The world of finance is always under threat, especially when it comes to online financial services. As expected, this is what cybercriminals target. Financial services juggle money, but also personal information that can get into the wrong hands. This is why, in the world of finance, ensuring security is paramount. Practices like “Anti-Money Laundering”, or “AML”, are the barrier between your financial service and cybercriminals.

AML practices keep money safe and protect the integrity of a financial system. It’s about safeguarding your customers’ funds and personal information, as well as streamlining their banking experiences. If incorporated well into a system, AML practices to boost customer experiences, and we all know how important this is for a company’s success!

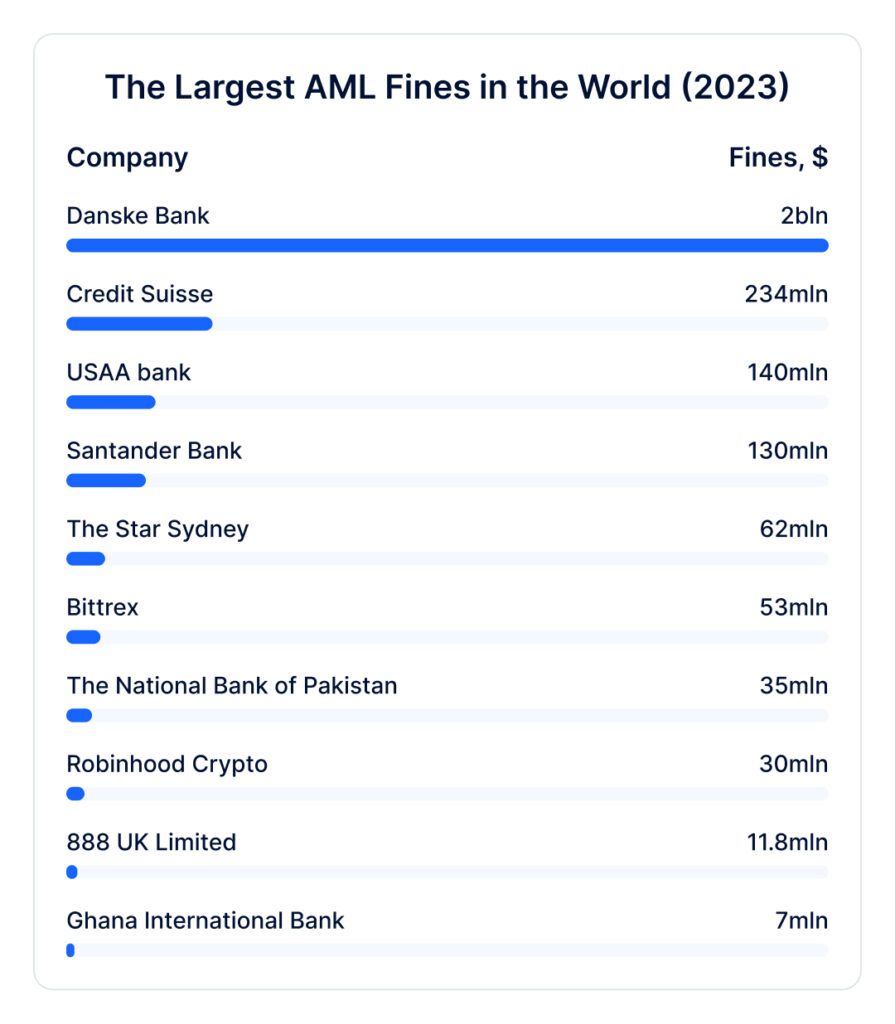

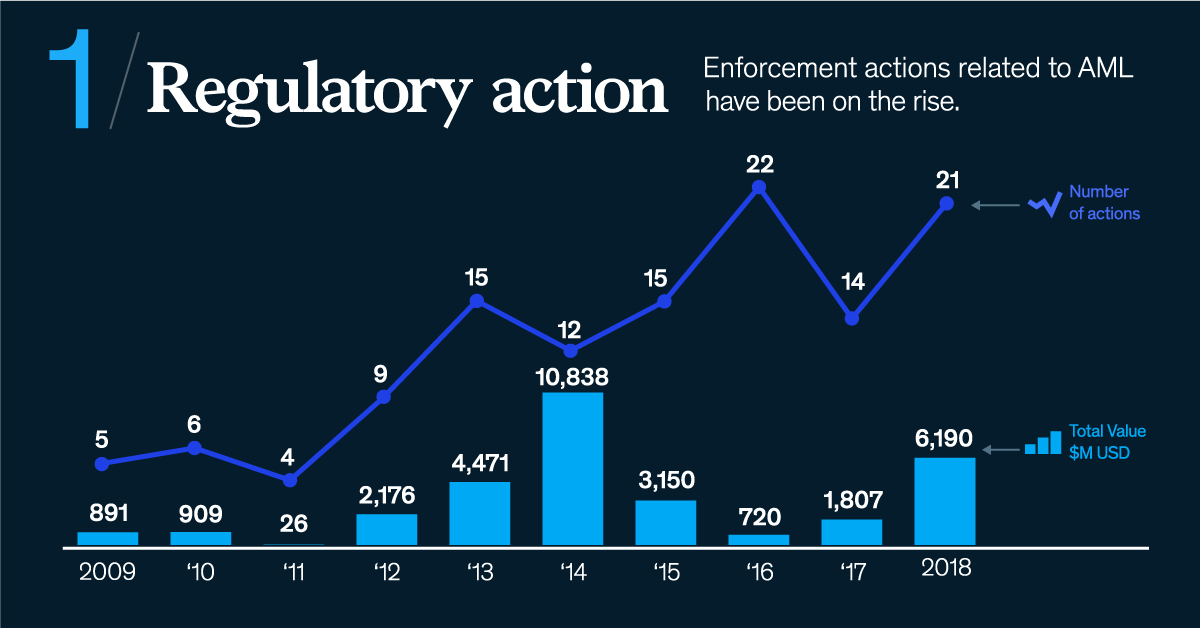

It’s not just about customer experience, either. In 2022 alone, global financial institutions were fined over $5 billion for AML and other violations (such as KYC violations), which is 50% more compared to the year before.

Not convinced just yet? Well, 88% of consumers agree that their willingness to share personal information with a business depends on how much they trust the company. If your financial service is not trustworthy in the eyes of the audience, that leaves you with very few people willing to use it.

In the wrong hands, sensitive customer data is a high-value target for criminals. They can exploit it for everything from identity theft to fraud to laundering.

This post delves into the importance of using AML practices to secure customer data and explains how it will boost your customers’ experience.

What is AML?

AML is an abbreviation for Anti-Money Laundering, a system that financial institutions like banks use to identify and prevent money laundering. AML is embedded in financial security these days, especially since it is closely linked to regulatory compliance, which every financial service needs to adhere to.

