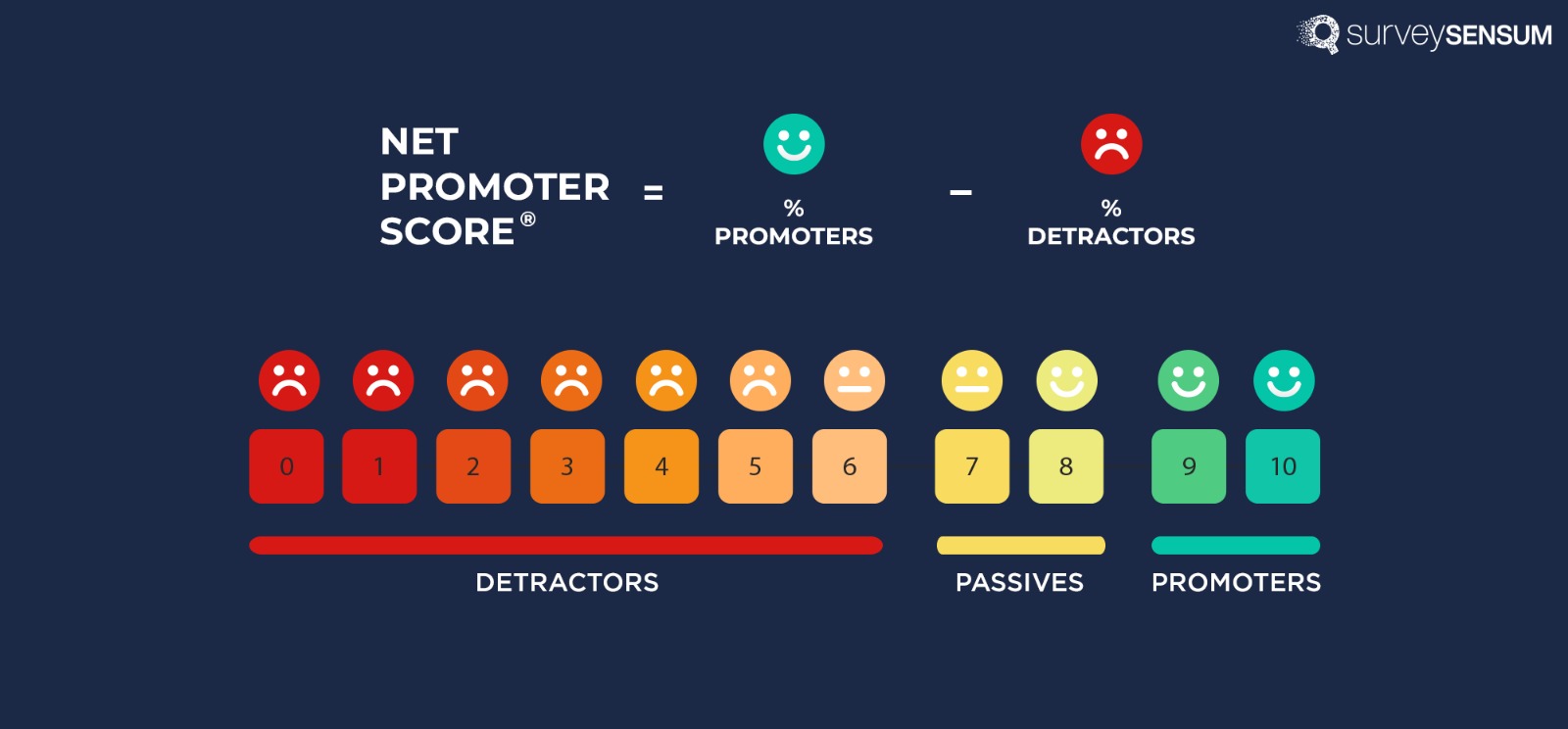

Measuring NPS in credit unions helps identify how satisfied and loyal members are. By focusing on these scores, you can enhance the member experience—because the more satisfied members are, the more likely they are to recommend your services, which in turn boosts your NPS.

