Understanding and Maximizing NPS in the Fintech Industry

Measuring NPS in the fintech sector serves as an indicator of customer satisfaction and loyalty. Fintech companies that make a real effort to up their customer experience game and boost their NPS scores are setting the stage for solid and long-lasting connections with their customers. It’s the secret sauce for success in the cutthroat fintech market – happy customers, happy business! And because of this effort, the average score of the NPS finance sector for 2024 is 73.

But here’s where it gets a bit tricky. The intricate dance between complex financial products, regulatory constraints, and the constant demand for seamless user experiences makes it hard to gauge customer satisfaction.

For fintech software development companies, there’s a double duty—not only do they need to offer top-notch financial services, but they also have to keep their customers’ data safe. Regular surveys can sometimes mess with this delicate balance, risking data privacy. Striking the right balance between getting feedback and keeping things locked down is a real head-scratcher.

But, how to do that? Let’s find out!

The Fix – Personalized Unique Survey Links

Over the years of working with many Fintech companies, I have found that personalized unique links offer a cutting-edge solution to the challenges posed by traditional survey methods.

These links, facilitated by advanced NPS software, act as secret doors to gather feedback without putting data at risk. Unlike generic surveys, these links are tailor-made for individual customers, ensuring a personalized and secure feedback collection process.

I have personally experienced some amazing benefits of these links while working with fintech companies. Some of them are:

Benefits of Using Personalized Unique Links in the Fintech Sector

- Enhanced data security: Using personalized unique links helped me mitigate the risks associated with traditional fintech surveys as they directly address data security concerns. Each link is unique to the recipient, ensuring confidentiality.

- Increased response rates: The personalized nature of the links fosters a sense of importance and relevance for customers. This helped me to have higher engagement with the NPS scale question and increased response rates.

- Customization for targeted feedback: These links provide customization options. Using these links, I have customized survey questions based on individual user interactions and behaviors, yielding more specific and actionable insights.

- Accurate tracking of survey responses: The unique links facilitate precise tracking of responses, which allowed me to analyze NPS feedback trends and implement targeted improvements.

Boosting NPS is not a one-time process, it requires continuous analysis and improvement. But fret not, with SurveySensum’s CX consultation from CX experts you can track, and analyze your NPS effectively.

Now, let’s dive into a real-time NPS in finance case study on how it improved its NPS with these customized links.

Case Study: Fintech Success with Personalized Unique Link

The Challenge

A major Fintech company in India was facing the challenge of keeping its customer’s personal information secure while gathering feedback from them. So, in a bid to ensure data security, all the while measuring and improving their NPS, they collaborated with SurveySensum.

The company had a large number of customers with sensitive personal data and they wanted to send NPS surveys to their customers in a bid to improve its NPS in Banking and Fintech. But their major concern was with the leak of sensitive personal data of its customers. If their customers can’t trust them with their personal data then it doesn’t reflect well on the company’s reputation.

The Solution – Step-By-Step Process

Now, in order to send surveys to them they were brainstorming solutions to keep the PII of these customers safe and secure.

So, what’s the solution here? – Personalized Unique Survey Links.

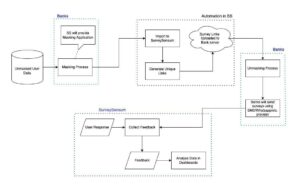

1. They Imported Data Specific to Each Customer ID

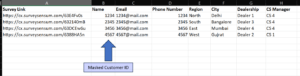

Every company maintains a customer ID for each customer. This ID is mostly a randomly generated numeric string which is used as a primary key. The client made use of this numeric string and imported the data corresponding to each ID preventing the need for accessing PII outside the system.

Here’s how they executed this process:

- They masked their customer IDs using the SurveySensum masking application.

- These masked customer IDs were then uploaded to the SurveySensum system where unique survey links were generated and uploaded to the bank’s server.

- Then these unique survey links were sent to the customer via the WhatsApp number that the customers were already familiar with.

- The feedback was collected, analyzed, and displayed in the SurveySensum dashboard.

2. They Created Unique Survey Links

This led to the use of Personalised Unique Links, a feature that creates a unique and personalized link for every single customer. In SurveySensum’s survey builder, they used the option to create unique survey links of the same survey for different customers.