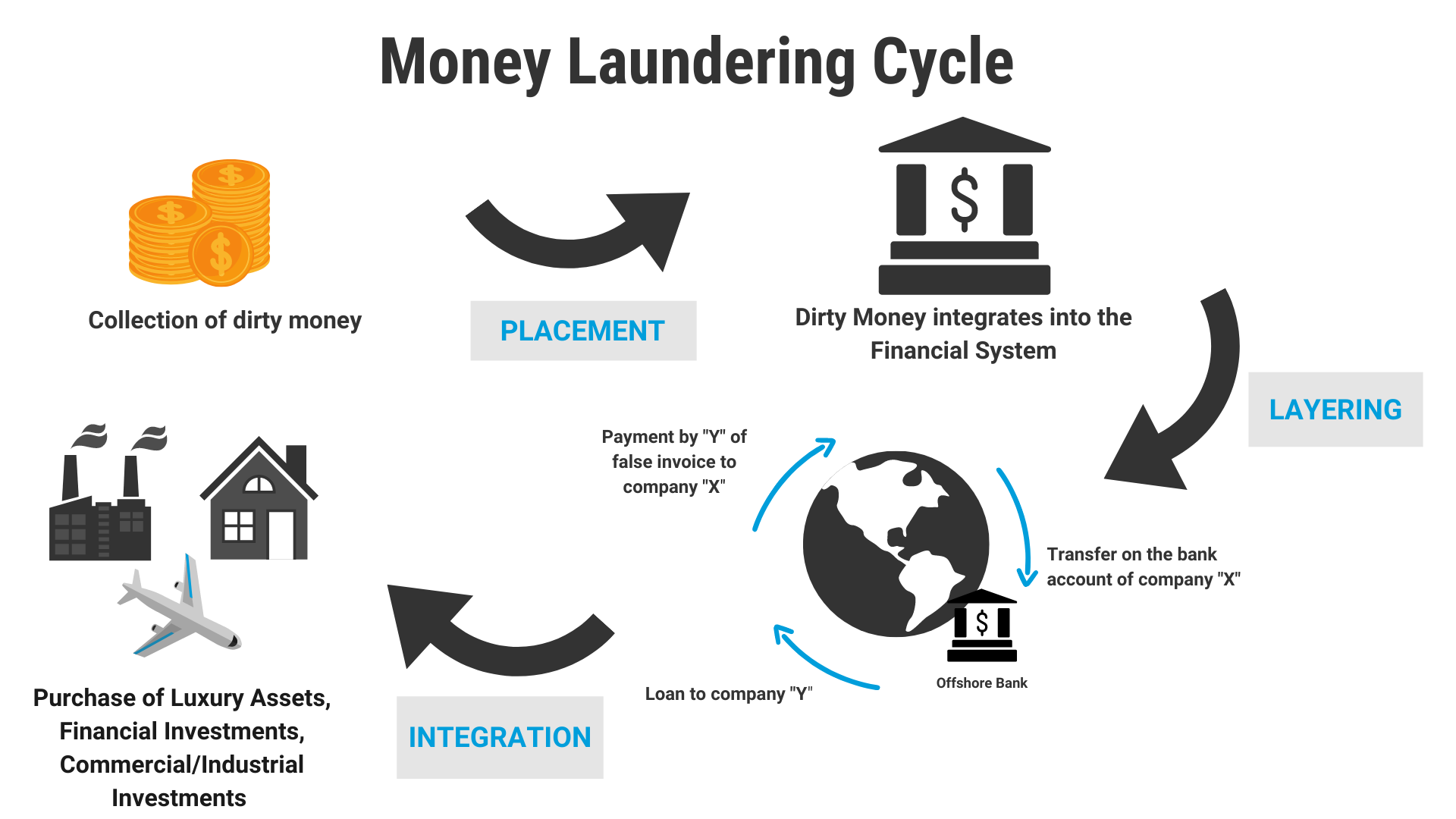

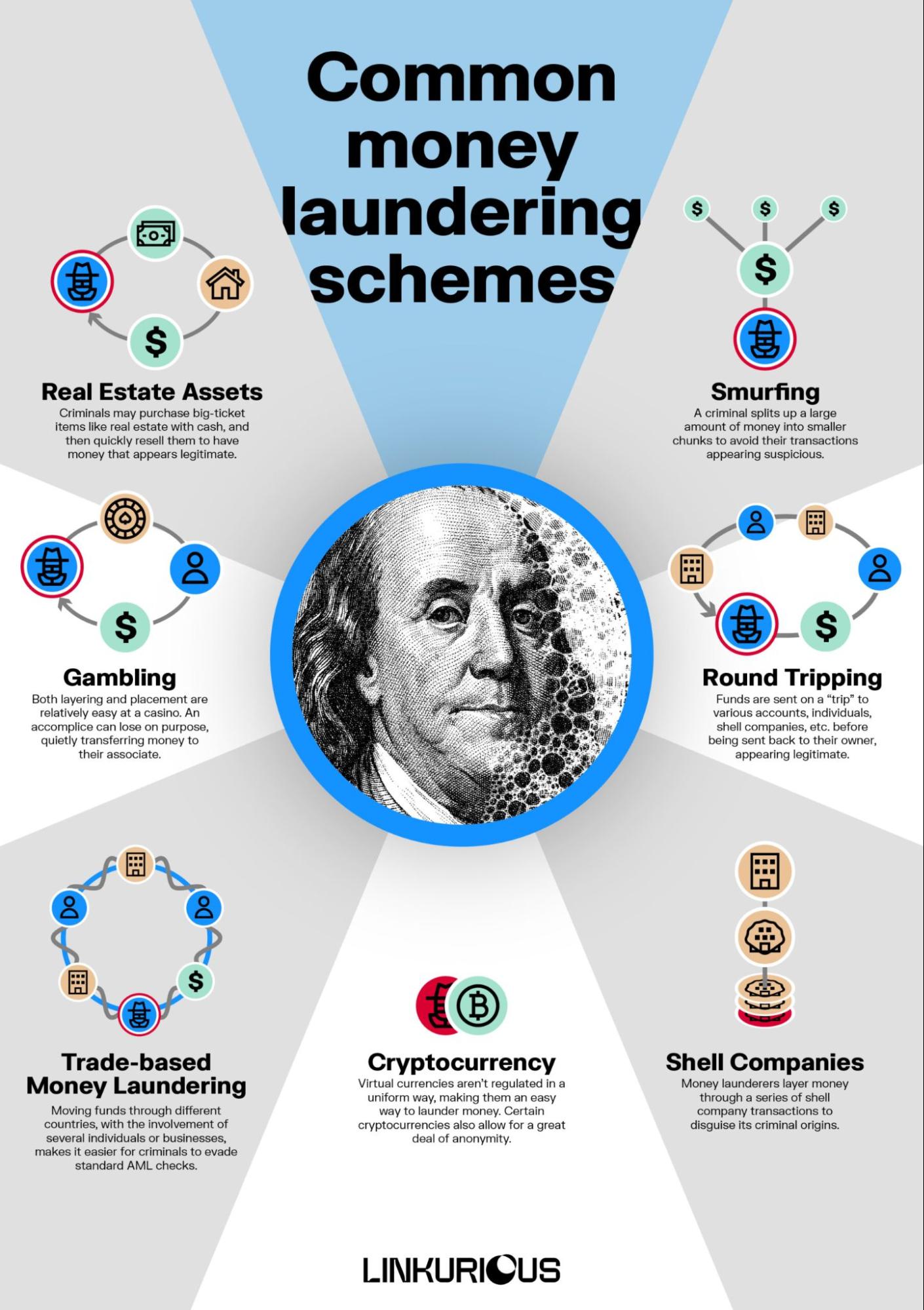

AML works in close conjunction with systems like KYC or Know Your Customer. Simply put, AML uses the data obtained through KYC processes to detect suspicious or unusual financial actions or transactions. Its task is to prevent the transfer of ‘dirty money’ through your financial service. The procedures are specifically designed to detect – and prevent such legal activity. While implementing robust AML practices, it’s also crucial to stay informed about crypto taxes, as they are an essential aspect of financial compliance for businesses dealing with digital currencies.

What is Transaction Monitoring?

AML compliance ensures that the financial institution or service uses measures like surveillance and transaction monitoring, as well as customer risk evaluation and fraud reporting. Compliance with AML regulations is important as it helps the entity avoid three detrimental consequences:

- Financial penalties

- Reputational risks

- Legal liabilities

Thankfully, while technology brought on the cybercrime risks we all fear, it also gave us opportunities to monitor transactions with minimal effort and maximum efficiency. AML transaction monitoring is simpler than ever thanks to automated tools that follow each activity, use a pool of data to compare it to, and highlight the suspicious activities in real-time before they do any harm or result in, well, money laundering.

How AML Requirements Work?

As we mentioned, Anti-Money Laundering regulations are procedures, regulations, and laws designed and frequently updated to prevent criminals from laundering money. Criminals constantly try to make illegally obtained funds appear as legitimate income, so such measures are essential to safeguard financial services against crime.

The penalties for not adhering to such regulations are enormous, but that is usually not the biggest problem for financial services. The biggest problem is the reputation. When customers learn that your financial service is a place where people can launder money and is not safe for them, getting back on their good side is usually impossible.

On the other hand, a proper AML process can help you gain a competitive advantage, especially in the financial sector.

The primary objective of AML is to detect and report any suspicious activity that looks like money laundering. With this, AML disrupts the networks that support enterprises like drug trafficking and terrorist funding, as well as extortion and corruption.