But it’s not always easy. Many credit unions struggle with balancing the need to protect members’ trust and data while also gathering honest feedback. Regular surveys can sometimes feel intrusive, as members deeply value their privacy.

Finding the right balance between collecting meaningful feedback and keeping members’ information secure is challenging. That’s why it’s essential to use a robust feedback tool that comes with a CX consultant to guide you in creating and sharing surveys at the right time.

But what exactly is NPS in credit union, and how can it make an impact? Let’s dig in and find out.

What is NPS in Credit Union?

The average NPS score in credit unions is in the 60s which is well-above the industry average of 34.

Credit unions often have higher NPS scores because they focus on member service and community involvement. They aim to give the best services to their members to enhance their experience. To do this effectively, they regularly measure NPS to track member satisfaction, identify areas for improvement, and maintain a competitive edge over banks.

Not just that. They also ask follow-up questions to understand the reasons behind the scores. This offers deep insights into member needs and expectations, allowing credit unions to improve their services and reduce member churn.

A higher NPS score means more satisfied members who are likely to stay loyal and refer others to your credit union.

Using NPS to measure customer satisfaction and loyalty is a simple but effective way to make improvements based on real feedback.

Are you struggling to gauge your customers’ true satisfaction? Create and analyze NPS surveys effortlessly with SurveySensum! Discover how this tool helps you gather actionable insights and improve your credit union’s member experience effortlessly.

Factors Contributing to NPS in Credit Unions

Here are the following factors contributing to boosting NPS in credit unions, each playing a vital role in shaping member satisfaction and loyalty:

1. Member-Centric Service

Credit unions keep their members at the center to meet their needs and expectations. With this approach, they personalize their services either by offering competitive rates, flexible loan options, or financial products catering to various life stages. This emphasis on understanding and addressing individual member needs leads to higher satisfaction and consequently increases the NPS score.