Here’s how unique survey links were created with SurveySensum:

- Log in to SurveySensum

- Create a survey

- Click on ‘Share’

- Now, select the ‘Unique Links’ option.

- Here, upload the contact list, select the expiry date of the survey, and then click on ‘Generate Links’.

And the best part about this process is that SurveySensum has no knowledge of who the customer is: no Name or Email or Phone Number. This way, no PII data leaves the internal systems.

Here’s how customer ID is masked, keeping important data secure

Once the responses are in, the client tracks the Customer ID (or masked ID) and all data associated with the customer that can help with the analysis and ultimately with closing the feedback loop with customers.

Meet your customers where they are! Sign up today with SurveySensum and launch your surveys via multiple channels like SMS, Emails, WhatsApp, etc!

3. They Created Unique Survey Links

They had an existing WhatsApp account which was already used for their support and general updates, so the customers were familiar with the number. Now, with the help of SurveySensum’s WhatsApp survey feature, they use this WhatsApp number to share these unique survey links.

The Result of the Case Study

Happy with the data integrity and safety, they started collecting transactional NPS feedback within the first 2 months with the help of unique survey links and API integrations using WhatsApp.

By identifying the most common issues on different touchpoints and closing the loop effectively with the help of instant detractor alerts, the client increases its NPS score by +15 points and also improves its customer retention.

If this case study inspired you to improve your NPS in fintech, then let us give you some important information and tips to boost your NPS fintech. Let’s start with understanding the importance of NPS in fintech sector.

Now, our journey of understanding and improving NPS in fintech sector doesn’t end here. With my experience of working with different clients in this sector, let me share some extra tips that will help you understand your customer’s journey better and create an NPS program that yields results.

So, let’s begin by understanding the importance of NPS in fintech sector.

What is the Importance of NPS in the Fintech Industry?

Here are some importance of NPS in financial service.

1. Boosts Revenue: I recently came across a study conducted by the London School of Economics on customer advocacy that states that an increase in the NPS score by 7 points equates to a 1% growth in revenue. Now, this happens because a higher NPS reflects better customer satisfaction and advocacy, leading to increased sales through repeat purchases, positive word-of-mouth, and reduced churn rates.

2. Improves User Experience: Fintech platforms rely heavily on digital interactions, where seamless UX is critical. NPS helps identify pain points and enables fintech companies to deliver smoother, more intuitive user experiences.

3. Improves Customer Loyalty: I have found that customers in the financial services value consistency and reliability in services like digital banking, payments, and investments and rightfully so. With NPS you can discover key areas of improvement in your service and boost your customer loyalty, which translates into higher retention and increased customer lifetime value. And we all know that a 5% increase in customer retention can lead to a profit increase of 25-95%.

4. Provides Competitive Advantage: In his book, The Ultimate Book 2.0, Fred Reichheld found that companies that have adopted NPS grow twice as fast as their competitors. This is because NPS-focused companies prioritize understanding and exceeding customer expectations, creating a virtuous cycle of loyalty, advocacy, and sustainable growth.

5. Enhances Customer Lifetime Value: NPS is not only beneficial for customer loyalty, it also enhances CLV. By tracking NPS, fintech companies can prioritize enhancing the experience for promoters, boosting overall CLV and profitability. And according to Temkin research, promoters are 4.2 times more likely to buy again, 5.6 times more likely to forgive a company after a mistake, and 7.2 times more likely to try a new offering compared with detractors.

So, these are all the reasons why you should invest in improving your NPS, but how to do that? Let’s discuss.

How Fintech Companies Measure NPS?

There are some best practices that I have implemented to help many of our fintech clients measure and ultimately improve their NPS score. Here are some key best practices you can also implement for your organization.

1. Define Goals: Before launching NPS surveys, you must clarify their objectives, such as, assessing overall customer satisfaction, identifying areas for product or service improvement, tracking loyalty trends over time, and benchmarking their score against industry benchmarks. This ensures that the insights gathered are aligned with actionable outcomes and strategic priorities.