The regulations may differ in different parts of the world since they are established by varied regulatory bodies, but one thing is common for all – they mandate certain measures for the handling, protection, and storage of sensitive customer data.

How Money Laundering Threatens Financial Services?

Money laundering is bad for financial institutions, but also for the overall economy. The problem goes beyond legal compliance or fines. The amount of money being laundered in the world every year averages 2 to 5% of the global GDP, which means that it can go up to 1.87 trillion dollars.

If we fail to prevent money laundering, this can erode the reputation of financial institutions, leading to tremendous financial losses. Companies have paid billions in AML fines, such as DanskeBank’s $2 billion fine, for instance.

When illicit funds go through a legitimate financial system without any checks, it corrupts the financial service it passes through.

For these reasons, financial institutions today invest in AML programs that offer services like compliance management, transaction monitoring, customer due diligence, and more.

The Benefits of AML for Customers

Now you’re probably wondering – how do the AML efforts benefit the customer?

To begin with, these are used to ensure the customer’s money is in secure hands. A financial service that verifies every customer’s identity and follows unusual activities on every account protects customers against fraud, identity theft, financial damages, and more.

This is, without a doubt, a reason for the customer to feel more secure and therefore, it significantly elevates customer satisfaction.

So, it is not just about avoiding fines or legal problems – it is about ensuring safe transactions and protecting data privacy.

Launch Customer Satisfaction Survey

Best AML Practices to Boost Customer Experiences in the Financial Sector

AML only works if implemented properly and across the entire financial system. Here are some of the best practices for a financial service that wants to avoid money laundering:

- Investing in technology. This is not something you can do manually, not even if you employ a hundred people to track all transactions. AML requires focusing on every little detail and using tons of data to detect unusual activities. Automated technology offers a quick and reliable analysis of huge amounts of data, allowing you to capture threats in real-time.

- Regular staff training. Training the people who tackle customer information is crucial, even if you are using the costlier AML software. Employees need to be skilled in AML procedures and updated on the latest regulations. They must know how to act when the system flags an unusual activity, where to report it, what to do, how to handle customer concerns, and more.

- Due diligence for high-risk customers. When dealing with big transactions and high-risk customers, it is the responsibility of the financial service to enhance their due diligence i.e. conduct more thorough background checks and monitor all transactions carefully.

- Customer education. Customers should be aware of the risks and the actions they can take to boost their security. By encouraging them to report unusual activities, you get some help to create a more secure financial service. It is also a great way to build trust in your customers and essentially, boost their overall satisfaction.

- Collaboration with other institutions. These include regulatory organizations where you need to send reports and reach out with concerns, or other financial institutions that can help you.

How These Practices Can Secure Customer Experience?

Such AML practices to boost customer experience in financial services in several ways:

- Increased trust: When a customer is assured that their personal information and funds are protected from identity theft, money laundering, and different kinds of financial fraud, they feel more secure and are therefore more likely to trust the service.

- More streamlined transactions: AML procedures such as transaction monitoring or customer due diligence allow financial services to streamline transactions. In return, customers have a faster and smoother experience, which also contributes to a positive CX.

- Proactive fraud prevention: AML practices are created to enable financial services to identify and prevent fraudulent activities. By doing real-time monitoring and analyzing the transactions, they can detect suspicious behavior early and prevent giant financial losses and legal problems for the institution and its customers. By minimizing these risks, the approach enhances CX.

Key AML Challenges in the Financial Sector

AML procedures are forward-thinking but also very diverse and as such, they come with challenges. The regulatory landscape is changing all the time, especially in the last decade when the focus on data privacy is stronger than ever.

With that in mind, some of the AML challenges you might come across include:

- Changing and evolving AML requirements to keep you compliant

- Cross-border operations if you have customers from different locations

- Emerging technologies that require adaptability and innovation

How Secure is YOUR Financial Service?

What measures has your financial service taken to prevent money laundering? Are you certain that you are doing your very best to detect criminal activity and protect your customers and your business? If you aren’t, the time to implement AML practices is today – not just for the sake of your reputation, but also to avoid hefty fees and legal problems. Doing this will help you keep your customers safer and make your financial service more trustworthy in their eyes.