significant hurdle. Churned customers rarely responded to these annual surveys, leaving the company clueless about the high return rates. Additionally, the sales team, focused on acquiring new customers, lacked time to follow up with churned ones.

After exploring the challenges, the next step was to act on it and develop the best possible solution. So, to address this, they turned to SurveySensum

The Solution – Step-By-Step Process

Initially, they started sending CSAT surveys within 5-7 days post-purchase.

The survey was designed to gather specific insights:

- How satisfied were customers with the installation of the new machine?

- What prompted their given satisfaction score?

- Were they satisfied with the training provided? (Yes/No)

Let’s uncover how the company acted on the responses step-by-step and closed the feedback loop.

1. Revelations from Customer Feedback

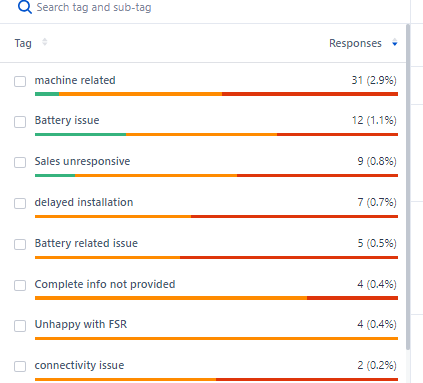

After sending surveys, they received eye-opening responses, especially to the question, “Why did you give this score?”

With text analytics software, they dug deeper into customer feedback. It helped them sort and understand the responses better. Many customers mentioned problems with how the machine worked, issues with the battery, and the sales team’s lack of responsiveness.

2. Addressing Machine and Team Issues

After gathering valuable customer feedback, the company directly contacted customers facing issues. Some had returned machines, while others were open to trying again. Identified machine and battery problems were promptly shared with the hardware team, resulting in fixes within months. They also found some challenges concerning the sales team.

3. Uncovering Sales Team Challenges

Further exploration revealed a critical issue: the sales team’s need for post-installation support. Their approach involved:

- Minimal training and directing customers to support.

- Leading to accessibility issues.

- Long wait times.

- Frustration management.

Recognizing the sales team’s sales-centric focus, the company established an onboarding team. This team’s role was to install, train, and provide crucial support during the initial 15 days of machine use, aiming to address core process issues beyond installation.

After working on all the issues, the company got amazing results with a reduced churn rate!

The Results

The changes helped in reducing churn significantly by a whopping 12% within just six months. It was a tangible testament to the power of addressing customer issues early on, preventing dissatisfaction from snowballing into churn.

Conclusion

This use case underscores the transformative power of leveraging a customer feedback tool like SurveySensum to steer a company away from the edge of churn. By implementing onboarding surveys strategically, the retail fintech company identified and resolved machine-related issues and redefined its customer support approach.

The lesson learned: real-time customer feedback and proactive measures can be a game-changer in retaining customers and fostering long-term success.