2. Define Key Touchpoints: To gather relevant and timely feedback, strategically decide when to send the surveys. Some key touchpoints are post-transaction surveys that are sent immediately after a transaction, onboarding surveys to assess the ease and effectiveness of the signup or account activation process, and periodic surveys to track satisfaction trends over time.

3. Ask Open-ended Questions: Ask open-ended questions to uncover specific customer pain points. This qualitative data complements the quantitative NPS score and provides actionable insights for improvements.

4. Calculating the Score: The next step is to calculate the NPS score to determine whether you have a positive or negative score.

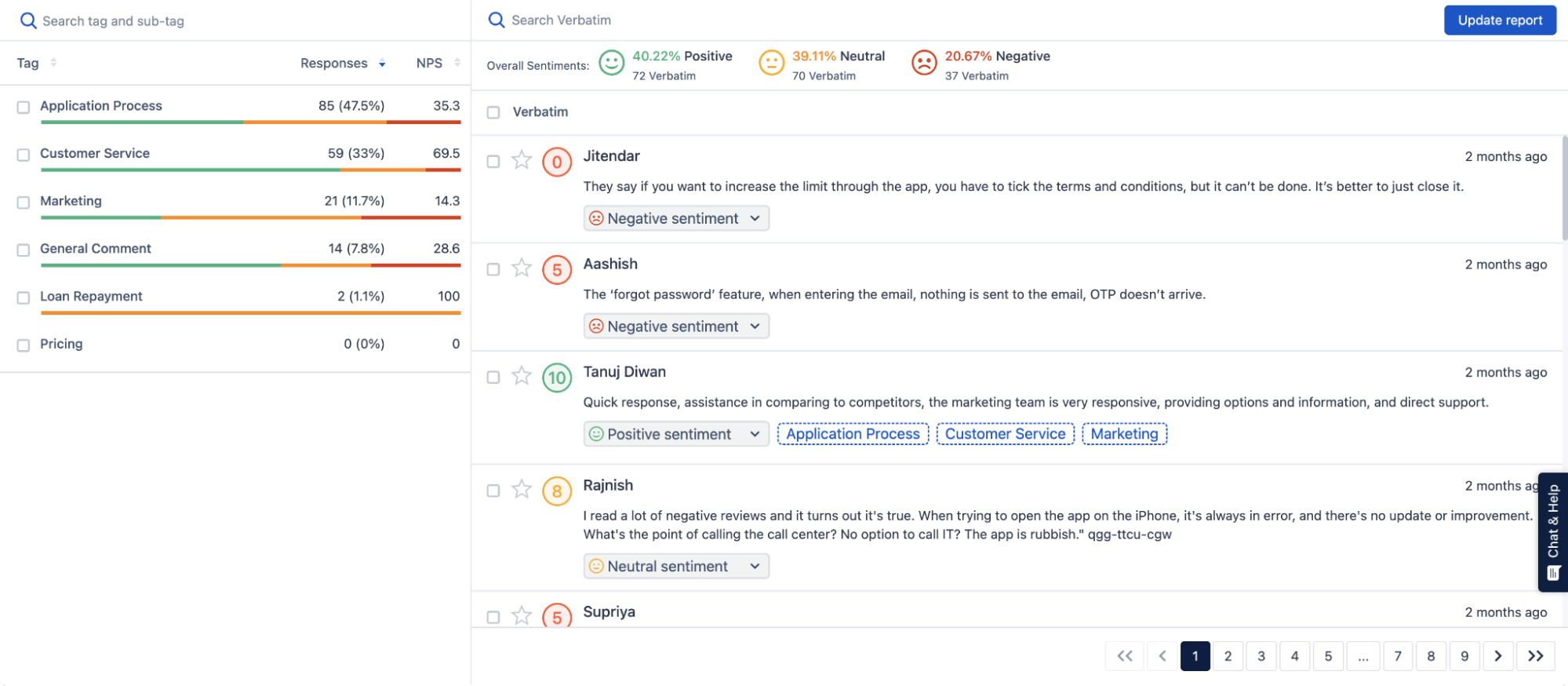

5. Data Analysis: You got the score but the analysis doesn’t end there. Now leveraging AI and machine learning you need to dive deeper into the qualitative feedback to uncover trends and actionable insights.

