Costs you More: Closing a new customer is FIVE times more expensive than retaining the existing ones, so yes customer churn costs high. So much so, that the probability to sell to the current customers is 60-70% while that of the new ones is 5-20%.

A huge margin, I must say – proving that preventing customers churn SHOULD be the focus of the businesses, and is the challenge for many.

However, to improve anything you must draw the starting line, so is the case with customer churn. To avoid customers from leaving, you need to first calculate it, analyze the reasons, and implement effective strategies.

Let’s first start with the understanding of what customer churn is.

What is Customer Churn?

Customer churn is when you customers stop being your customers – they stop doing business with you. It happens when customers are dissatisfied with your services or products.

Also known as customer attrition, customer churn can be measured with the metric called Customer Churn Rate.

What is the Customer Churn Rate?

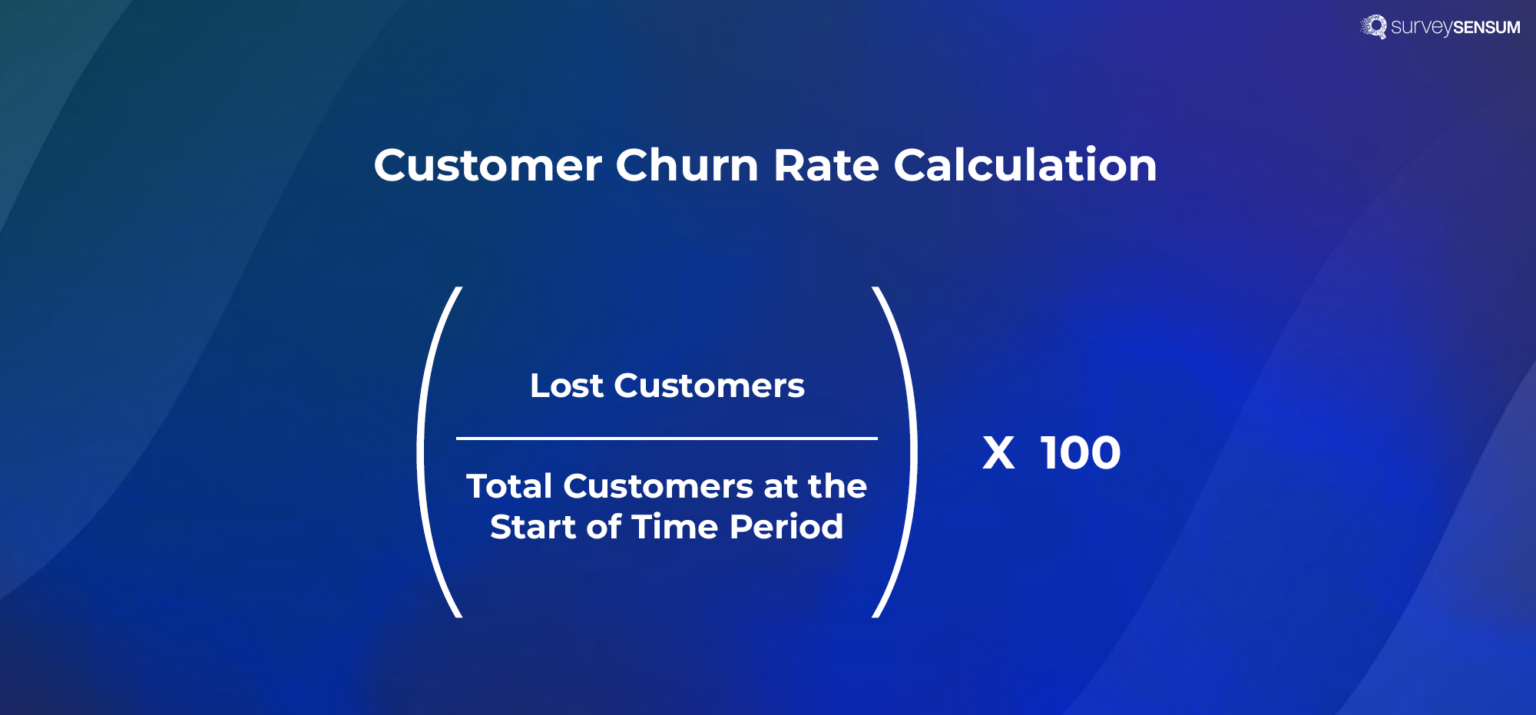

Customer Churn Rate is a metric used to gauge customer customer churn in any organization. It basically calculates the number of customers who stopped using your product or service in a particular time period, be it month, quarter, or an year.

But how to calculate customer churn rate? Well, it can be calculated with the churn rate formula.