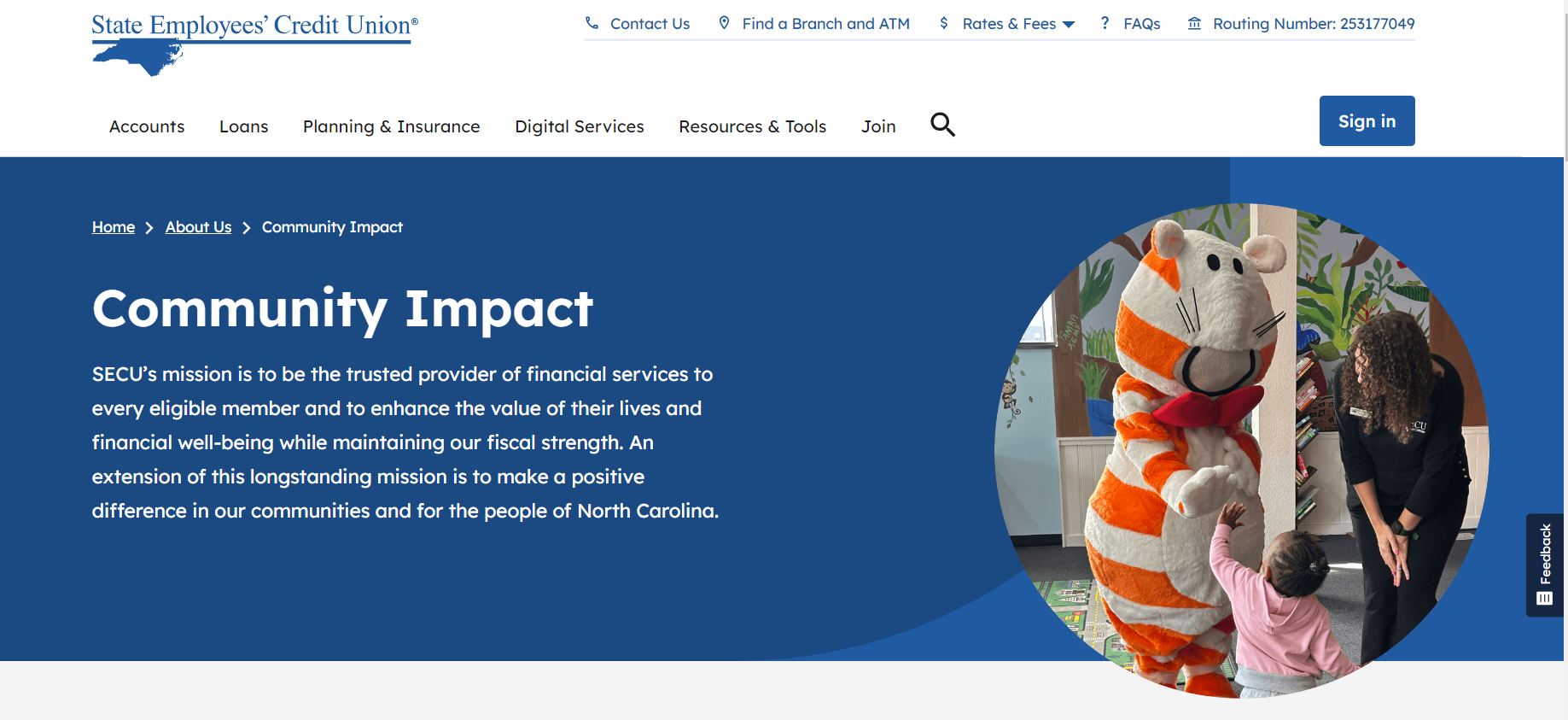

2. Build Loyalty through Community Engagement

Credit unions strategically engage with their community to build loyal members. They actively participate in their community and support local initiatives such as sponsoring local events, supporting charities, etc. that resonate with their members.

A prime example is the SEFCU (State Employees Federal Credit Union), which actively participates in community events and supports local charities.

This fosters a sense of belonging and trust, making members feel that their financial institution is not just a place for transactions, but a partner invested in the community’s well-being. This deep-rooted connection fosters loyalty and encourages members to promote the institution within their social circles.

When members see their credit union making a positive impact in their community, they are more likely to become enthusiastic brand advocates, significantly improving NPS.

3. Strong Member Relationship with Trust & Transparency

Trust and transparency are the fundamentals of any business.

And this is what credit unions have mastered. Unlike for-profit banks, credit unions operate with a not-for-profit structure, where the primary goal is to serve the members rather than generate profits for shareholders. This structure fosters a high level of transparency in operations, particularly in areas such as fee structures, loan terms, and interest rates.

Credit unions ensure that their members completely understand the financial products and services they are using. This transparency builds trust, a vital component of member satisfaction and loyalty. When members feel that their credit union offers them fair interest rates, no hidden fees, about its operations and genuinely has their best interests at heart, they are more likely to remain loyal and spread positive word-of-mouth to others.