With SurveySensum’s text and sentiment analysis software, you can automate the process of analyzing thousands of feedback in a matter of minutes and gain comprehensive insights into your customer sentiments.

6. NPS Benchmarking and Competitive Analysis: By comparing their scores to industry benchmarks, you can identify whether their customer experience is above or below market standards.

Also, let’s discuss some tried and tested strategies that will help you improve your NPS.

Strategies to Improve NPS in Fintech

Here are some strategies that Fintech companies can implement to improve their NPS score.

1. Listen to the Voice of Your Customers

Tell me this – if you don’t know what your customers are thinking and experiencing with your service, then how can you improve and build meaningful relationships with them? So, listen to their voices at important touchpoints and identify areas of improvement to take prioritized action. For example, onboarding is an important touchpoint in the customer journey, so by using in-app surveys understand and address customer pain points in real-time. This not only streamlines onboarding but also reduces drop-offs and fosters trust from the start.

2. Be Proactive: Resolve Issues Before They Arise

Imagine this – A new user downloads your bank mobile app to use for mobile banking. However, they get stuck during the account verification process as the instructions are not clearly conveyed and the user gets confused which eventually prompts them to abandon the app frustrated. Now, this is where proactive support would have avoided this abandonment.

In fact, 78% of customers have stated that getting the issues resolved quickly is the most important factor in a positive customer experience. So, offering assistance through multiple channels- like in-app chat, AI chatbots, email, and social media – ensures users can reach out quickly and conveniently. When customers feel supported, knowing there’s always someone (or something) to help them. This creates a relationship of reliability and ensures they stick with your service for the long-term — building customer loyalty.

3. Prioritize Security

Imagine the anxiety of entering your banking details on a platform you’re not sure you can trust. To ease these worries, show your customers you value their security as much as they do.

So, implement advanced measures like biometric authentication, which adds a personal touch of security, or secure authentication, which reassures them with an extra layer of protection. Encryption ensures their data stays safe, even if intercepted. When customers know their data is in safe hands, it builds trust and confidence—key ingredients for a lasting relationship.

