Creating a survey is the beginning. Sharing it with the right people, at the right time, on the right channel is another game.

Now, if you have done all of this, and you are jumping with joy with the rising responses, then what are you planning next?

The results are coming, and people are responding, but how are you making sense of all of it?

That’s where survey data analysis comes in.

So, in this article, we are going to discuss everything there is to know about analyzing survey data.

Dive in!

So, what is Survey Data Analysis?

Survey Data Analysis basically is a process of analyzing all the raw data received from the surveys and extracting actionable and easy-to-understand insights from it.

Because survey results are just large amounts of data and the actual lucrative process begins when you start analyzing the survey data, breaking it down, gathering insights, and taking action on them.

That’s why it is important to always have a proper data analysis plan after gathering feedback.

Let’s understand this in more detail.

Why should you analyze survey data?

Let’s say you are a restaurant owner and you recently conducted a customer feedback survey asking for new options for the new menu.

Around 300 of your customers filled out your feedback form, expecting the menu to upgrade in the next 2 or 3 weeks. But nothing happens!!

They are disappointed to see the new menu and their feedback is just lying around.

So, what is the point of taking all the customer feedback if you are NEVER going to use it? Only after analyzing the feedback data can you uncover trends and patterns in customer behavior, what they like and dislike, which is the popular food on the new menu, what they are expecting, and how these insights can help increase restaurant sales through smarter business decisions.

That’s why analyzing survey data is important.

Now that we know why you should analyze survey data, it’s time to know the ‘HOW’.

But, before that, let’s learn some golden rules of surveys that will help you analyze survey data efficiently.

Things to keep in mind before launching a survey

While analyzing the survey data is incredibly important, it comes with its potential challenges if the survey was not created efficiently. That’s why proper PLANNING while launching a survey is paramount.

For example,

1. Having a clear objective

What’s one problem that you are trying to solve?

While creating a survey, it is incredibly important to have the clear objective of the survey in mind. Because, a survey created without a purpose, asks a lot of irrelevant questions from the customers and doesn’t deliver significant feedback.

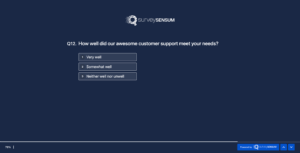

2. Choosing correct questions

Asking too many open-ended questions annoys the customer and adds complexity to the survey analysis. On the other hand, asking no open-ended questions or just close-ended questions generates only quantitative data and doesn’t offer much to the survey data analysis.

Moreover, asking biased questions, and leading, or barreled questions also skew results.

So always pick the right questions for every touchpoint.

Here’s an example of a biased survey question.

Instead, go for

3. Determining the right sample size

You will always pull meaningful results from the right sample size. Sample size basically means the number of people you need to make the survey statistically valuable.

For example, if you launched a survey to a sample size of 50 people, but that’s not going to be enough. Or taking feedback from all the promoters (happy customers) only won’t give you useful results.

That’s why before launching any survey, always make sure that your sample size is big and random enough to deliver objective insights. For example, 200 people with a 7% margin of error is a decent sample size to start.

That’s why CREATING AN EFFICIENT survey also plays an important role in survey data analysis.

Create a FREE survey with SurveySensum.

So, let’s move on to the ‘HOW’

How to analyze survey data?

Well, there are two types of data you have received from your customers. Quantitative and qualitative.

1. Let’s pick quantitative data first.

Why?

- It’s easier.

- Percentages are quickly understandable by our brains and are simpler to compare.

- And only when you know how many like X and not Y then can you focus on the ‘WHY’ – the reason behind their choices.

Here, cross-tabulation helps you analyze your data.

What’s cross-tabulation?

Cross-tabulation is a two-dimensional table that is used to analyze the relationship between two or more variables. Cross-tabulation is effective when you have categorical variables or data.

For example, a categorical variable can be customer reviews by region. You can divide the reviews based on the geographical area of the respondent and determine people of which area likes your company and not.

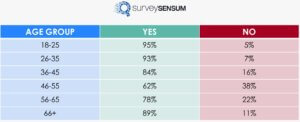

So, cross-tabulation basically helps you to draw insights from your quantitative data and add context to it. For example,

Let’s say 70% of the respondents said Yes and 30% said No.

That’s simple math.

Let’s drill it down.

This is where cross-tabulation helps. It will help you answer how many people from each age group like or dislike chocolate.

Now if a chocolate company looks at this data, they’ll know that they should target people of age between 18 to 35 and above 66.

That’s how quantitative analysis works.

