If you are reading this, you already know what JD power does.

It is a famous market research organization that offers ranking, reviews, and reports by analyzing consumer data on products and services across different industries. It is one of the oldest marketing research companies.

Though it is best known for its research in the automotive industry, JD power analyzes consumers from other industries as well.

And you might also know how they gather insights? – but here’s a quick summary.

How does JD Power gather consumer insights?

JD Power survey results help manufacturers to understand what their customers think of the products that are already on the market, and what they need and expect. This enables them to design and sell their products as their consumers want.

STEP 1: Identifying the sample audience

To gather these insights, JD power first selects the sample audience to survey. The audience is not selected at random. Instead, the respondent should be the user of the product or service.

STEP 2: Sharing the survey

The survey questions are asked from the car buyers in a face to face interviews and include more than 200 questions categorized into 8 categories such as exterior, interior, seats, and features. The participants are invited to share their detailed feedback on the car and are incentivized accordingly.

STEP 3: Analyzing the result

Later the results are analyzed manually by the associates and the data gathered is sold or shared with the organizations that are talked about in the findings.

The thing to note here is that respondents are incentivized for their responses.

And JD Power’s survey objective is to thoroughly understand the car buyer – not just for your brand but every brand so that they can sell these insights and rankings to those brands.

But people are copying the JD power survey for internal research

The problem arose when people started copying the JD Power survey to gather feedback about THEIR OWN services and products or internal CSI/SSI research.

I have even seen brands calling and asking 37 questions which are similar to what JD power does.

Why is that a problem, you might ask?

1. The problem is incentivization

JD Power incentivizes its participants to share their detailed feedback to a long 150-200 questions survey.

If you are asking people to share their feedback on your 30-questions survey, then you also need to incentivize them.

2. The problem is long surveys

People do not like long surveys. Put yourself in their shoes and ask yourself, would you fill a 30-question survey? No, right.

Because no one wants to spend so much time on something without getting anything in return.

For instance, here’s a 15-question survey. See if you’d like to fill it.

- Why did you start reading this article?

- What did you find from the article?

- Did you find what you were looking for?

- Did you read any other articles on the JD Power survey?

- What other topics you were searching for?

- Did you find those topics?

- Where did you find those topics?

- Were the articles you found satisfactory enough?

- What other topics do you find interesting?

- Do you use JD Power insights?

- Do you also copy JD Power surveys for internal research?

- Name 4 things you like about the JD Power survey.

- Name 5 things you dislike about the JD Power survey.

- Please explain the purpose of your surveys.

- Please explain the challenges you were facing while launching a survey.

3. The problem is sharing one survey at all touchpoints

A person who just received their new car doesn’t remember the booking experience or test drive. So, why ask them a question about it? That’s the problem with JD Power surveys.

Let’s take an example here. Nancy took the test drive in January, booked the car in February, and the car was delivered to her in July. Post the car delivery, a survey is sent to her asking about the test drive, sales agent’s behavior, service agent’s behavior, delivery experience, booking experience, waiting time, and the list go on.

Do you think after 7 months’ time, Nancy would remember all of this, or does she even care? For her, the important thing is that her car is delivered on time, the sales advisor trained her on the features, and it works fine.

Now if you will ask 37 questions, you will get absurd answers!

Here’s an example of the JD Power Survey

So, what can you do? What is the solution?

The solution is to divide your survey questions based on each touchpoint across the journey. The surveys for every touchpoint across the customer journey should be created exclusively to improve the experience of that particular touchpoint. One survey doesn’t work for all. So, create surveys according to your objective.

Take a survey after each touchpoint instead at the end of it. For example, take a survey post-test drive, car booking, car delivery, etc.

This way you just have to ask 3 to 4 questions in one survey and you will receive honest reliable feedback.

4. Another problem is – irrelevant questions

Why asks so many questions from the customer when you dont even need to KNOW their feedback on many of the questions are asking. You are merely annoying your customers with these long surveys.

When you send these 30-50 questions long surveys to your customers, without sharing any incentives, they WILL NOT share their feedback. Or they’ll drop off the survey in between leading to low response rates resulting in a futile survey program.

That’s why dont ask too many questions. Ask questions according to your objective.

The JD Power surveys talk about the overall experience with the product. That’s their objective.

What’s YOURS?

Identifying the objective of the survey based on the touchpoint

This is the most significant stage of surveying – Identifying the OBJECTIVE.

When you dont know what you want to achieve from the survey, then your survey WILL NOT give you efficient results.

That’s why identify your objective.

What is it that you are trying to achieve? What is it that you are looking for?

Here’s an example.

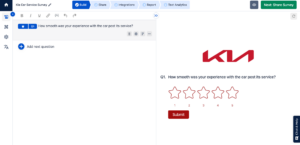

Nancy recently got her car serviced from the service station. How was her experience? Was she satisfied?

You dont need 30-40 questions to understand this. Only 4 would be enough.

Objective: To understand the performance of the service station and the satisfaction of Nancy.

Survey Questions:

- How satisfied were you with the sales advisor’s behavior when you shared your problems with them?

- Were you informed of the costs covered for the car service?

- How smooth was your experience with the car post its service?

- Were your listed problems fixed post the car service?

It’s simple.

When you can achieve your objective in just 4 minutes, why send a 30-question survey and waste your customers’ time filling it which rarely happens?

So, what’s the Solution???

Stop copying JD Power surveys. Create your own!

It’s really really simple.

How?

STEP 1: Launch surveysensum.com and create a free account by signing up.

STEP 2: Choose the template of your choice based on YOUR OBJECTIVE.

STEP 3: Edit and customize your template to create the survey in your brand voice and colors.

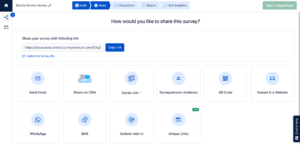

STEP 4: Launch the survey in your customers’ preferred channel.

And not just that!

- All the feedback is gathered in one place.

- The feedback is analyzed on its own with text analysis and gives your top trends and feedback from the feedback.

- You can set up an alert notification on any negative feedback.