4. Identify Pain Points With Advanced Data Analysis

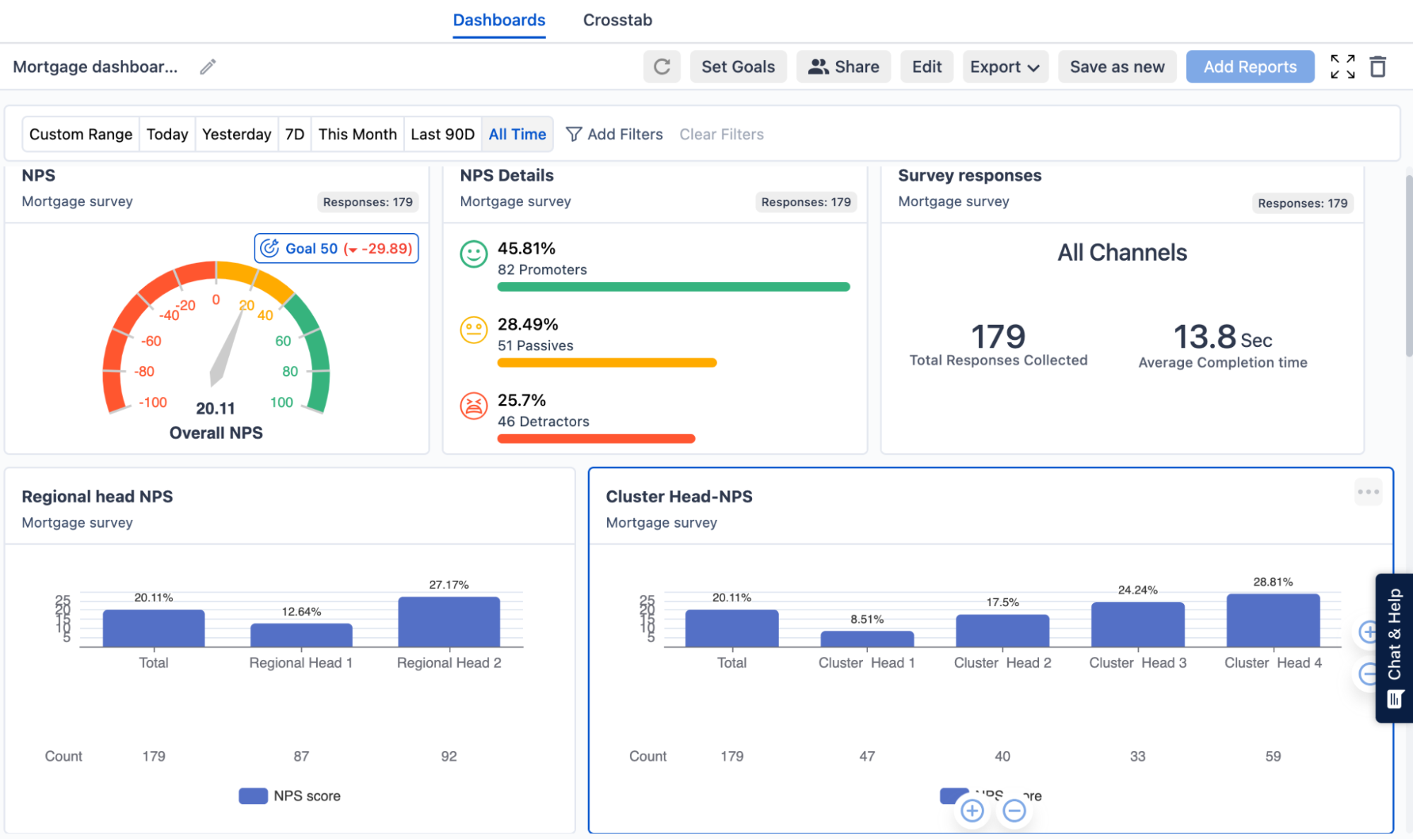

By using text and sentiment analysis and centralized dashboards, businesses can quickly identify pain points and areas for improvement. For instance, you might notice a recurring frustration in customer reviews about their mobile app’s loan application process.

Now, by using a centralized dashboard, like SurveySensum’s NPS dashboard, you identified that customers often drop off at the income verification stage due to unclear instructions. This enables you to address this issue in real-time – perhaps by adding a step-by-step guide or enabling AI-powered assistance.

But that’s not all. Go a step further and close the feedback loop by acknowledging feedback promptly, informing customers about the steps taken to address their concerns, and keeping them updated on improvements.

5. Personalize Customer Journey

Customers expect more than generic offers—they want experiences tailored to their unique needs. According to McKinsey, 71% of consumers expect personalized interactions, and 76% get frustrated when this doesn’t happen.

For example, if you have never expressed any interest in home loans in your entire customer journey then sending you exclusive offers and discounts on home loans doesn’t make sense right? So, use customer data to provide personalized recommendations, such as targeted investment opportunities or relevant financial tools. Don’t send the same offers to all customers, send offers or suggestions based on user behavior (e.g., prompting savings account holders to set up automatic deposits).

Don’t just collect data – turn it into actionable insights with SurveySensum’s NPS software that offers advanced features like automated feedback collection, sentiment analysis, and real-time reporting.

NPS Score in the Banking and Financial Services Sector

As per the 2024 Retently NPS Benchmarks for B2C, the average Net Promoter Score (NPS) for banking and financial services is 73.

What Constitutes a Good NPS Score in the Sector?

According to Bain & Company, an NPS score of 50 or above is typically regarded as good in the banking and financial services industry, while a score of 70 or higher is considered exceptional.