Customer Churn Rate Formula

Churn Rate = (Number of Customers at the Start of the PeriodNumber of Customers Lost During a Period)*100

Let’s understand this with an example –

In the beginning of the month, the company has 1000 customers and it loses 50 customers by the end of the month. Now the churn rate would be:

Churn Rate = (50/1000)×100=5%

→ Low churn rate indicates that customers are satisfied with your product or service, while high churn rate indicates customer dissatisfaction. There could be multiple reasons for it – high pricing, poor customer service, technical glitches, product not meeting expectations, etc.

Understand the reasons behind customer churn with customer churn or drop off surveys with SurveySensum

Why Should You Focus on Customer Churn?

High customer churn means low customer retention and high customer dissatisfaction. But that’s not it. There are multiple reasons why you should start focusing on customer churn.

- Costs you More: As said it is 5 times more expensive to onboard a new customer than to retain an existing one!

- Impacts Revenue: According to Forbes, Marketing Metrics, the probability to sell to the current customers is 60-70% while that of the new ones is 5-20%.

- Poor Word of Mouth: While it’s rare that satisfied customers will talk about their experience, dissatisfied customers WILL pass along negative word of mouth which leads to 21% of the prospects losing the trust in the brand.

- Losing out to the Competition: When your customers are dissatisfied and your churn rate is high, your competition can easily snap your market share.

- Indicates Future Growth: Your churn rate can be a key indicator to your future growth. When you launch a new product or service into the market, it is your existing customers that will try it first and give you reliable feedback. But if your CLV is poor, your growth will suffer.

Steps to Take After Calculating Churn Rate

So yes, you’ve calculated your churn rate. Is it high? What can you do now? What are the strategies to reduce it? Let’s discuss.

1. Harness the Power of NPS

Before working on preventing the customer churn, you need to know about which customers are more likely to churn. Well, NPS is the metric for it. With a simple loyalty question, it will give you the list of your most loyal customers and most unhappiest customers.

Now that you know who your dissatisfied customers are, take a step forward to understand ‘why’ they are dissatisfied. Understand their issues, concerns, and expectations and focus on how you can improve it.

With NPS, you can basically turn your unhappiest customers into the happy ones if timely actions are taken.

2. Don’t Forget to Measure CES

96% of the customers become disloyal if they had to face high-effort service interaction – establishing the importance of an effortless and seamless customer experience.

So, don’t forget to measure CES Score at relevant touchpoints. Not only will it help you identify the touch points with the most friction, it will help you understand customers’ struggles. Knowing these data, you can take relevant action to boost customer satisfaction.

3. Offer Exceptional Customer Service

Poor customer service is one of the biggest reasons for customer churn. Infact, the number is as high as 70% and the common reasons are – incompetent staff and slow service.

No one likes to wait forever to get a simple query resolved! That’s why customer service should be the first area to improve the overall customer experience. Start gauging the CSAT score of your customer service. Identify the common challenges faced by the customers and resolve them.

Simultaneously, train the front line agents the importance of customer satisfaction, create KPIs, and ensure that they are well-equipped to manage any issues coming their way.

4. Close the Loop Before It’s Too Late

Did you know that businesses that close the feedback loop in time increase their customer churn by 2.1% every year. On the other hand, if they DO close the loop, they can decrease the customer churn by 2.3% per year (at least).

So yes, closing the loop is crucial. When your customers are coming to you with a problem, they expect you to do something about it, and you should! Create a process, listen to the voice of the customers, understand their issues in detail, resolve their issues, and simply give them a call (in case of B2B).

When you close the loop, you build a rapport with your customers, you show them that you care and it directly impacts their loyalty!

Get notified as soon as there is a detractor with SurveySensum’s ticketing system. Take relevant action and close the feedback loop in time

TIP: Consistently Analyze Customer Churn Rate

Calculating customer churn rate is not a one time job! It needs to be calculated consistently to keep a track of the number of customers leaving. It will help you identify common trends and patterns, enabling you to resolve the issues before it’s too late!

Average Customer Churn Rate By Industry

Here’s the list of average customer churn rate by industry:

- Computer Software: 14%

- Consumer Packaged Goods: 40%

- Energy / Utilities: 11%

- Financial Services: 19%

- IT Services: 12%

- Industry Services: 17%

- Logistics: 40%

- Manufacturing: 35%

- Professional Services: 27%

- Telecommunications: 31%

- Wholesale: 56%

Takeaway

Gauging and understanding customer churn is crucial. It impacts the long term success of any business. However, calculating the customer churn rate is simply the first step. While it gauges the health of the customer relationships with you, you must implement timely strategies to improve the churn rate. Focus on improving customer service, leverage CX metrics NPS and CES, be consistent with measuring the churn rate, and never forget to close the loop. All of this will boost customer satisfaction, increase customer retention, and positively impact the revenue.

An effective customer feedback tool like SurveySensum, helps you gather relevant customer insights, share key drivers with prioritization, close the feedback loop in time, and enable you to take action that directly impacts your business KPIs.

So, what are you waiting for? Start calculating your customer churn rate and prevent customers from leaving you!