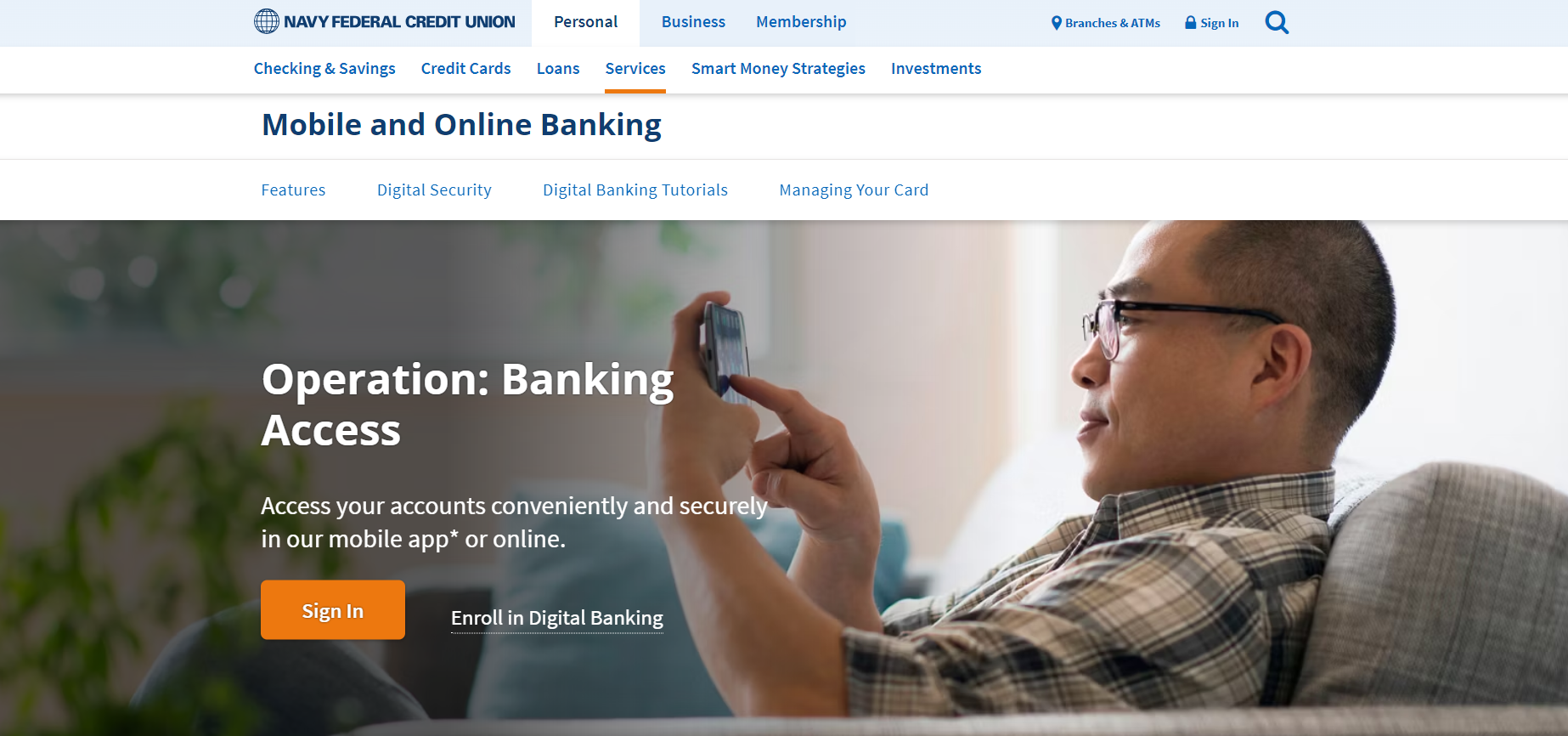

4. Innovative Mobile-Friendly Technology to Elevate Member Experience

To give members access to their finances at their fingertips, credit unions offer online banking platforms, mobile apps, and digital payments. This digital experience lets users manage their finances anytime and anywhere.

For instance, Navy Federal Credit Union offers digital banking to manage users’ cards, money, and profiles. This use of technology enables members to perform transactions, check balances, and apply for loans with just a few taps. Also, credit unions leverage this technology to offer personalized member interactions, and tailored financial advice based on data insights.

5. Omnichannel Customer Service to Turn Every Member Interaction to Loyalty

To increase your member satisfaction and experience, you must offer omnichannel customer service to meet your customers where they are.