NPS Benchmarks: 27 NPS Scores for Leading Financial Institutions

Leading Banking and Financial Institutions NPS Scores

| Company | NPS Score | |

| 1 | First Republic Bank NPS | 72 |

| 2 | First Direct NPS | 66 |

| 3 | ING Luxembourg NPS | 63 |

| 4 | American Express Bank NPS | 52 |

| 5 | Royal Bank of Scotland NPS | 51 |

| 6 | JP Morgan Bank NPS | 31 |

| 7 | Santander UK Banking NPS | 27 |

| 8 | Tesco Bank NPS | 23 |

| 9 | Bank of America NPS | 18 |

| 10 | CitiGroup NPS | 18 |

| 11 | Morgan Stanley NPS | 16 |

| 12 | ANZ NPS | 15.4 |

| 13 | National Australia Bank (NAB) NPS | 15.4 |

| 14 | PNC Bank NPS | 15 |

| 15 | TSB Bank | 12 |

| 16 | CBA NPS | 10.4 |

| 17 | HSBC Bank NPS | 7 |

| 18 | Goldman Sachs NPS | 5 |

| 19 | Westpac NPS | -6.9 |

| 20 | USAA NPS | 75 |

| 21 | Charles Schwab NPS | 52 |

| 22 | ABN AMRO NPS | 30 |

| 23 | SoFi NPS score | 90 |

| 24 | OnDeck NPS score | 84 |

| 25 | Affirm NPS Score | 83 |

| 26 | LendingClub NPS score | 79 |

| 27 | Funding Circle NPS score | 77 |

The CX and NPS Profile of the Top 3 Banks

- First Republic Bank NPS

The First Republic Bank is enjoying an NPS score of 72, one of the highest in the banking industry.

- First Direct NPS

The First Direct Bank is enjoying an NPS score of 66.

- ING Luxembourg NPS

The ING Luxembourg Bank is enjoying an NPS score of 63.

The Future of NPS in Fintech

With AI capabilities and advanced analytics, fintech companies can leverage NPS to deliver hyper-personalized experiences, tailoring services to meet specific customer needs and creating targeted offers that suit customer journeys. With these advanced features, NPS is no longer a standalone metric. By integrating it with customer journey analytics, fintech companies can pinpoint exactly where customers face friction and refine their processes to enhance satisfaction.

While the future looks promising, fintech companies must tackle challenges like survey fatigue, ensuring unbiased NPS data collection, and interpreting scores effectively across diverse demographics.

Conclusion

This extended case study underscores the power of sending personalized unique survey links to gather and improve NPS in Fintech companies. The success achieved in ensuring data safety, improving the NPS score, and enhancing customer satisfaction validates the potential for similar strategies across the Fintech sector.

Don’t Compromise on Data Security With SurveySensum’s Advanced Data Encryption and Security Protocols!

Frequently Asked Questions

NPS in banking is a customer loyalty metric used to gauge the likelihood of customers recommending their bank to others. NPS helps banks understand overall customer satisfaction and loyalty, identify areas for improvement, and measure the effectiveness of customer experience initiatives. By tracking NPS, banks can make data-driven decisions to enhance their services and foster stronger customer relationships.

NPS is a metric used to measure customer loyalty and satisfaction by asking customers how likely they are to recommend a product or service to others.

Types of NPS include:

- Transactional NPS (tNPS): Measures customer feedback after specific interactions or transactions, such as after a purchase or customer service interaction. This helps companies understand the immediate impact of individual experiences on customer satisfaction.

- Relational NPS (rNPS): Measures overall customer loyalty and sentiment over a broader period. It provides a general sense of how customers feel about the company or brand, rather than specific interactions.

NPS is used for several reasons:

- Simplicity and Clarity: The single-question format of NPS makes it easy for customers to respond and for companies to collect data.

- Actionable Insights: NPS helps identify both satisfied and dissatisfied customers, allowing companies to take targeted actions to enhance customer experiences, address issues, and improve overall satisfaction.

- Benchmarking: NPS benchmarking allows companies to assess their performance against industry standards and competitors.

- Customer-Centric Focus: By continuously measuring and analyzing NPS, companies can maintain a strong focus on customer satisfaction and loyalty.

- Predicting Growth: Higher NPS scores are often correlated with customer loyalty, repeat business, and positive word-of-mouth referrals.

In finance, NPS stands for Net Promoter Score. It’s a metric used to measure customer loyalty and satisfaction by asking customers how likely they are to recommend a company’s services or products to others. NPS is often used in the financial services industry to gauge customer sentiment, predict retention, and assess overall service quality.

According to the Retently 2024 NPS Benchmarks for B2C, the average NPS score for banking and financial services is 73.