Create a FREE survey with SurveySensum.

2. Analyzing Qualitative data

In another scenario, the CX head of a SaaS company has recently analyzed from the quantitative feedback that their customers are turning into detractors and their renewals are declining.

But why? What’s the reason behind this declination?

That’s where the qualitative feedback comes in. It gives you the WHY behind the quantitative feedback.

When the CX team analyzed the open-ended feedback, they found that the customers were visiting the website for support but they weren’t getting any. Their problems were not getting resolved and they were stuck. So, the renewals stopped!

In simple words, qualitative data supports and explains your quantitative analysis.

And both qualitative and quantitative analysis gives you the complete picture of survey data. For example, it tells you what your customers are thinking about you, what are their expectations, what are their likes and dislikes of the product, etc. Building robust data pipelines efficient data flow is essential for any organization. By focusing on architecture, automation, and real-time processing capabilities, businesses can streamline their data operations, reduce bottlenecks, and enhance overall productivity. Investing in strong data pipelines not only supports better decision-making but also prepares your organization for future growth and scalability.

But analyzing qualitative data is a little tricky, as there are thousands of open-ended customer responses to go through to identify the top complaints and sentiments.

Well, there are three ways to do it.

1. Manually Coding:

This is 100% doable if you’ve got 100-200 responses but for more than that, it can be a cumbersome task.

How does it work? All you have to do is read every feedback thoroughly, create tags to each feedback manually, and then at the end of it analyze those tags to identify top trends and patterns followed in the customer feedback.

Here’s an example of customer feedback being tagged

→ I really loved the app, but I think the pricing is too high.

Tag: Loved the app, Pricing

Sentiment: Neutral

→ I am unable to navigate through the app. It’s really complex!

Tag: App navigation

Sentiment: Negative

Now you have to do this for all the 100-200 customer responses, analyze their tags, and identify the customer sentiment and complaints from that sample.

But there are two drawbacks to it apart from manual error.

- When the responses start increasing, analyzing them becomes really difficult.

- Sometimes people bias these results by adding their emotions to them.

2. Outsource to a third party:

This is simple. Share all the received feedback with the third party and they will share their analysis with you.

Here are some drawbacks.

- Manual errors and unreliable findings

- Sometimes these third party takes too much time to analyze data such that when you think about taking action on the findings, it’s already late.

3. Automate the entire process:

The optimal solution however is to automate the entire process. There are various text and sentiment analysis tools out there that can help you with it

But how do they work?

→ Let’s take an example of SurveySensum’s Text and Sentiment Analysis tool

When you are receiving feedback in thousands, it is your go-to tool. It analyzes all your open-ended feedback and gives you top trends and sentiments within a few minutes.

How?

STEP 1: Initially, you’d have to create tags and add matching keywords for 15 responses.

The AI-enabled machine will learn the tags and will start tagging the responses on its own saving hours of your time.

STEP 2: Then, go to Tag Analysis. Therein you’ll find the updated report telling you the tags occurring the most times and their sentiments.

STEP 3: Now, you can validate these issues with the customers and check if this is happening across all channels.

You’ll know what kind of challenges your customers are facing, what are they expecting, how they feel about you, and which departments are concerned.

Run Text Analysis with SurveySensum.

Now that you have all the insights from the Quantitative and Qualitative analysis, how are you going to use it to improve your customer experience?

By comparing Feedback data with Operational data

Let’s start by understanding what they are.

Operational Data

Your operational data is customer data that is generated by CRM, website traffic, sales, finances, ERP, etc. Organizations used to make their business decisions based on this data. However, integrating the best ERP for small business solutions can enhance the accuracy and efficiency of this process. But, there is one drawback to it.

It tells you what has happened in the past, but it doesn’t offer you the ‘why’.

For example, the CSAT score of the product for the last quarter has declined. That, you can gather from the operational data. But why have they dropped?

For that, Feedback Data is required.

When you dig into the feedback data, you’ll realize that the latest platform update is full of bugs and glitches and customers aren’t liking it. Now you know the issue and you CAN resolve it.

So, what exactly is feedback data?

Feedback Data

The quantitative and qualitative insights you gathered from the customer feedback are called the feedback data.

The feedback data basically tells you about the customers’ emotions, intentions, and attitudes toward the Startup brand, service, or product. It helps a great deal to expect what’s coming – if customers are going to recommend your brand to someone, if they are planning to leave you, if they’d like to purchase more, etc. Basically, it helps you identify and resolve the problems that might occur in the future. And yes, it gives you the ‘why’ behind the operational data.