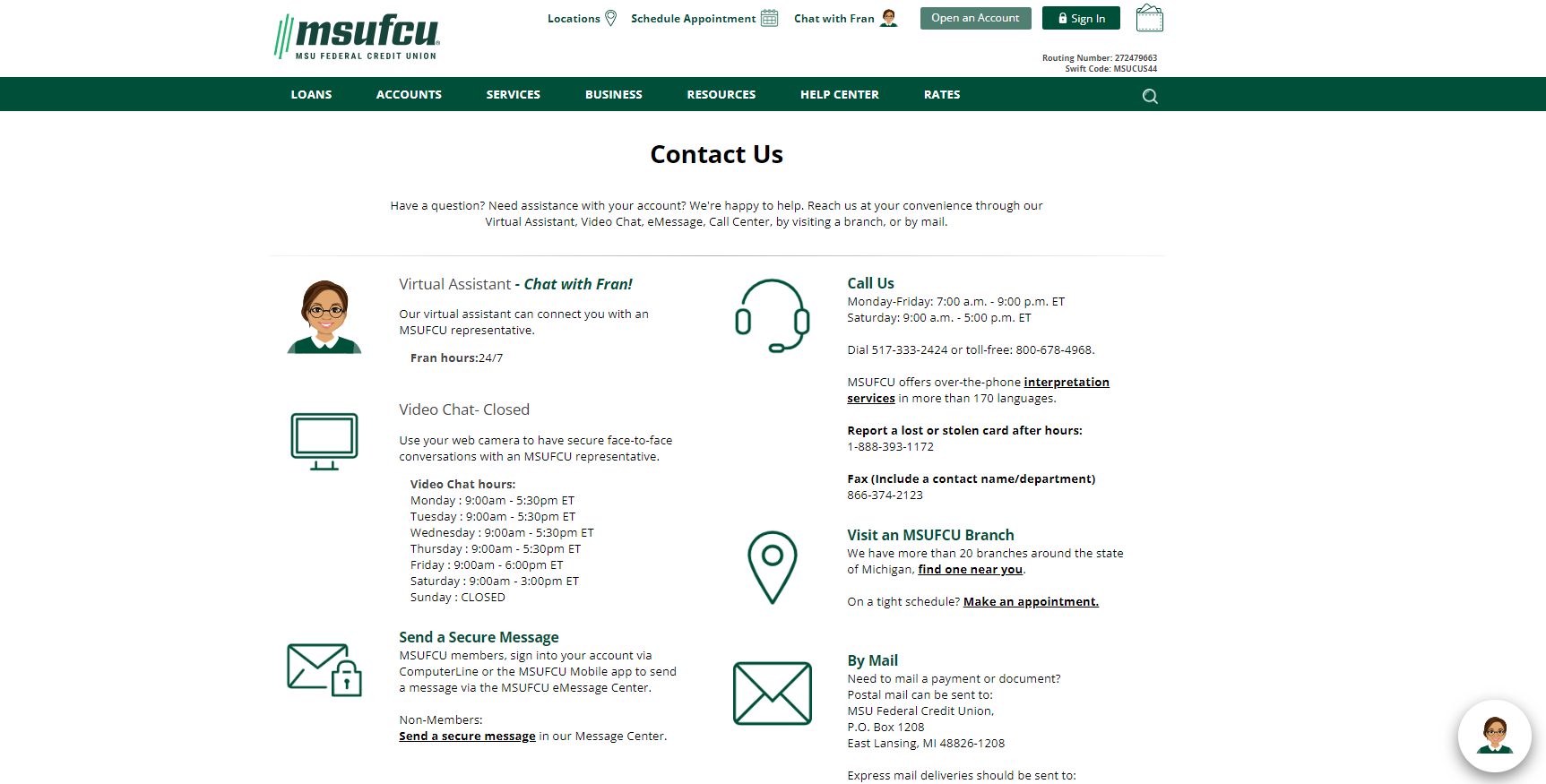

Credit unions like Michigan State University Federal Credit Union (MSUFCU) offer robust customer support through multiple channels like Virtual Assistant, Video Chat, eMessage, Call Center, visiting a branch physically, and by mail. It also involves ensuring that service representatives are well-trained, empathetic, and capable of resolving issues efficiently.

When members receive prompt and helpful responses, it not only resolves their immediate concerns but also leaves them with a positive impression of the credit union.

Conclusion

Now that you know that NPS is more than just a metric for credit unions. It’s a powerful tool to assess member satisfaction and loyalty. With all these factors, NPS is rising in credit unions. And a high NPS score highlights the number of happy members and drives growth through positive word-of-mouth and strong member advocacy.

To use NPS effectively, consider using SurveySensum to design, share, and analyze the survey insights with ease. This tool helps you gather accurate feedback, uncover actionable insights, and track your NPS performance over time. Not just that, but you can focus on what matters most to you — improving your member experience and driving your credit union’s success.