So, the next step is to combine your Feedback data with your operational data. Doing this tells you

- It tells you why there are unexpected or significant changes in your operational data. For example, why your customers aren’t renewing? The feedback data will tell you if they don’t like the new features, or they are unhappy with the current support, etc.

- It tells you why there are unexpected or significant changes in your feedback data. For example, why your customers aren’t buying air conditioners? If you dig in the operational data you’ll find that the weather for that particular segment audience is still cold.

- It alerts you if your customers are going to leave you. If your NPS scores are low for a particular segment, then your feedback data can tell you what it is that your customers aren’t liking.

- It helps you deliver personalized experiences to your customers. For example, for every unhappy high-value customer, you can assign skilled agents to give them support and help them through their journey.

Now that you have done your survey data analysis (quantitative and qualitative) and combined it with the operational data, it’s time to present your survey data results.

The last hurdle, presenting survey data results

The final step of survey data analysis is to present the results to the relevant teams, stakeholders, or management in the most understandable form.

Here are some common ways to present your survey data results.

1. By telling a story

Sharing your data is a skill to be learned. In order for your team, stakeholders, or your management to focus on your CX program, create a story that engages them.

Always remember a story is more powerful than numbers.

So build a story. Add emotions, create a hook, and then share the numbers to support the challenges and present the solutions.

2. Using visual presentation

Visualization creates interest in the audience. A Ai presentation is always a good option to exhibit your information. This is easy. You can easily include all your stages of the survey like objective, research questions, hypotheses, survey questions, analysis methods, and more in it. For businesses working with an Employer of Record, such presentations can effectively communicate hiring processes, compliance stages, and workforce management data. The most common methods of visual presentation are using graphs/charts, tables, or infographics.

But why is presenting the results of survey data analysis so important?

Creating a survey, gathering feedback, and analyzing the results are of no point if YOU ARE NOT GOING to take any action on it.

Because you might not always be responsible for it. And to create an efficient CX program, you HAVE to involve everyone in it.

That’s why sharing your survey data analysis is important. Because they are the ones taking action on it. And if not, they’ll understand why and customer feedback can help you improve your product or service experience.

Now, let’s take a real-world example.

The Challenge:

One of our clients, a fintech company that sells mutual funds, was measuring NPS scores once a year via a research agency. They observed that their score was declining for the past 2 years and they were unable to identify any reasons for it.

The Solution:

When they reached out to us, we advised them to measure CSAT every time a customer contacts the support team, purchases mutual funds, or even tries to but couldn’t.

As this was done in real-time, customers were able to share their problems right away.

STEP 1: From the quantitative feedback, we analyzed that 28% of these customers were detractors.

STEP 2: On the other hand, from the qualitative feedback, we found out that these customers were struggling to buy funds on their own because they didn’t know how to choose the right one.

So now we had the feedback data that tells us that 28% of these customers are detractors, and selecting the right mutual fund for them to buy is a huge challenge for them.

STEP 3: After extracting this information, we looked at the operational data and found out that the transactions were also declining from this unhappy segment for the past 1 year.

STEP 4: When the CX team combined the feedback and operational data, it became easy for them to convince the marketing team of the further steps that need to be taken. The client team discussed this with the stakeholders and the relevant teams and came up with a plan of action.

STEP 5: Actions taken

- The client’s marketing team created help articles and videos telling customers how to find the right mutual fund to invest in.

- They also created a webinar series on the same and pushed these recordings to the customers.

Result:

In a matter of 4 to 5 months, the number of transactions started growing, revenue from those customers increased by 43% and the NPS score rose by 5 points.

So now that you know what to do with the customer feedback, get going.

And if you face any challenge, SurveySensum can help you, be it anything from creating a customer survey to implementing your CX program.

Just reach out! 🙂

Analyze survey data with SurveySensum.

Frequently Asked Questions (FAQ) about survey data analysis

You can present your survey analysis in the following format:

- Through a story: Create stories that engage with our audience by adding emotions. After you have hooked your audience, add the numbers to support the challenges and present solutions.

- Using visual presentation: You can catch the attention of your audience through visual representations like graphs, charts, tables, or infographics and explain each stage of the survey data analysis.

It will depend on your survey objectives. However, using both quantitative and qualitative statistical analysis can help you analyze survey data better. The reason is that qualitative data supports and explains your quantitative analysis.

The best data analysis method will be using a combination of quantitative and qualitative data analysis. You can use these methods and then compare feedback data with operational data to get a clearer picture.